The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Microsoft (MSFT) Short Term Support Area

Read MoreCycle from 12.4.2023 low ended with wave (1) at 421.33 as the 30 minutes chart below shows. The stock then is pulling back in wave (2) with internal subdivision as a double three. Down from wave (1), wave ((a)) ended at 408.84 and wave ((b)) ended at 416.1. Wave ((c)) lower ended at 403.39 which […]

-

Uranium ETF (URA) Correction in Progress

Read MoreURA is a Uranium ETF that tracks the performance of companies involved in the uranium industry globally. It provides investors with diversified exposure to uranium mining, exploration, and production companies, offering a convenient way to invest in this sector. Below we will take a look at the Elliott Wave outlook for the ETF. $URA Elliott […]

-

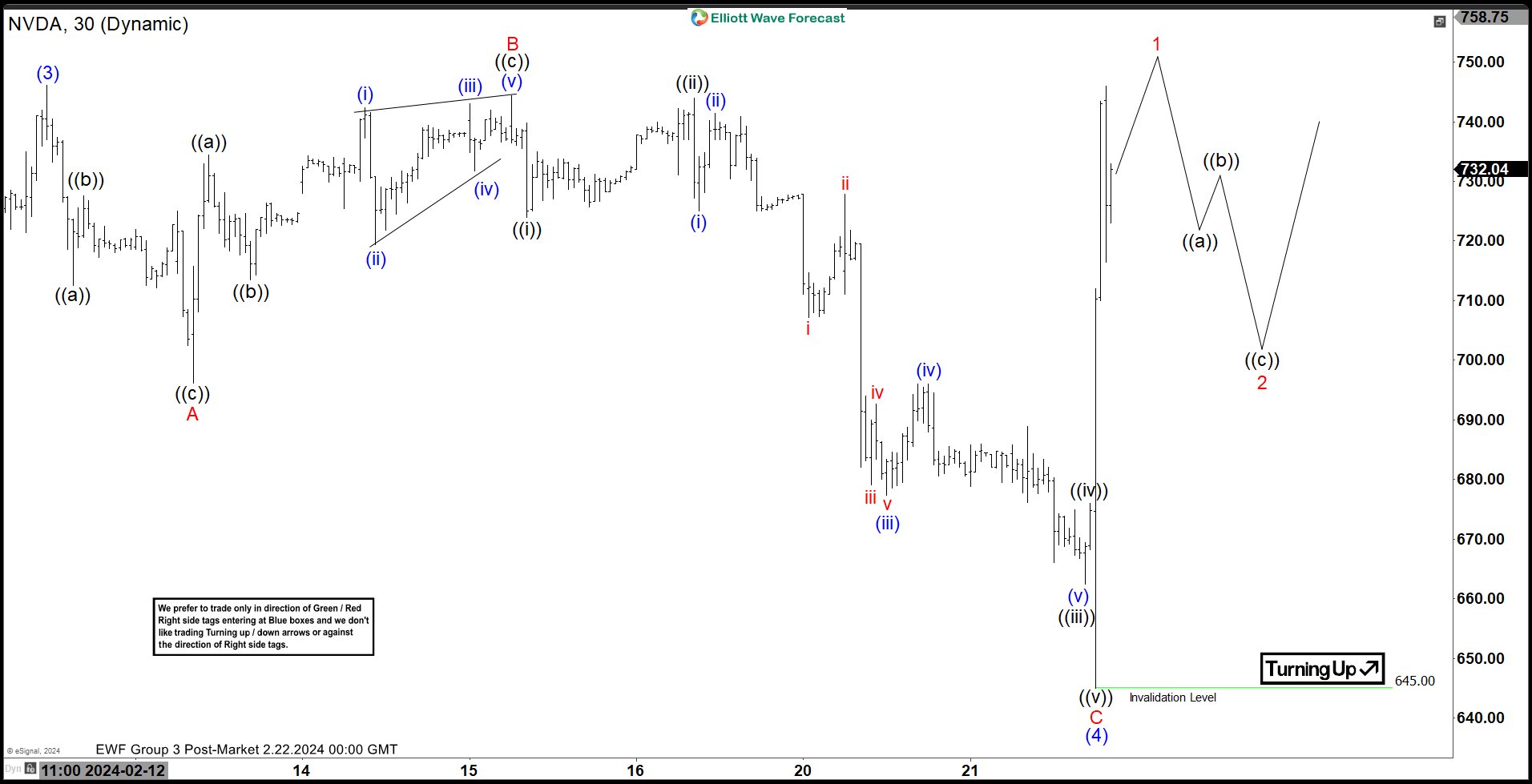

Nvidia NVDA Looks to Rally in Wave 5

Read MoreNvidia (NVDA) is rallying higher in wave 5 and dips should find support in 3, 7, 11 swing. This article and video look at the Elliott Wave path.

-

Netflix (NFLX) Should See Further Upside

Read MoreNetflix (NFLX) rallies in impulsive structure and dips should find support in 3, 7, 11 swing for more upside. This article & video look at the path.

-

Eli Lilly & Company (LLY) Should Continue Bullish Rally

Read MoreEli Lilly & Company (LLY) discovers, develops & markets human pharmaceuticals worldwide. It is having around 742 B$ market cap as on 16-February, 2024. It is based in Indianapolis, Indiana, US, comes under Healthcare sector & trades as “LLY” ticket at NYSE. LLY react higher as expected from previous article, favoring further upside in ((3)) […]

-

Nasdaq (NQ) Looking to Find Buyers at Support Area

Read MoreNasdaq (NQ) is looking to pullback as a zigzag. This article and video look at the short term Elliott Wave path for the Index.