The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Crowdstrike Holdings (NASDAQ: CRWD) Surging Into New All Time Highs

Read MoreCrowdstrike Holdings (NASDAQ: CRWD) is a global cybersecurity leader based in Austin, Texas. It has an advanced cloud-native platform for protecting endpoints, cloud workloads, identities and data. In this article, we will be delve into the Elliott Wave structure based on the weekly cycle. Last month, CRWD surged into new all time highs after breaking above 2021 peak […]

-

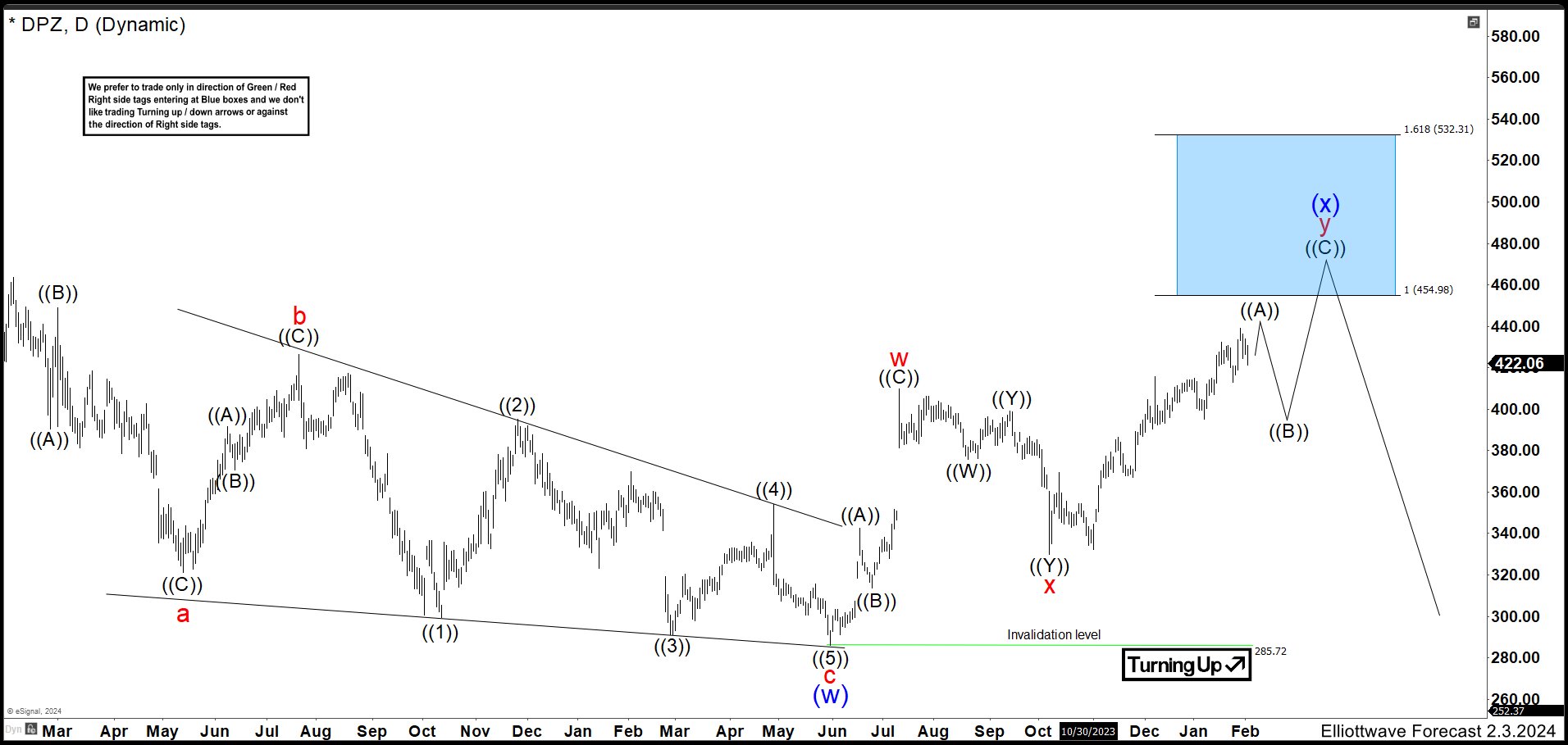

Domino’s Pizza (DPZ) Should Reach The Blue Box In this Quarter

Read MoreDomino’s is an American multinational pizza restaurant chain. Founded in 1960, the chain is owned by master franchisor Domino’s Pizza, Inc (DPZ). As of 2018, Domino’s had approximately 15,000 stores, with 5,649 in the United States, 1,500 in India, and 1,249 in the United Kingdom. Domino’s has stores in over 83 countries and 5,701 cities worldwide. DPZ Daily Chart October 2023 In […]

