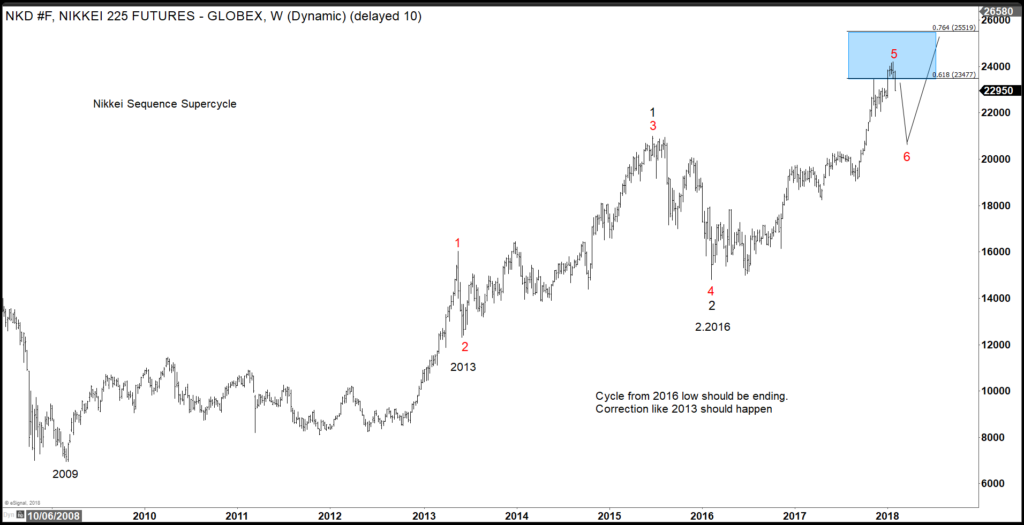

In this blog, I want to discuss with you why NIKKEI Index has still more upside. In the chart below you can see our NIKKEI Indexweekly chart. You can see that the NIKKEI is in the area of 61.8-76.4% Extension from 2009 lows. Showing an incomplete bullish sequence against that low. We do understand that markets never move in a straight line. That means markets always trend and correct. This correction is nothing surprising to us. We knew that between the 61.8-76.4% extension markets tend to correct in the 6th swing before more upside in the 7th swing will follow, but we need to be patient at this time. (Please note a 5 swing sequence is different than 5 waves impulse.) Therefore, it still remains a buy in 3-7-11 swings and its clear for our members how to trade it.

Weekly NIKKEI Index Swing Sequence

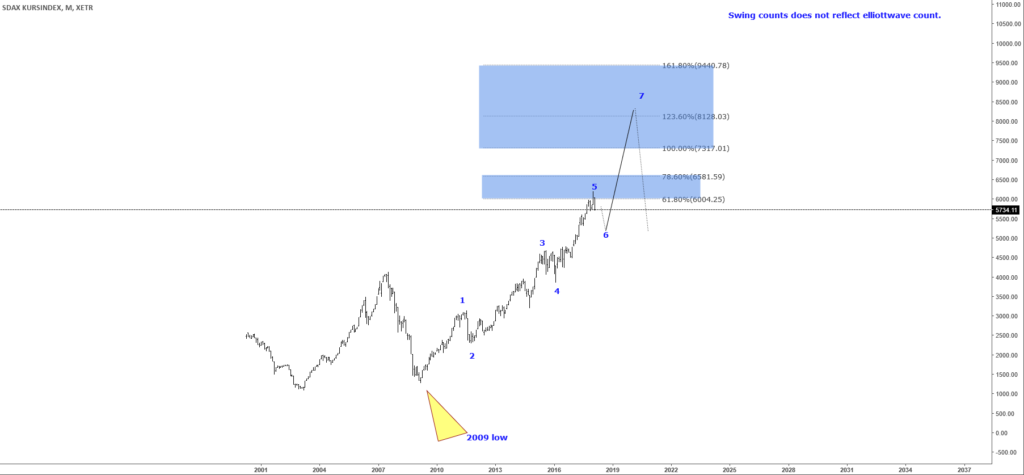

In the chart below, you can see the monthly chart of SDAX.

The SDAX is a German stock index of 50 small and medium-sized companies in Germany. These are small caps ranked directly below the MDAX shares in terms of order book volume and market capitalization.

From the post-financial crises low (2009), we can see that the SDAX has completed the possible 5th swing between 61.8-76.4%. Where it is now correcting in the 6th swing like the Nikkei above. We should see a dip and then followed by the last big push higher into 7317.01 areas. Before the biggest pullback could be seen. Overall, we can conclude that the SDAX also needs way more upside in the long term. And that we just ended the 5th swing just like we did in the Nikkei Index.

Monthly SDAX Chart

But why do we think this wil infulence the other global indices, you might ask yourself?

We believe in the one market concept. One of the Ideas which we have developed is a concept of “One Market”. The Elliott wave Theory is famous for always having more than one possible path and we see many traders following a principal path, then they have a series of alternative paths just in case the principal path doesn’t work.

From experience, we have concluded it’s hard to trade this way, so we add many tools to a system in order to help The Elliott wave Theory and remove the suggesting nature of the Theory.

The idea that each move can be seen in different ways is not reliable enough for you to place your money on one idea or side of the Market. The One Market concept follows as many instruments around the group and divides the instruments into groups and follow cycles and sequences for each instrument and groups and most of everything correlated them into a higher degree path, which always is more reliable than that following only The Elliott wave Theory.

We have been using this concept for a long time at www.Elliottwave-forecast.com and have been able to be in the right side most of the time and to forecast many big turns in the Market only base in the one market concept.

Therefore I show you now another index from Europe which could give us the floor for the U.S. Indices also. It is the MDAX from Germany.

From the post-financial crises low (2009), we can see that the MDAX has also completed the possible 5th swing between 61.8-76.4%. Where it is now correcting in the 6th swing like the SDAX above. We should see a dip and then followed by the last big push higher. Please read our article about indices here: https://elliottwave-forecast.com/stock-market/world-stock-index-has-much-more-upside/. Overall, we can conclude that the MDAX also needs way more upside in the long term just like NIKKEI Index.

MDAX Chart

The conclusion is that world indices still have more upside, accordingly to the one market concept. Our members know how to trade those markets correctly.

I hope you liked this blog and I wish you all the best. Join us for a 14 FREE trial, to see our latest trading setups and charts. Click Here

We believe in cycles, distribution, and many other tools in addition to the classic or new Elliott wave Principle. To get a regular update on the market and Elliott wave charts in 4-time frames. And the best thing is you can join us for a 14 days FREE trial to see whether our service suits you.

If you enjoy this article, check our work and join HERE to see Elliott Wave Forecast in 4-time frames for 78 instruments as well as getting access to Live Trading Room, Live Session, and more.

Back