The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

SPX Keep Reacting Higher From The Blue Box Area

Read MoreIn this blog, we take a look at the past performance of SPX charts. The index is showing a perfect reaction higher from the blue box area.

-

COST (Costco Wholesale) Should Pull Back Before Rally Resume

Read MoreCostco Wholesale Corporation., (COST) engages in the operation of membership warehouse in the United States, Puerto Rico, Canada, United Kingdom, Mexico, Japan, Korea, Australia, Spain, France, Iceland, China & Taiwan together with its subsidiaries. It offers branded & private-label products in the range of merchandise categories. It also operates e-commerce websites in the US, Canada, […]

-

Elliott Wave Intraday Analysis: Dow Futures (YM) Resumes Bullish Trend

Read MoreShort Term Elliott Wave View in E-Mini Dow Jones Futures (YM) suggests the trend should continue higher within the sequence started from April-2024 low as the part of daily sequence. It favors upside in wave 5 of (5) since 18-April, 2024 low, while dips remain above 40053 low. Since April-2024 low of (4), it placed […]

-

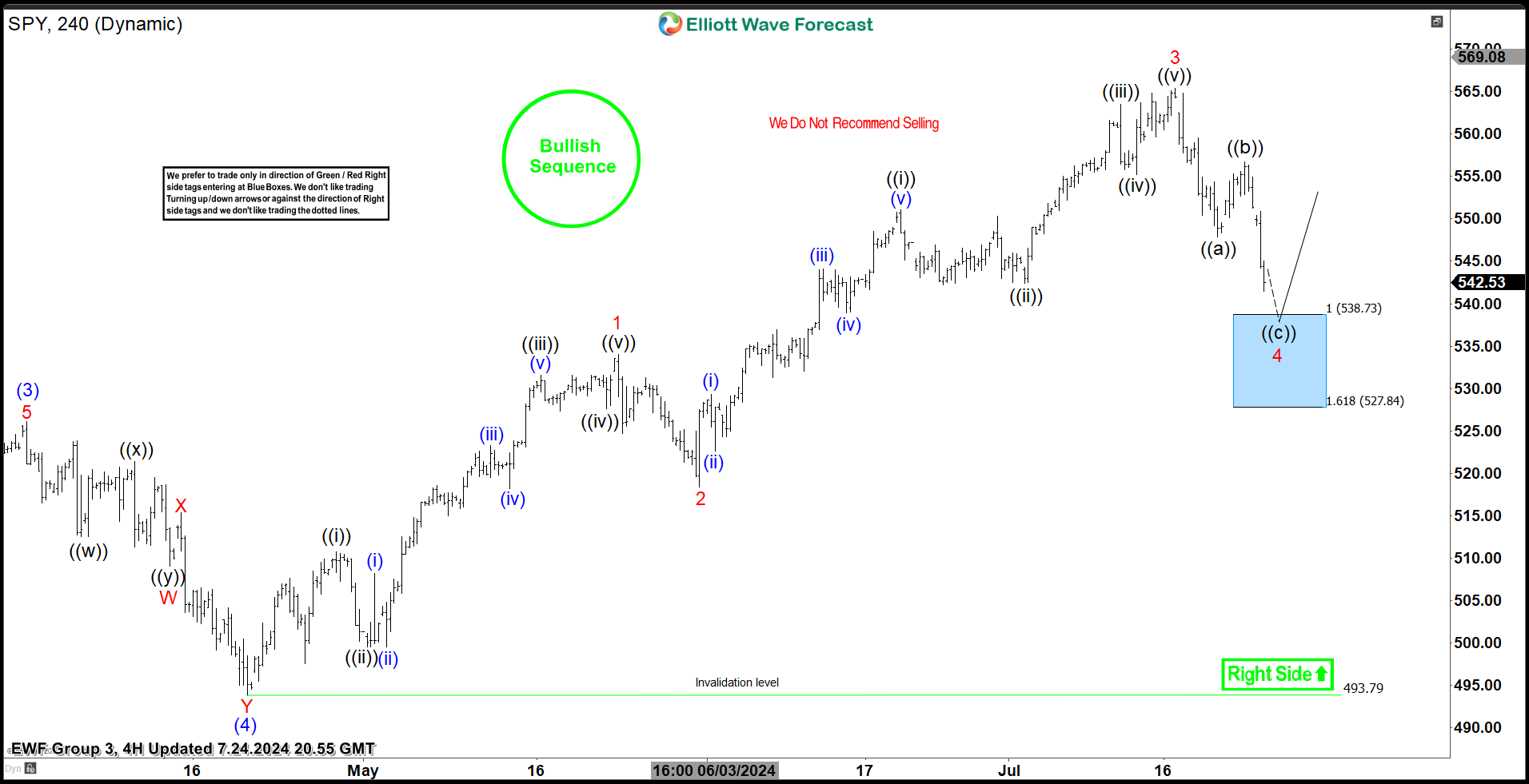

SPDR S&P 500 ETF ( $SPY) Found Buyers At The Blue Box Area As Expected.

Read MoreHello everyone. In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of SPDR S&P 500 ETF ($SPY) . The rally from 4.19.2024 low at $493.79 unfolded as 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. We will explain […]

-

Travelers (TRV) is Showing an Incomplete Bullish Sequence

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Weekly TRV Chart July 2023 One year ago, we wrote that TRV ended a great super cycle in the year of 2019 reaching a […]

-

Toll Brothers (TOL) Should Pull Back Soon Providing Another Opportunity

Read MoreToll Brothers, Inc., (TOL) designs, builds, markets, sells & arranges finance for the range of detached & attached homes in Luxury residential communities in the United States. It also owns & operates architectural, engineering, mortgage, title, land development, insurance, smart home technology, landscaping, lumber distribution, house component assembly & manufacturing operations. It is headquartered in […]