Hello Traders, in this article we will see how the NIKKEI ( JAPAN225 ) index has reacted lower from equal legs area. Here at Elliott Wave Forecast we have developed a system that allows us to define areas of the market in which buyers and seller agree to a reaction. These are high frequency areas in which gives us at least an 85% chance of a 3 waves reaction from these areas.

As soon as we can project an equal legs area we present it into our charts and our members know what they can expect. Nikkei has been trading within a 1 hour cycle from 03.15.2023 to complete its ((x)) leg higher. Consequently, having it’s first leg higher and connector within the corrective bounce we have presented the equal legs area. Let’s see the 1 hour update we presented to members from 04.01.2023 weekend update.

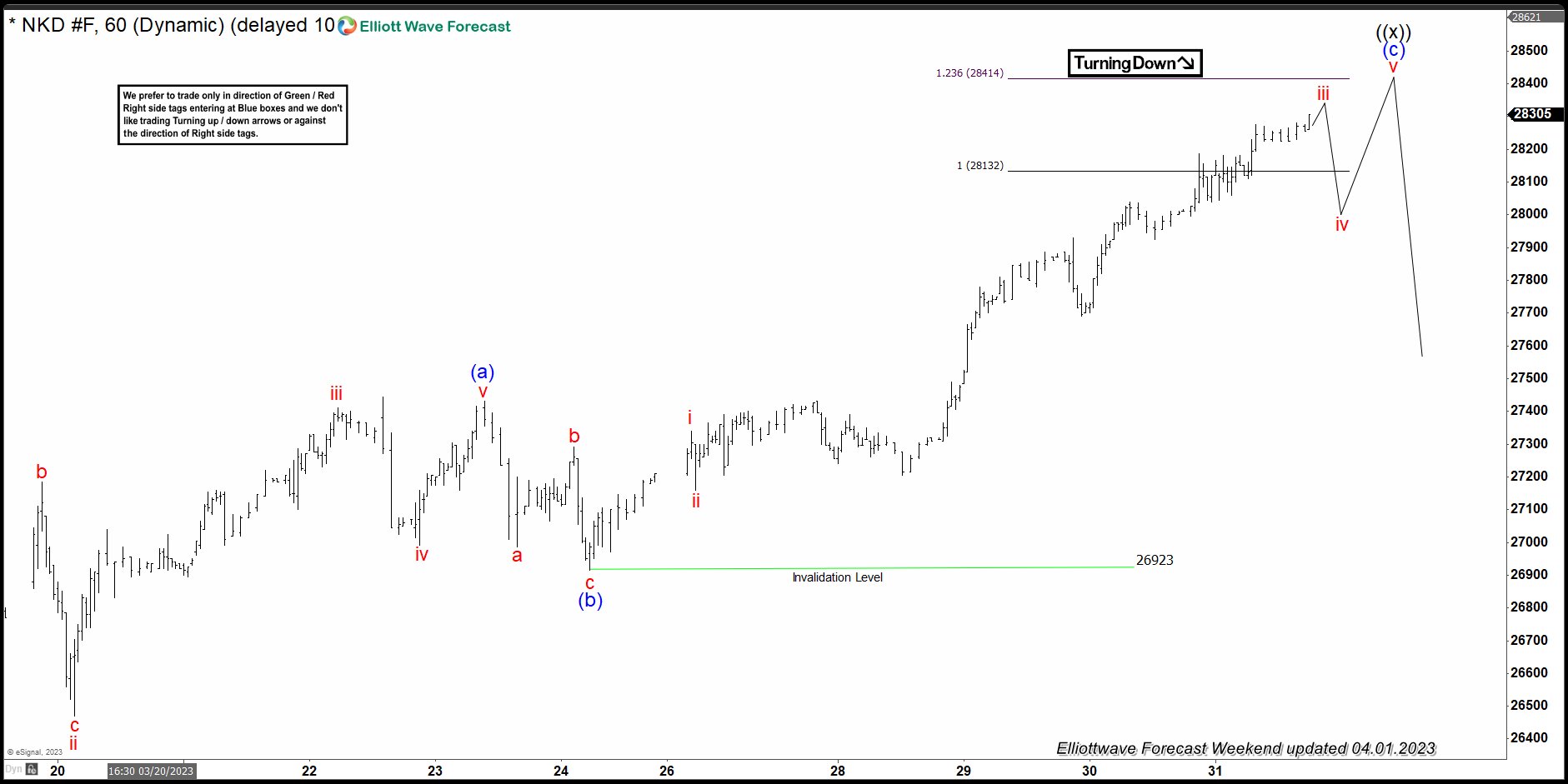

NIKKEI 1 hour Weekend update 04.01.2023

As we can see at that time we were within equal legs area of 28132 – 28414 area in which we were expecting a minimum of 3 waves reaction lower at least. Traders have a defined entry level with a defined Stop Loss at this point. As it is highly important to have a proper risk management system that allows you to enter and exit the market at all times. Next let’s have a look at the aftermath after the update. We will check the latest 1 hour weekend update from 04.08.2023.

