The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Amazon (AMZN) Reaching Inflection Area

Read MoreAmazon (AMZN) is pulling back and currently in the inflection area where the stock can extend higher. This article and video look at the Elliott Wave path.

-

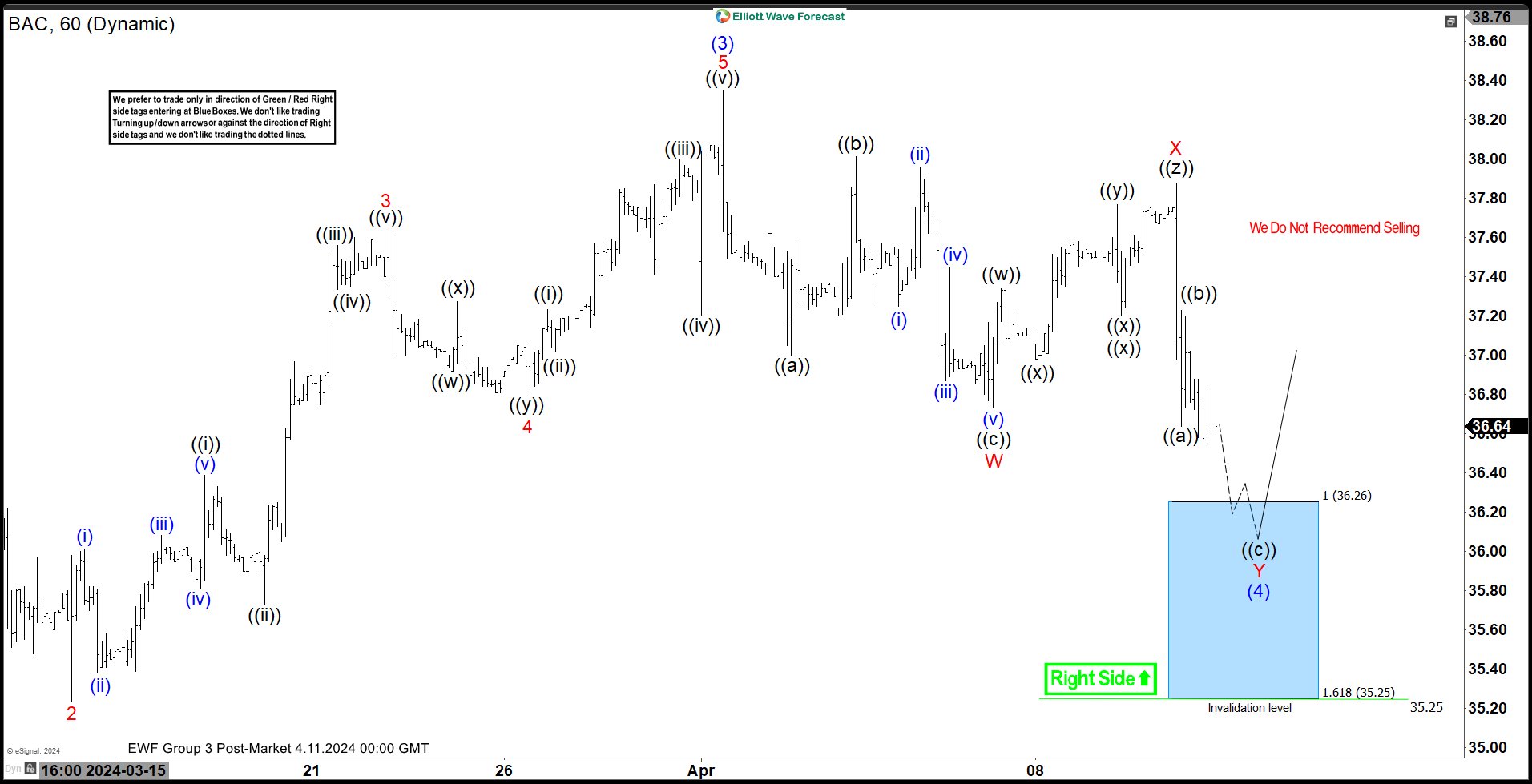

Bank of America ( $BAC) Found Buyers at the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of Bank of America Corp. ($BAC). The rally from 1.17.2024 low at $31.28 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the […]

-

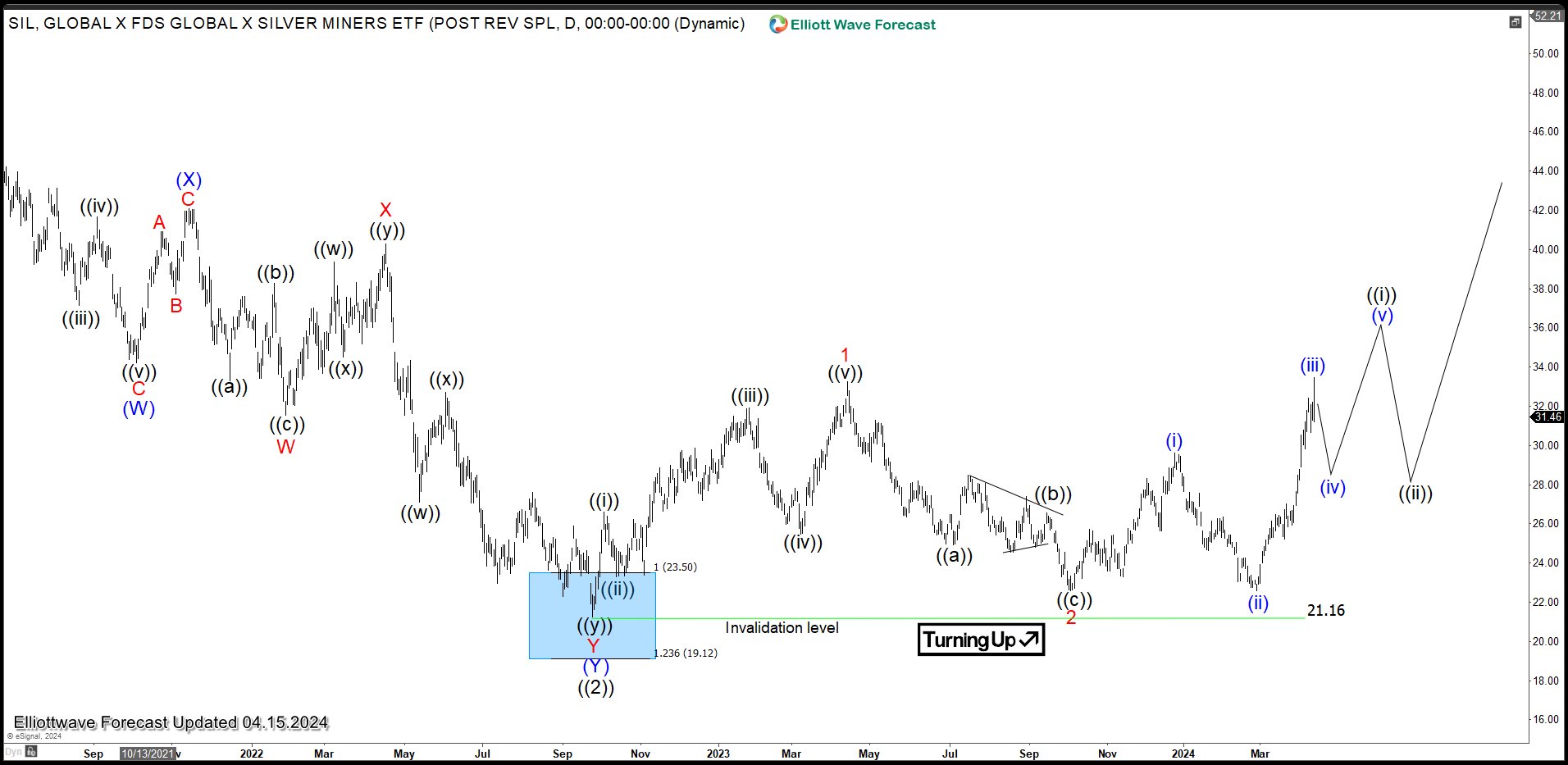

Silver Miners ETF (SIL) Has Turned Higher

Read MoreSIL (Silver Miners ETF) is a financial product designed to mirror the performance of silver mining companies. It offers investors a straightforward way to gain exposure to the silver market without directly purchasing physical silver or individual mining stocks. SIL diversifies risk by spreading investments across multiple companies within the sector, potentially providing a hedge […]

-

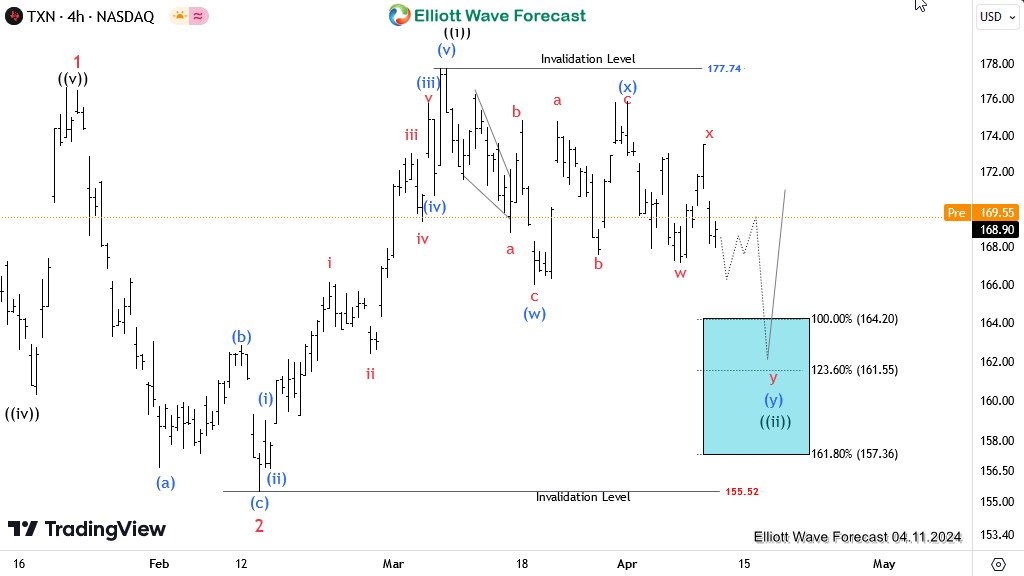

TXN Elliott Wave Analysis: Buyers waiting at the extreme

Read MoreTexas Instruments Incorporated (TXN) is a well-established American technology company headquartered in Dallas, Texas. It’s known primarily for its semiconductor and integrated circuit products, which are used in a wide range of applications including industrial, automotive, consumer electronics, and telecommunications. In this post, we will look at the TXN Elliott Wave Analysis. TXN Elliott Wave […]

