The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

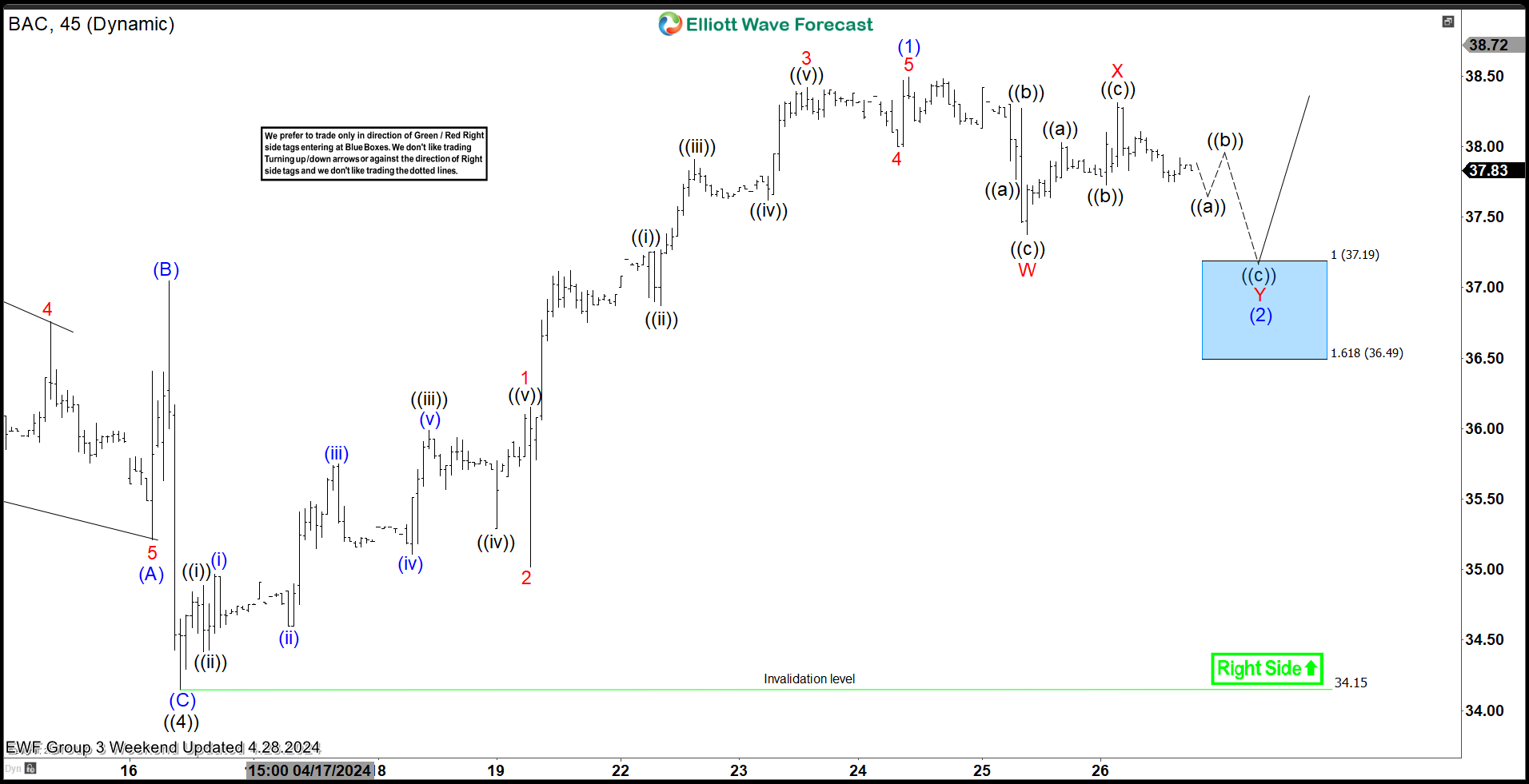

BAC Made New Highs From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of BAC charts. In which, the stock made a new high from the blue box area.

-

NVIDIA Corp ( $NVDA) Reacted From the Blue Box Area as Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 1H Hour Elliott Wave chart of NVIDIA Corp ($NVDA) . The rally from 5.02.2024 low at $812.70 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 7 swings and find buyers again. We will explain the structure […]

-

Home Depot (HD) Reacted from the Blue Box Looking for more Downside

Read MoreHome Depot (HD), is an American multinational home improvement retail corporation that sells tools, construction products, appliances, and services, including fuel and transportation rentals. Home Depot is the largest home improvement retailer in the United States. After reaching all-time highs in December 2021, the price of HD fell considerably. According to the Elliott Wave Principle, […]