-

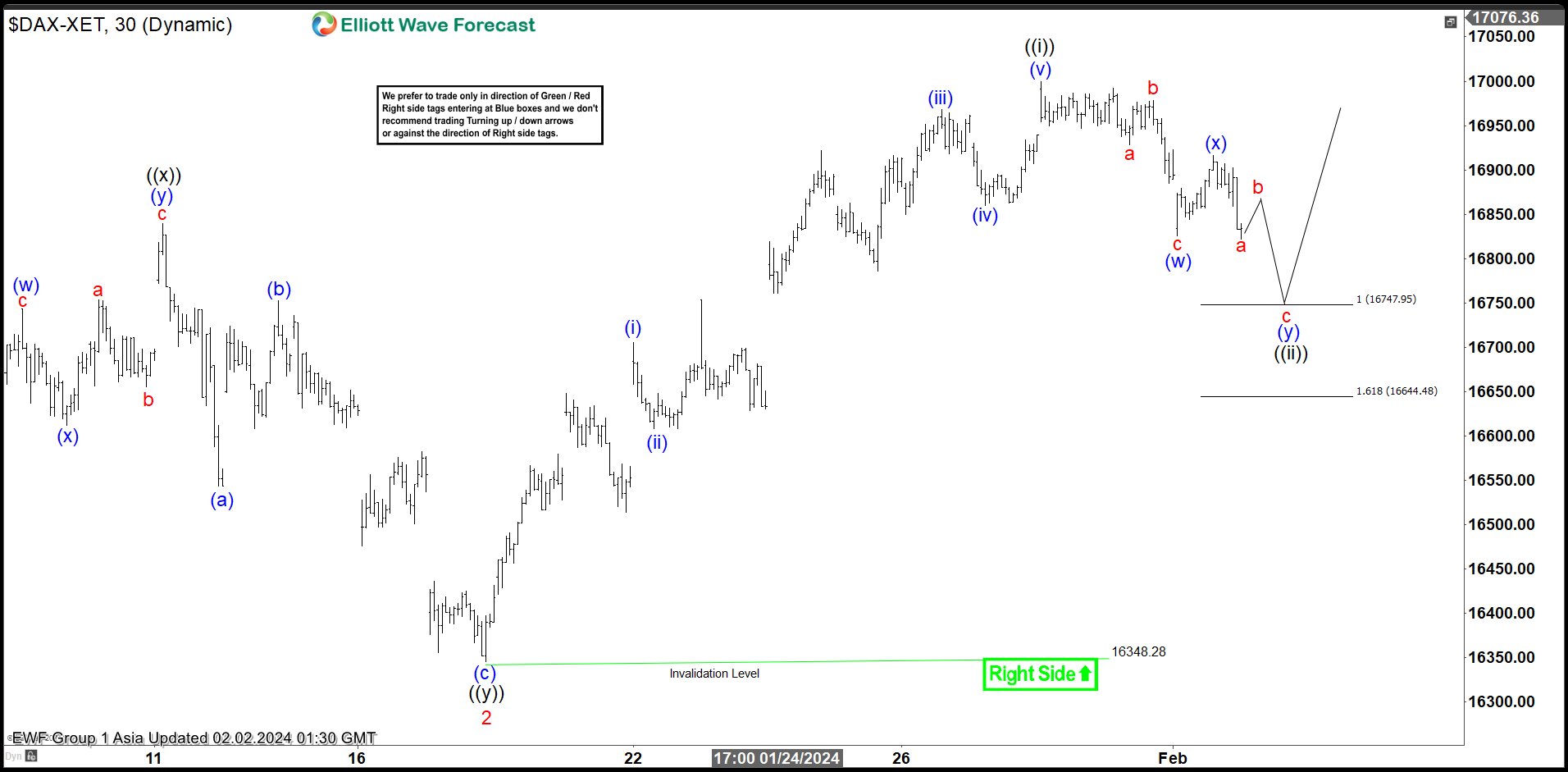

DAX Near Term Support Area

Read MoreShort Term Elliott Wave view in DAX suggests the rally from 10.23.2023 low is unfolding as a 5 waves impulse. Up from 10.23.2023 low, wave 1 ended at 17003.28. Wave 2 pullback subdivided into a double three Elliott Wave structure. Down from wave 1, wave ((w)) ended at 16448.71 and wave ((x)) rally ended at […]

-

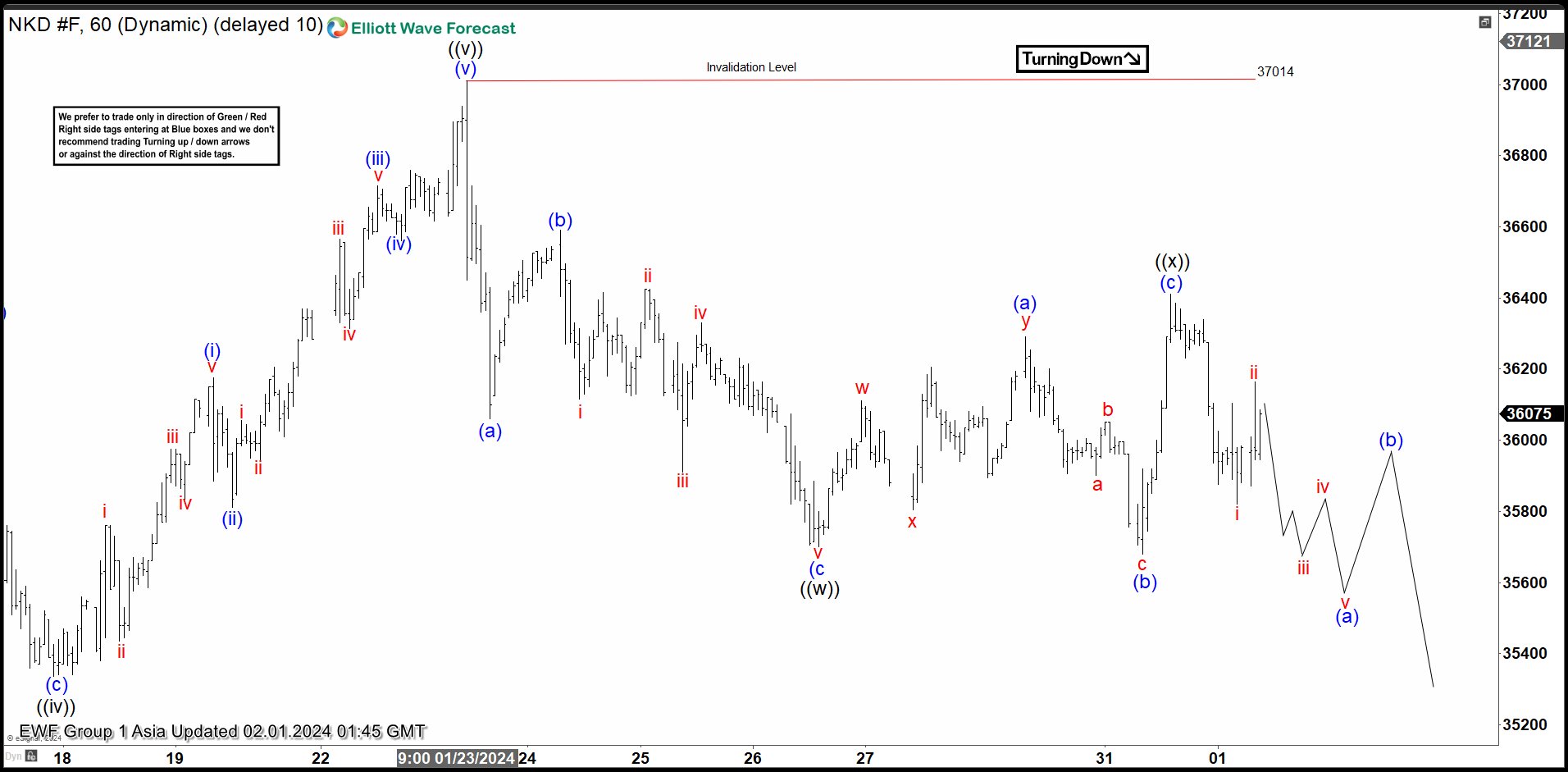

Nikkei (NKD_F) Looking for Further Downside Correction

Read MoreNikkei (NKD_F) is looking to do larger degree correction as a double three Elliott Wave structure. This article and video look at the path.

-

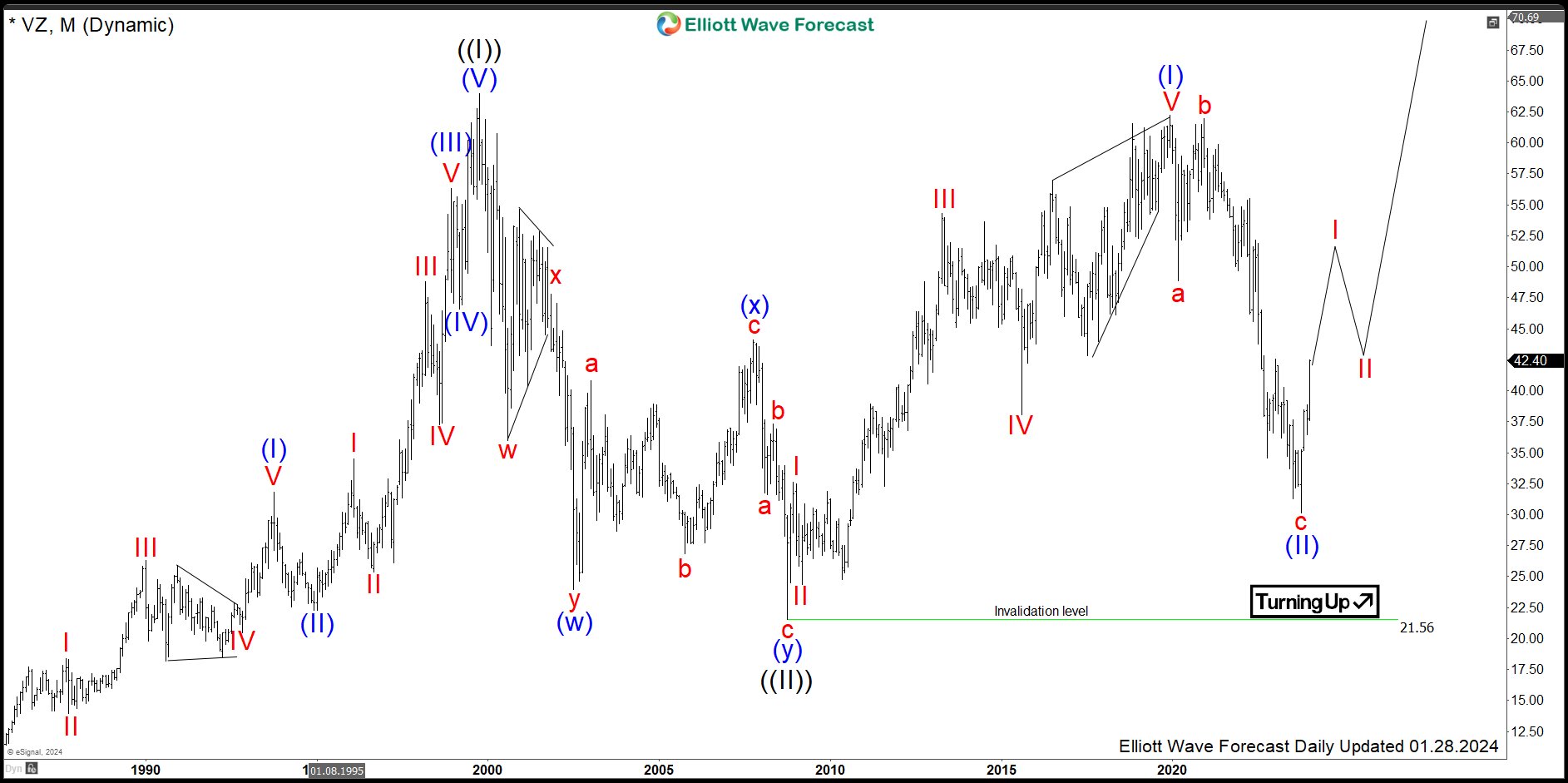

$VZ: Verizon Communications Starts New Bullish Cycle

Read MoreVerizon Communications Inc., commonly known as Verizon, is an US American telecommunications giant. Founded in 1983 as Bell Atlantic, it is a result of the break up of the Bell System into seven regional Baby Bells. Headquartered in New York, USA, Verizon is a part of DJIA, S&P100 and S&P500 indices. One can trade it […]

