The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

DAX Elliott Wave Signals Bullish Breakout Toward 25,450

Read MoreDAX continues to break to new all-time high suggesting the trend remains bullish. This article and video looks at the upside target of DAX.

-

Hecla Mining (HL) and the $150 Silver Thesis

Read MoreStrong correlation between HL and XAG/USD suggest both should have tremendous gains in years ahead. This article talks about potential targets for both.

-

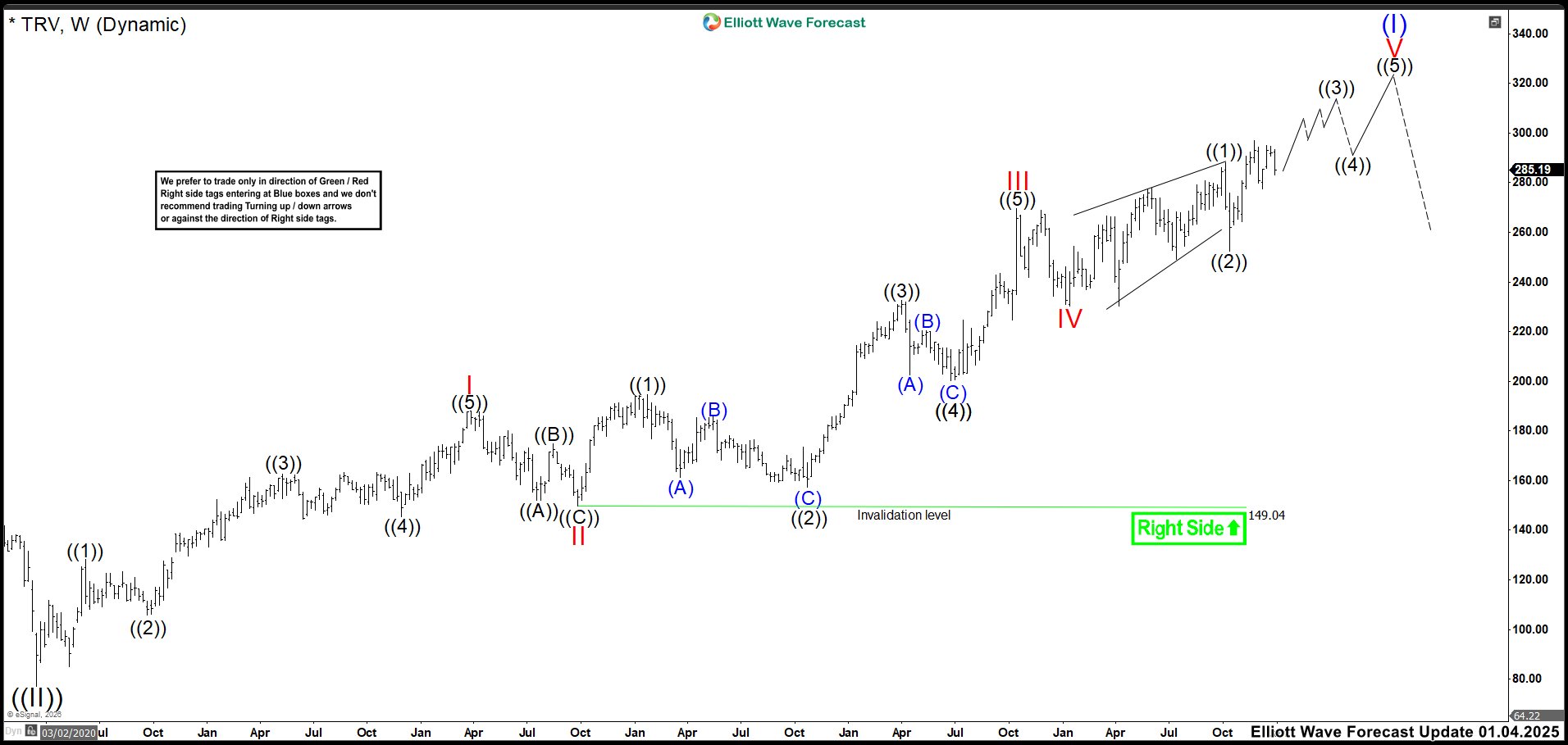

TRV Extends Its Rally: The Jan 2025 Impulse Drives Next Move

Read MoreAt the beginning of the year, TRV often moves into a price‑discovery phase shaped by analyst updates and early‑quarter earnings expectations. Most analysts rate the stock as a Hold, with an average 12‑month target near $294.25. That level suggests only a 3.13% upside from current prices, which signals that institutions expect steady underwriting results rather […]