-

Uranium Miners ETF (URA) Extends Impulsive Rally

Read MoreThe Uranium ETF (URA) is an exchange-traded fund that aims to track the performance of companies involved in the uranium mining industry. It provides investors with exposure to the global uranium sector, including companies engaged in uranium mining, exploration, and production. URA offers a convenient way for investors to gain diversified exposure to uranium without […]

-

IBM Elliott Wave Analysis-Unraveling the Recovery Ahead

Read MoreIBM, founded in 1911, is a global technology leader known for pioneering innovations in computing. From tabulating machines to AI and quantum computing, IBM has consistently shaped the tech landscape, providing cutting-edge solutions for businesses worldwide. IBM stock is listed on the New York Stock Exchange NYSE. In this blog post, let’s do the IBM […]

-

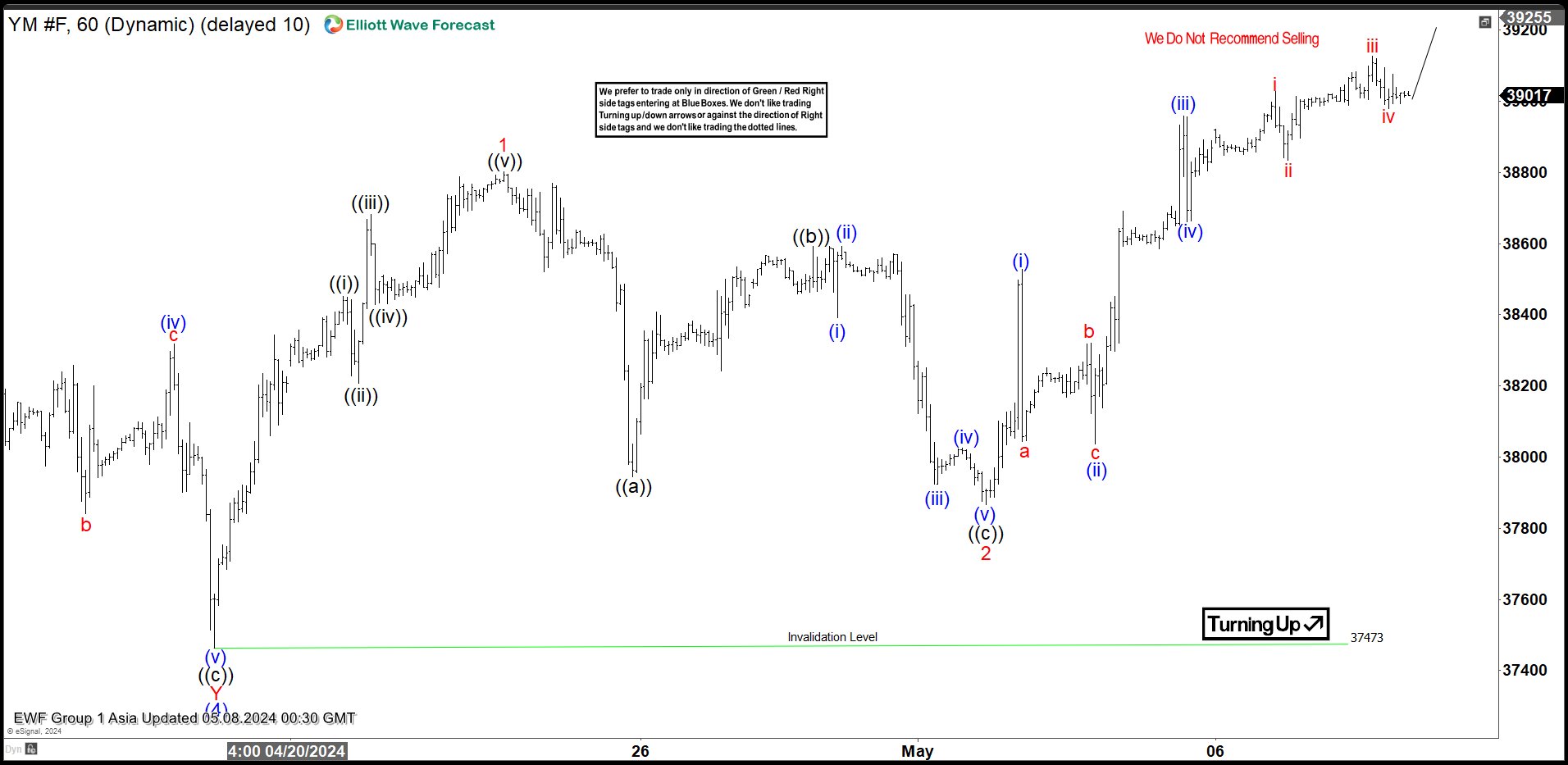

Elliott Wave Analysis on Dow Futures (YM) Favors Upside

Read MoreDow Futures (YM) has started a new leg higher as an impulse. This article and video look at the Elliott Wave path for the Index.