-

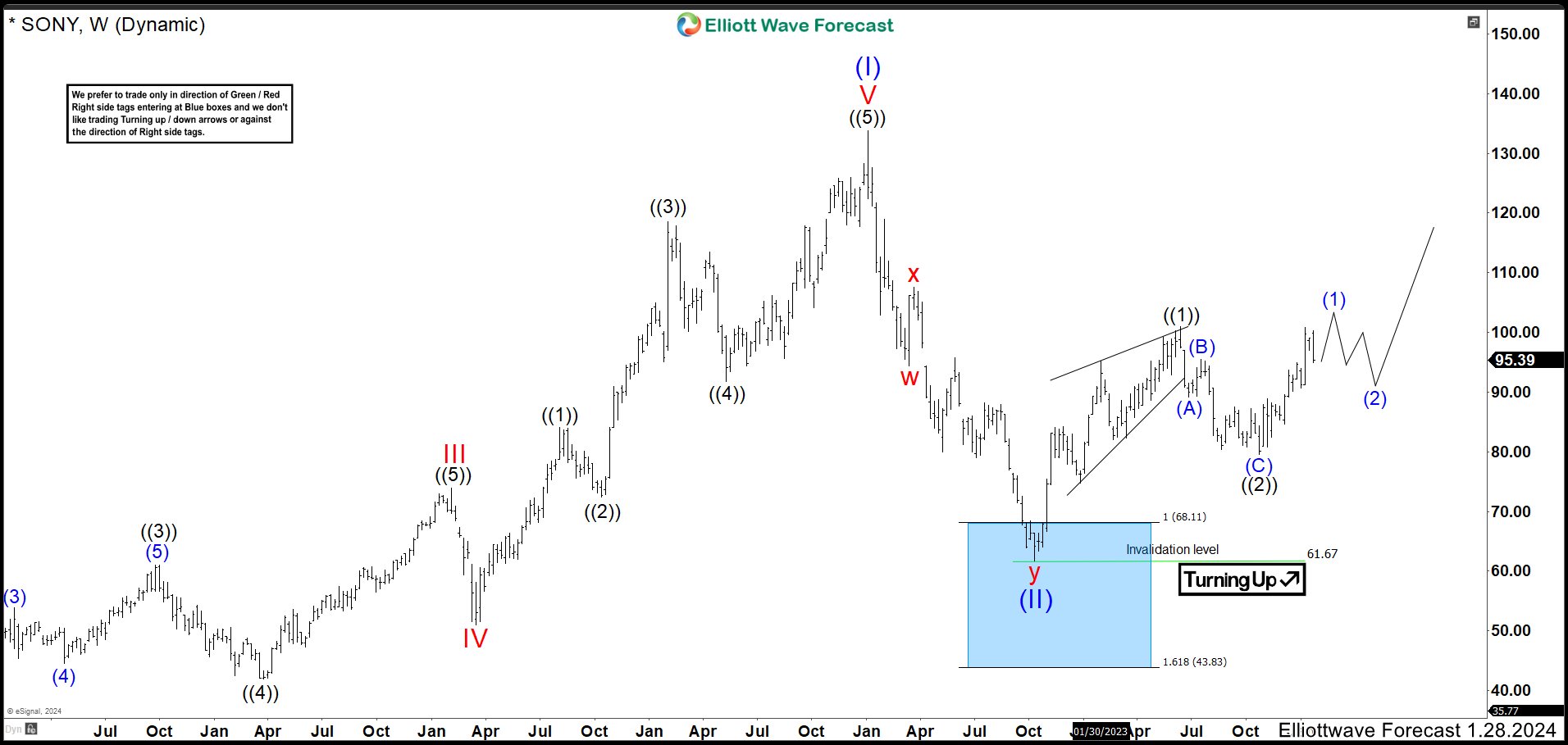

SONY Ended Wave ((2)) Correction And Bullish Scenario Is On Going

Read MoreSony Group Corporation, commonly known as SONY, is a Japanese multinational conglomerate corporation. As a major technology company, it operates as one of the world’s largest manufacturers of consumer and professional electronic products, the largest video game console company. SONY ended an impulse that began at the end of 2012. The share price reached 133.75 […]