-

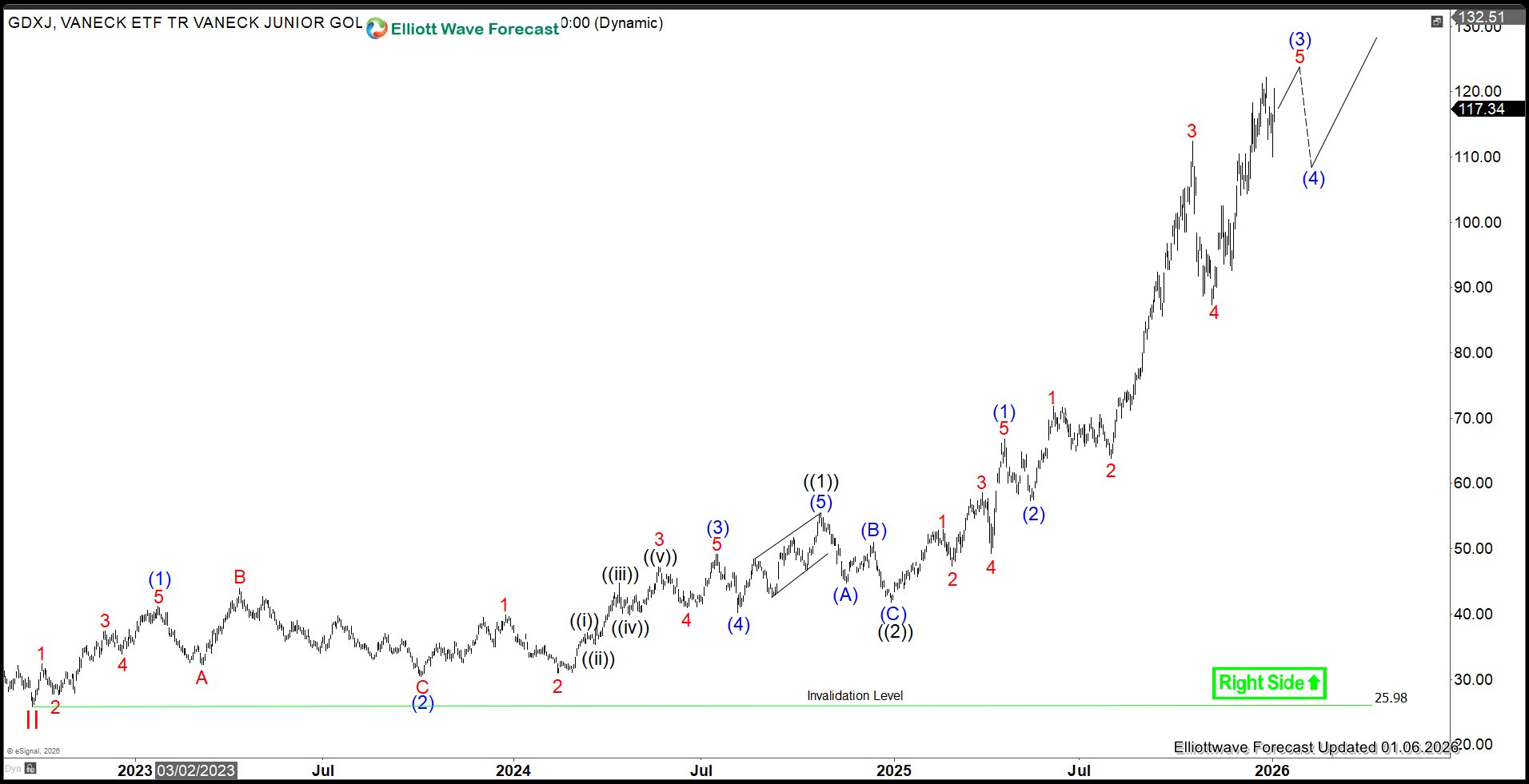

GDXJ – Gold Miners Junior: Impulse Rally in Motion

Read MoreThe VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that provides exposure to small- and mid-cap companies primarily engaged in gold and silver mining worldwide. In this article, we will explore the long term Elliott Wave technical path of the ETF. GDXJ Monthly Elliott Wave View On the monthly timeframe, the Elliott Wave outlook […]

-

Walmart (NYSE:WMT) $120 Target Precedes a Dip

Read MoreWalmart (NYSE: WMT) continues to lead the market following its rebound last year. Today, we examine the Elliott Wave structure behind its current breakout. This analysis charts the precise pathway and key upside targets for its next advance. Our technical blueprint reveals a compelling setup, driven entirely by strong momentum. Elliott Wave Analysis WMT’s recent […]