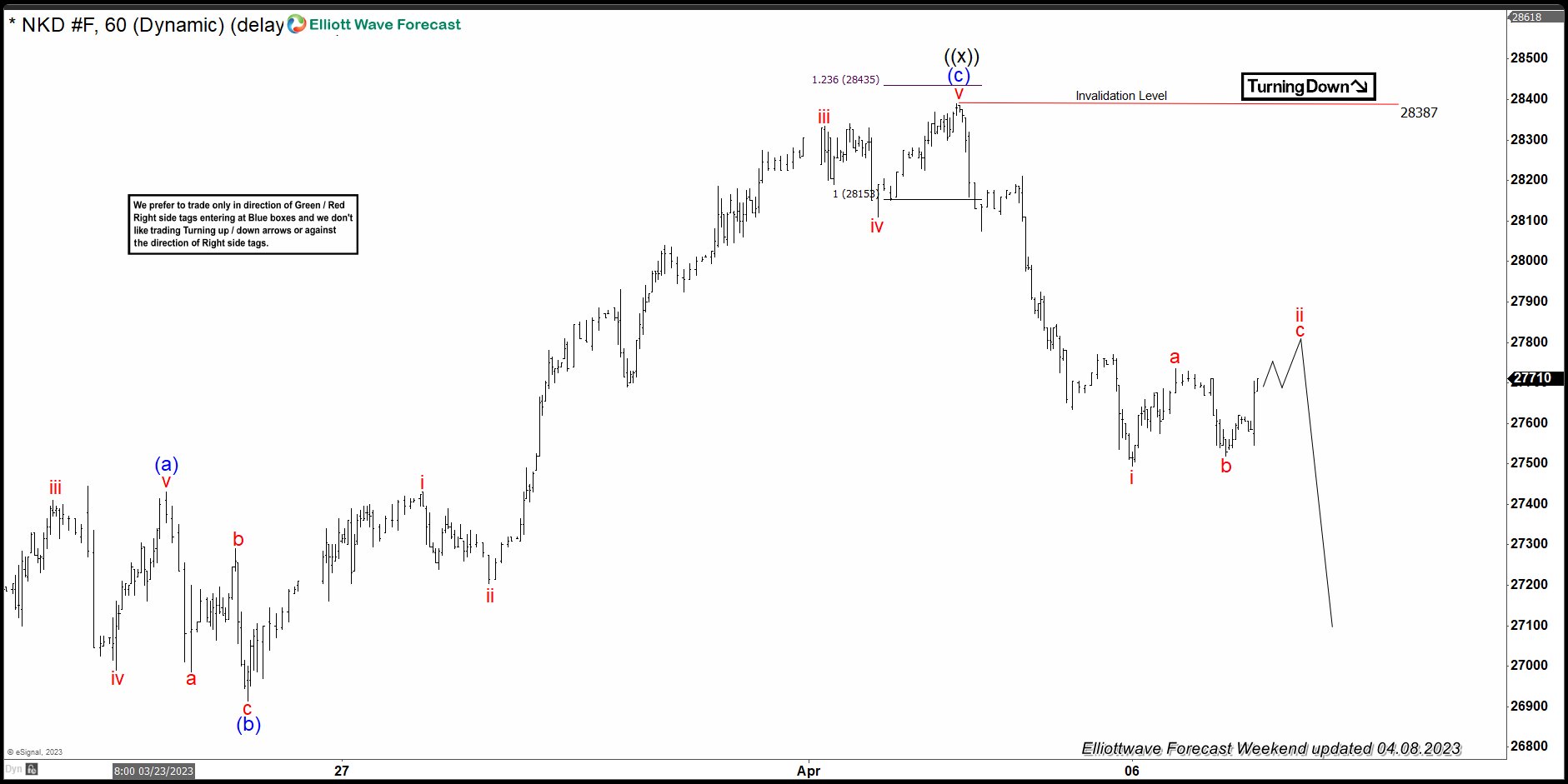

NIKKEI 1 Hour Weekend Update 04.08.2023

It has reacted lower as expected within wave i. Currently it is bouncing within wave c of ii and expected to fail below 28387 for wave iii lower. NIKKEI belong to our Group 1 instruments amongst other Indices such as the SPX, FTSE, DOW JONES.

You can learn how to trade the right side and when to enter and/or exit the market. Moreover, learn how to trade equal legs areas and blue boxes. Alongside with daily Live Analysis Sessions & Live Trading Room. On top of that we have a 24 hour live chat and chat room in which we answer any questions for each instrument. Click the links below to sign up or try first our 14 day trial.

Join us today: Elliott Wave ForecastElliott Wave Forecast Trial Plan Page

Or for a 14 day trial: