The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Alphabet Inc. ($GOOGL) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of Alphabet Inc. ($GOOGL). The rally from 10.27.2023 low at $120.25 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain the structure & […]

-

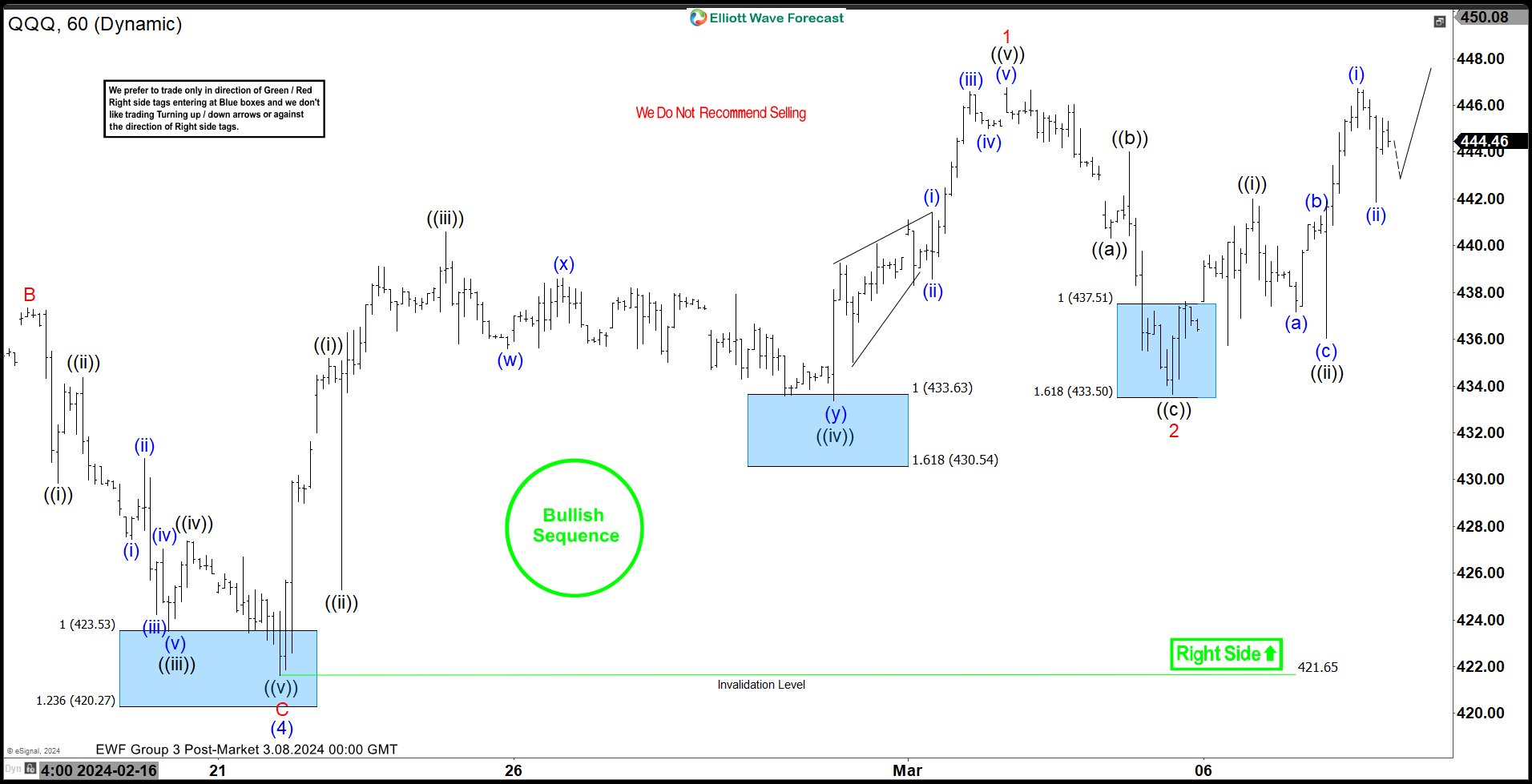

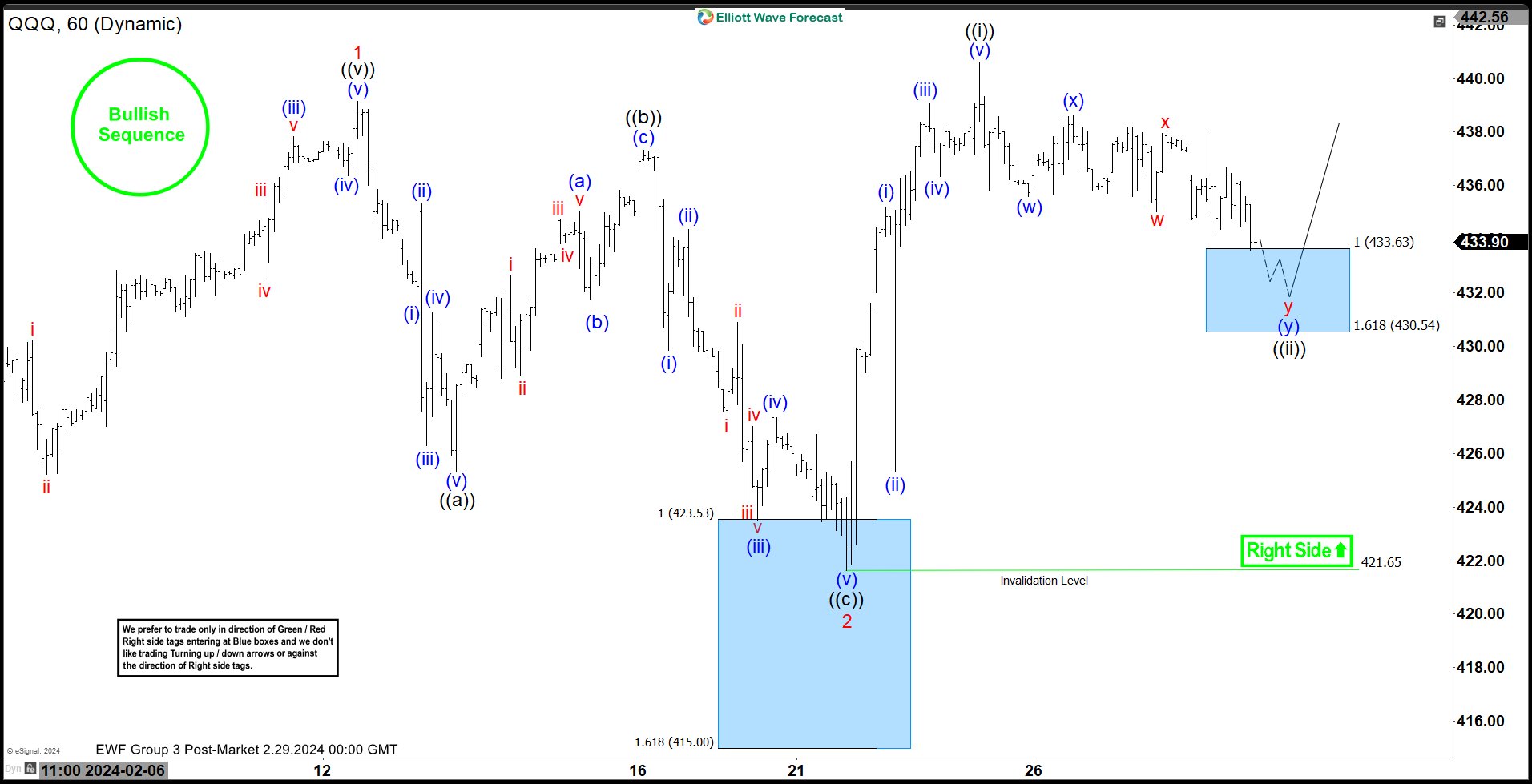

Nasdaq 100 ETF (QQQ) Further Upside Expected

Read MoreNasdaq 100 ETF (QQQ) Shows Bullish Sequence and should continue higher. This article and video look at the Elliott Wave path.

-

MicroStrategy ( MSTR ) Breaks 2021 Peak with Bullish Momentum

Read MoreMicroStrategy Incorporated (NASDAQ: MSTR) is an American company that provides business intelligence, mobile software, and cloud-based services. Since 2020, MicroStrategy started investing in Bitcoin as a treasury reserve asset which impacted its stock price in the recent 4 years. In this article, we’ll take a look at the Elliott Wave Structure taking place and explore the potential path for the […]

-

DAX Bullish Impulse Looks Incomplete

Read MoreDAX Bullish Structure Looks Incomplete and the Index can see further upside. This article and video look at the Elliott Wave path for the Index.