-

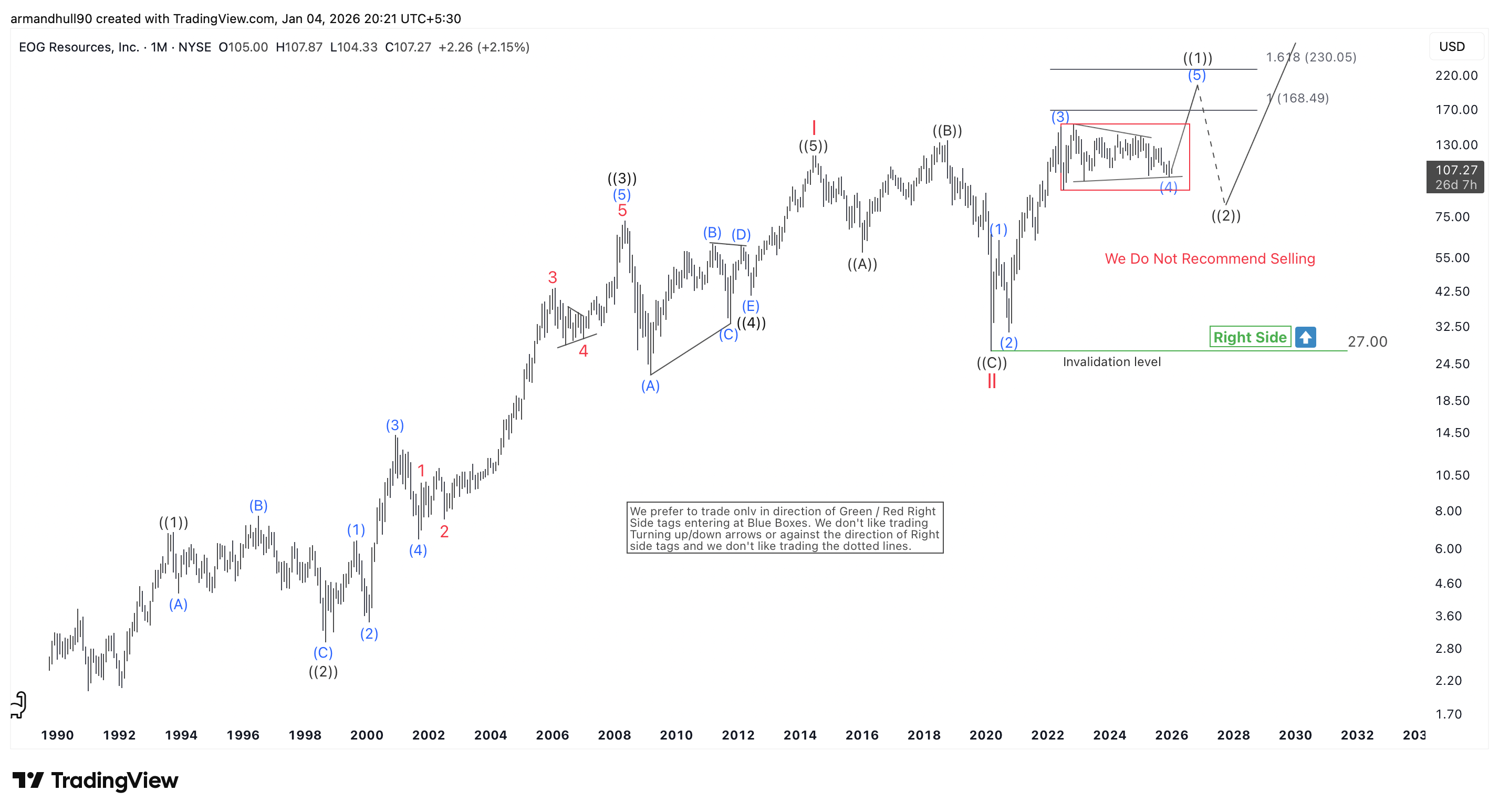

EOG Resources Elliott Wave Outlook: Range Breakout Could Target 168.49 and 230.05

Read MoreEOG consolidates inside a Wave (4) range in the very start of a powerful Wave III advance, with a bullish breakout pointing to higher Fibonacci targets. EOG Resources, Inc. (NYSE: EOG) continues to trade within a strong long-term bullish Elliott Wave structure on the monthly chart. The broader trend remains firmly positive. Price action from […]