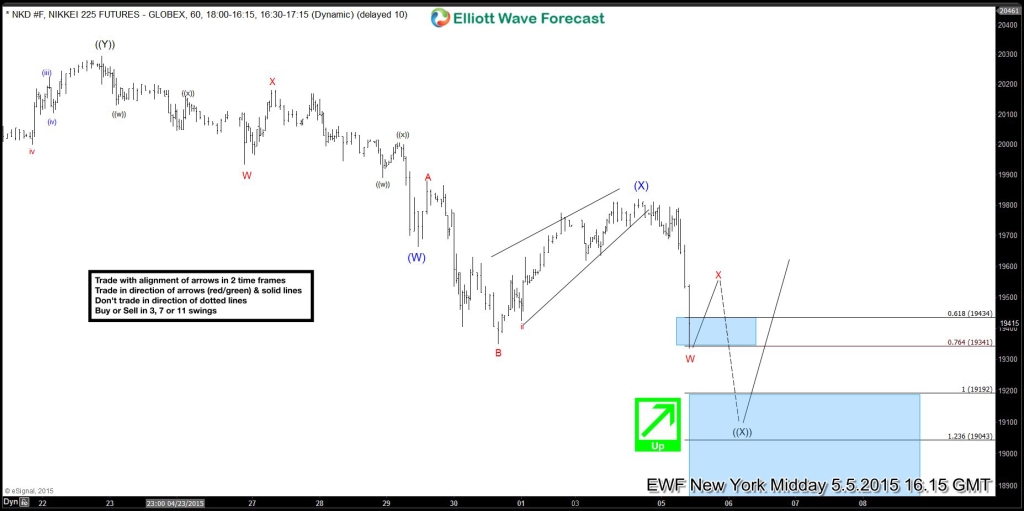

Index has broken below 19348 low which means we are still in wave ((X)) pull back which is taking the form of a double three i.e. (W)-(X)-(Y) Elliott wave structure. Wave (W) ended at 19665, wave (X) took the form of a FLAT (3-3-5 structure) and completed at 19820. Wave (Y) low is now in progress and ideally expected to test 19192 – 19043 area to complete wave ((X)). In the above area, we expect to see buyers in the Index and a 3 wave reaction higher at least as per Elliott Wave hedging idea. We don’t like selling the Index in proposed push lower.

At EWF we offer 24 hour coverage of 41 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits. Click for 14 day Trial

Back