-

QQQ Strong Reaction Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of QQQ charts. The ETF produced a strong reaction higher from blue box area.

-

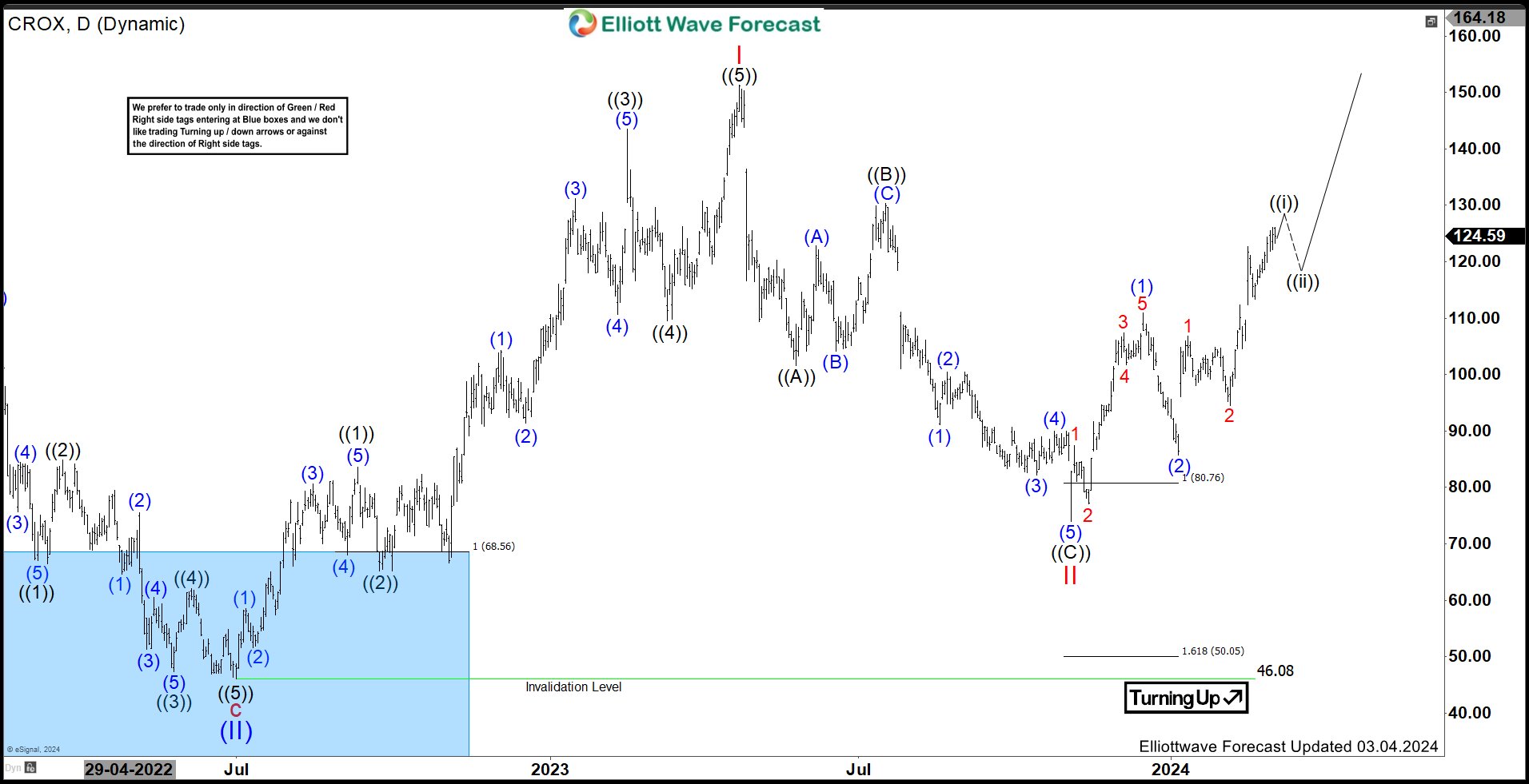

Will Crocs Inc (CROX) Continue Upside As Bullish Sequence?

Read MoreCrocs Inc., (CROX) designs, manufactures, markets & distributes casual lifestyle footwear & accessories for men, women & children worldwide. The company sells its products in approximately 85 countries through wholesalers, retail stores, e-commerce sites & third-party marketplaces. It is based in Colorado, US, comes under Consumer Cyclical sector & trades as “CROX” ticker at Nasdaq. […]