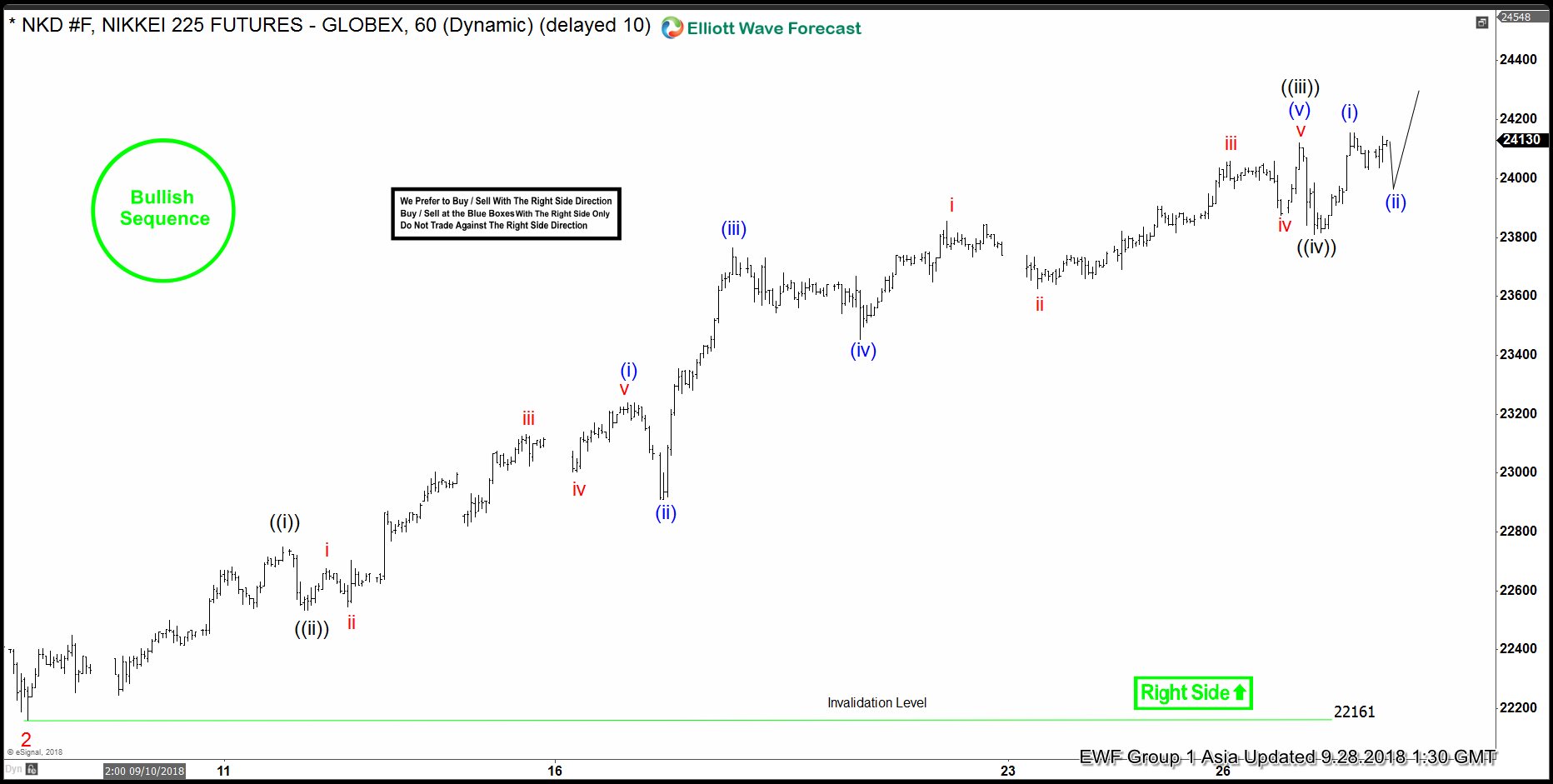

Nikkei short-term Elliott wave view suggests that the decline to 22161 on 9/06/2018 low ended Minor wave 2. Above from there, Minor wave 3 remain in progress, nesting higher in an impulse structure. With lesser degree cycles showing sub-division of 5 waves structure in each leg higher i.e Minute wave ((i)), ((iii)) & ((v)) expected to unfold in 5 waves structure. Also, it’s important to note that the right side is up & instrument is having a bullish sequence tag available in below chart. This suggests that the selling is not recommended.

Up from 22161 low, the initial rally to 22750 high ended Minute wave ((i)) in 5 waves. The decline to 22535 low ended Minute wave ((ii)) pullback. Then the rally higher from there ended Minute wave ((iii)) at 24120 high. The pullback to 23810 low ended Minute wave ((iv)). Above from there Minute wave ((v)) of 3 remain in progress, looking to extend higher towards 24401-24766 100%-161.8% Fibonacci extension area of a Minute wave ((v))=((i)) target area approximately to complete Minor wave 3. Afterwards, the index is expected to do a wave 4 pullback in 3, 7 or 11 swings before further upside is seen provided the pivot at 22161 low stays intact. We don’t like selling it & expect buyers to appear in 3, 7 or 11 swings against 22161 low.