The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SCCO Should Rally In Bullish Sequence & Remain Supported

Read MoreSouthern Copper Corporation (SCCO) engages in mining, exploration, smelting, refining & processing of Copper, Molybdenum, Zinc, Silver, Gold & Lead in Peru, Mexico, Argentina, Ecuador & Chile. The company is based in Phoenix, Arizona, US, comes under Basic Materials Sector & trades as “SCCO” ticker at NYSE. As shown in previous article, SCCO expected to […]

-

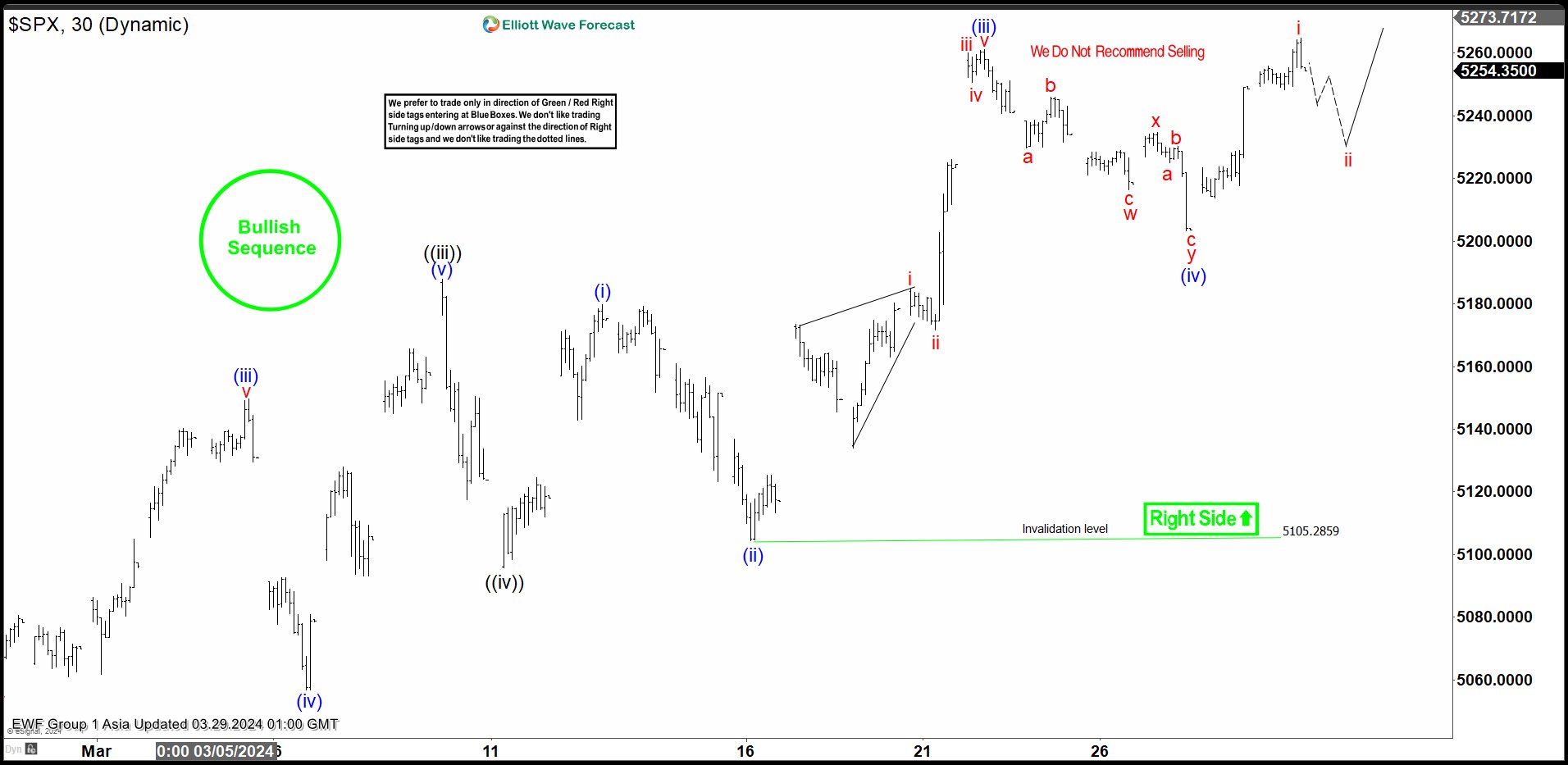

S&P 500 (SPX) Looking to Complete 5 Waves Impulse

Read MoreS&P 500 (SPX) is looking to complete 5 waves impulse and short term can see further upside. This article and video look at the Elliott wave path.

-

Nasdaq 100 (NQ) Potential Support Area

Read MoreNasdaq 100 (NQ) is looking to do a double three correction. This article and video look at the potential support area of the Index

-

Nikkei (NKD_F) Looking to End Impulsive Rally

Read MoreNikkei (NKD_F) is looking to complete 5 waves impulse structure and should see further upside. This article and video look at the Elliott Wave path.

-

AMC Entertainment Will Bring Us More Selling Opportunities

Read MoreAMC Entertainment Holdings, Inc. is an American movie theater chain headquartered in Leawood, Kansas, and the largest movie theater chain in the world. Founded in 1920, AMC has the largest share of the U.S. theater market ahead of Regal and Cinemark Theatres. It has 2,866 screens in 358 theatres in Europe and 7,967 screens in 620 […]

-

Freeport-McMoRan (FCX) Should Continue Upside

Read MoreFreeport-McMoRan Inc., (FCX) engages in the mining of minerals in North America, South America & Indonesia. It primarily explores for Copper, Gold, Molybdenum, Silver & other metals. It is based in Phoenix, Arizona, US, comes under Basic Materials sector & trades as “FCX” ticker at NYSE. As showing in the previous article, FCX ended ((1)) […]