The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

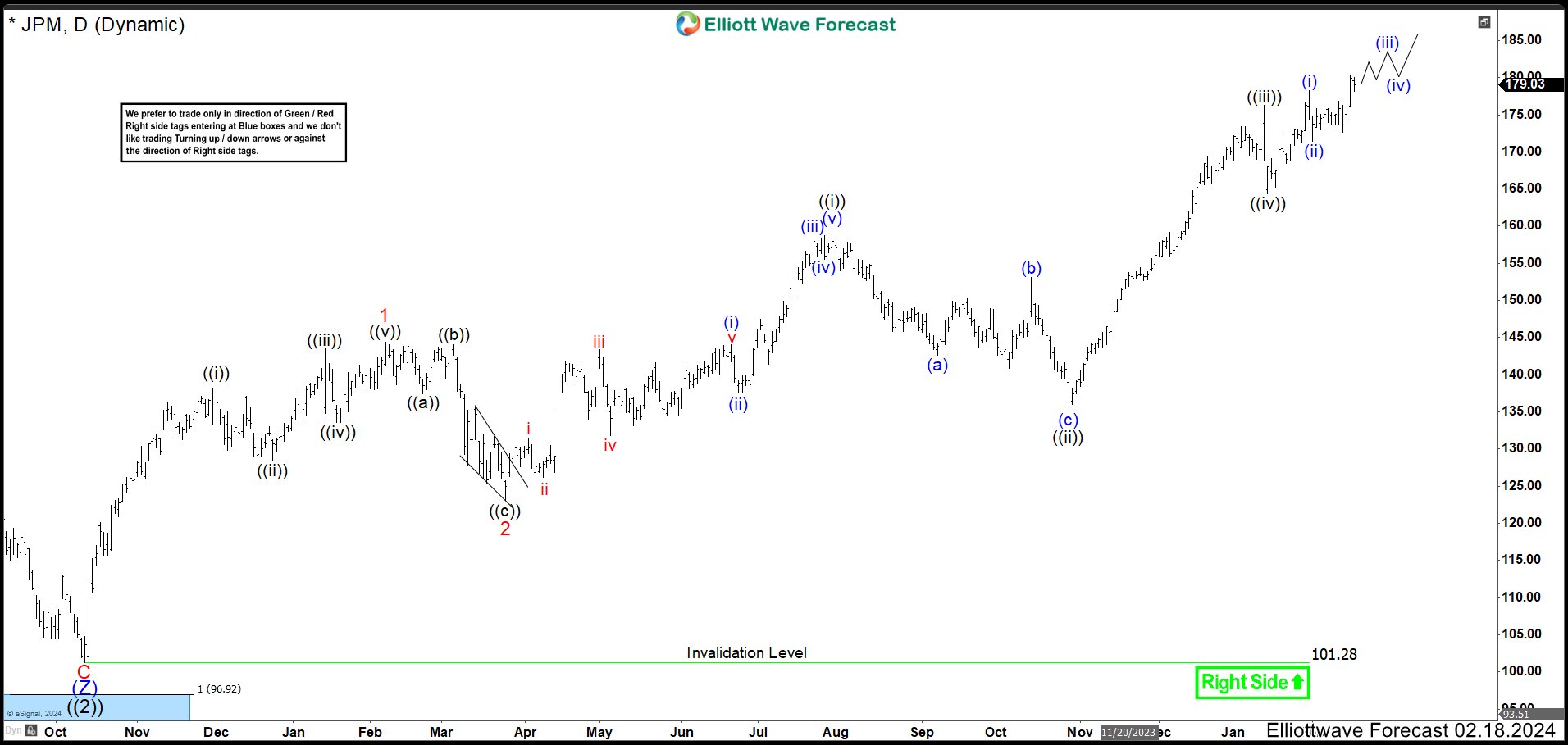

JPMorgan (JPM) Rallied as Expected Avoiding Any Crash

Read MoreJPMorgan Chase & Co. (JPM) is an American multinational investment bank and financial services holding company headquartered in New York City and incorporated in Delaware. As of December 31, 2021, JPMorgan Chase is the largest bank in the United States, the world’s largest bank by market capitalization, and the fifth-largest bank in the world in […]

-

Health Care Select Sector ($XLV) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1 Hour Elliott Wave chart of Health Care Select Sector ($XLV). The rally from 1.25.2024 low at $137.21 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

NextGen Energy (NXE) Pullback Should Continue to Find Buyers

Read MoreNextGen Energy ($NXE) is a Canadian uranium exploration and development company focused on advancing its high-grade Arrow deposit in the Athabasca Basin in Saskatchewan. With a robust portfolio of uranium assets and a strong emphasis on sustainable development, NXE is poised to play a significant role in the global transition to clean energy, particularly as […]