-

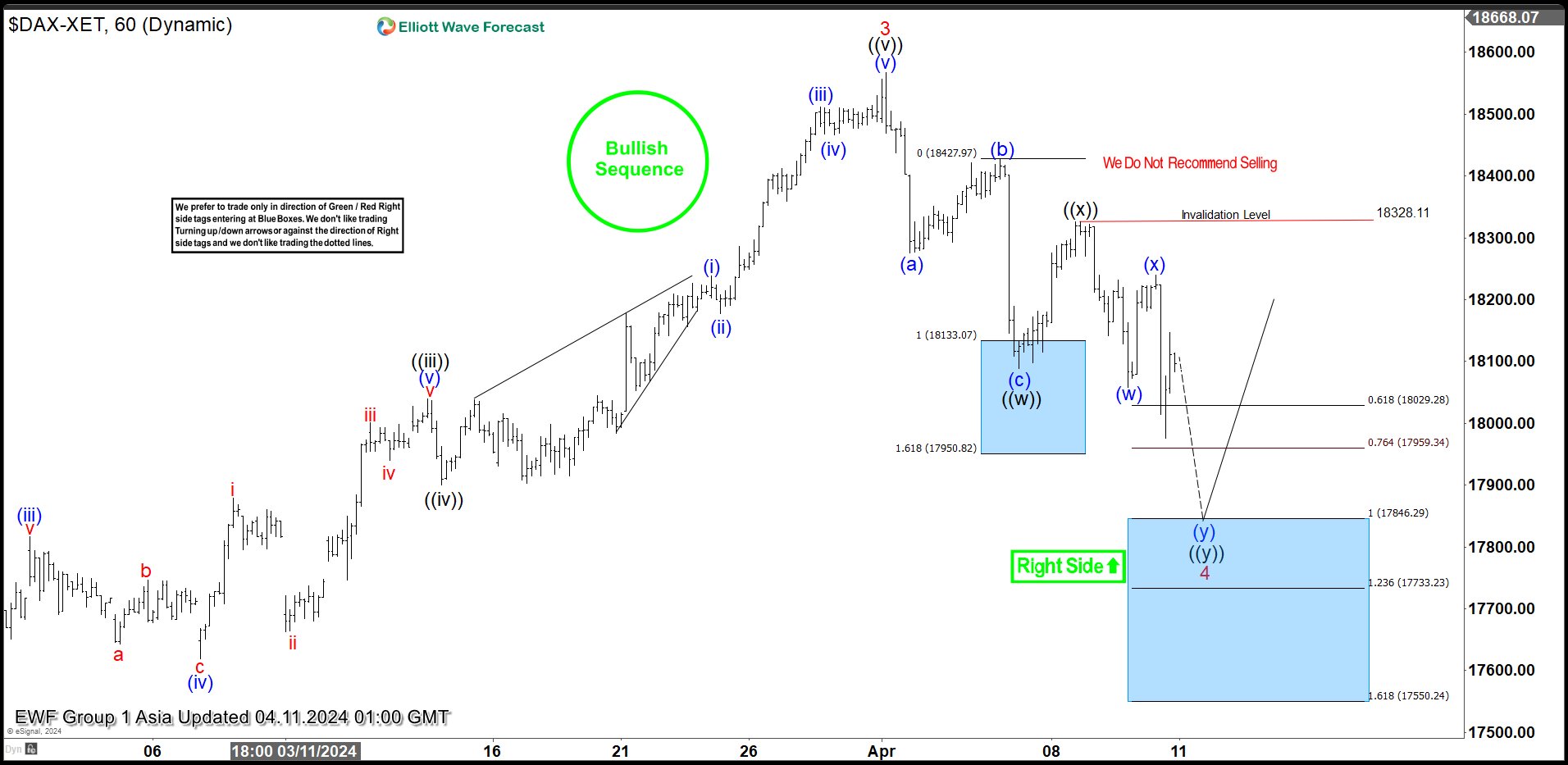

DAX Looking to do Double Correction

Read MoreDAX is looking to do a double correction lower. This article and video look at the short term Elliott Wave path for the Index.

-

S&P 500 E-Mini (ES_F) Still Needs Validation for the Next Leg Higher

Read MoreS&P 500 E-Mini (ES) is bouncing after 3 waves pullback. This article and video look at the short term Elliott Wave path for the Index.