-

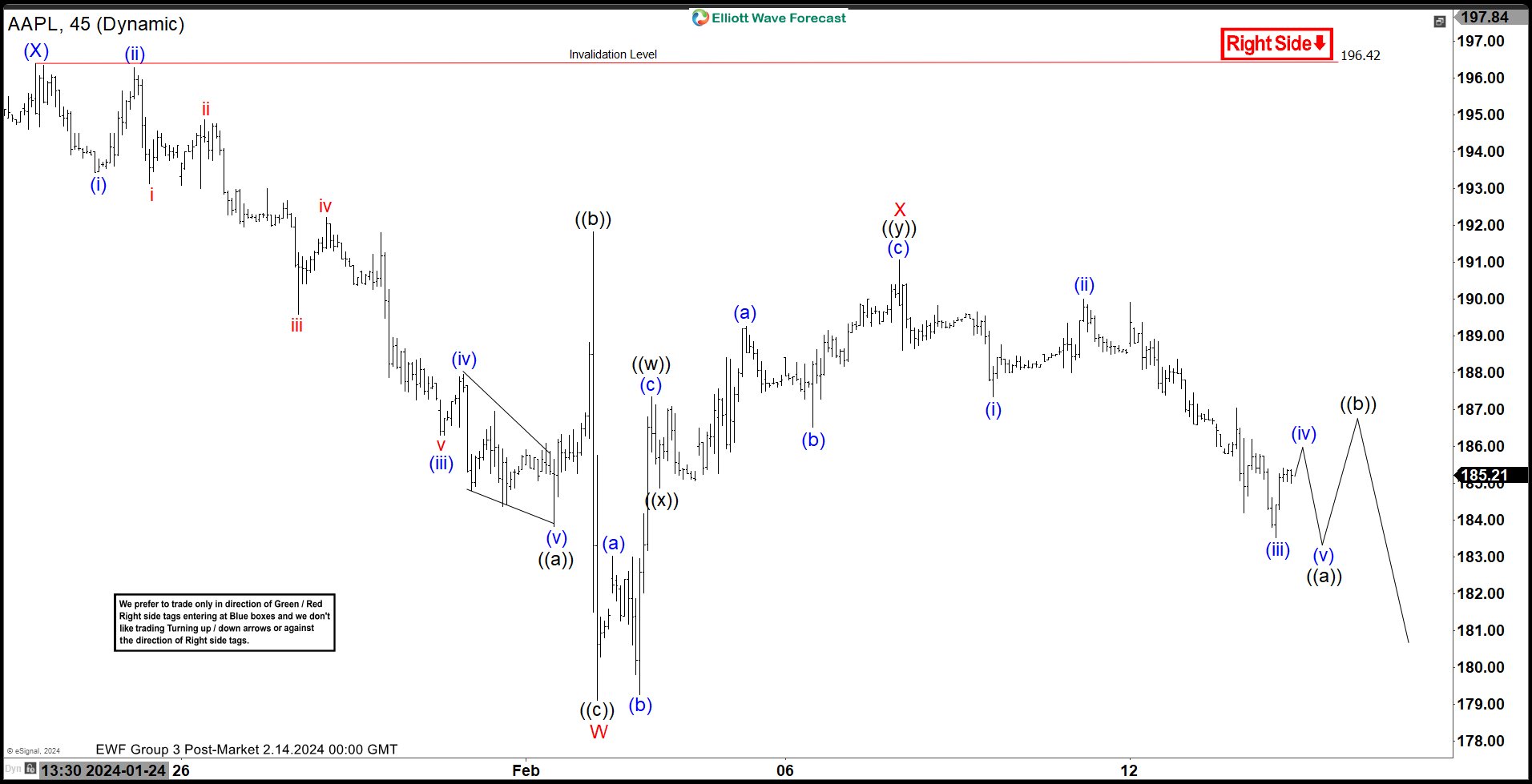

Apple (AAPL) Should See Further Downside

Read MoreApple (AAPL) correction from 12.14.2023 high remains in progress. This article and video look at the short term Elliott Wave path.

-

Visa Inc (NYSE: V) Nest structure Signals Further Upside

Read MoreVisa Inc (NYSE: V) is an American multinational payment card services corporation headquartered in San Francisco, California. It facilitates electronic funds transfers throughout the world, most commonly through Visa-branded credit cards, debit cards and prepaid cards. This article dives into the potential technical trajectories within its weekly cycle using Elliott Wave Theory. In November 2023, Visa stock surged […]

-

XPO Continue Rally In Bullish Sequence

Read MoreXPO INC., (XPO) provides freight transportation services in United States, rest of North America, Europe, UK & internationally. It operates in two segments, North American LTL & European Transportation & offers services to different industries. It is based in Greenwich, CT, comes under “Industrials” sector & trades as “XPO” ticker at NYSE. It is having […]