There is no shortage of Meme stocks these days to trade. Zac Morris is a trader who has a large following on Twitter. Lately, his stock picks have had the “wall street bets” effect where retail floods in to create large surges in price. I decided to take a look at his latest pick, Nextplay Technologies. First, lets take a look at what they do as a company:

“We develop engaging and exciting products and services in over-the-top (OTT) content entertainment, gaming, in-game advertising, travel, and fintech/crypto banking, leveraging AdTech, Artificial Intelligence, and Blockchain solutions. By combining our existing technologies’ strengths with the acquisition of new capabilities to fuel growth, we enhance our stakeholder value.”

Lets dig into the charts!

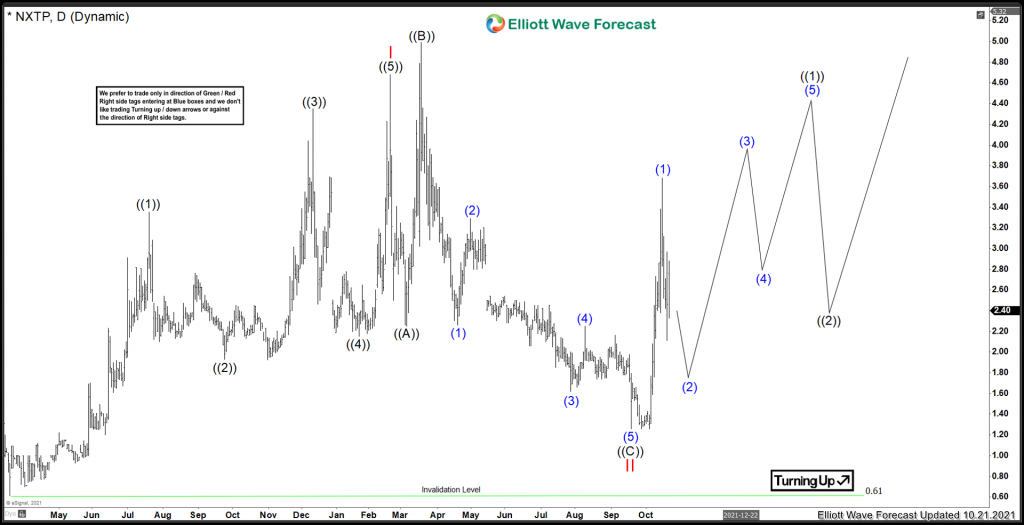

Nextplay Technologies Inc Daily Elliottwave View:

Nextplay Daily chart since the low in March 2020 shows the bigger picture at play. The stock is favoured to have rallied in 5 waves higher into Red I. After that, Red II has played out as a flat structure which struck a low in September 2021. It is favoured off the September 2021 lows that this stock will do another 5 waves higher, into a nest for ((1)) and ((2)). In order for this count to remain intact, the September 2021 lows must remain intact.

Nextplay Daily chart since the low in March 2020 shows the bigger picture at play. The stock is favoured to have rallied in 5 waves higher into Red I. After that, Red II has played out as a flat structure which struck a low in September 2021. It is favoured off the September 2021 lows that this stock will do another 5 waves higher, into a nest for ((1)) and ((2)). In order for this count to remain intact, the September 2021 lows must remain intact.

Nextplay Technologies Inc 1H Elliottwave View:

Nextplay Shorter cycles since September 20, 2021 lows. It is favoured that this stock has advanced from September 2021 low of 1.26 to a peak of 3.68 set on Oct 15/2021 in a 5 waves structure. After that peak, prices are now pulling back to correct that cycle. The price action today suggests that a connector in X is set, and now the stock will be heading lower to the blue box. The next area where buyers may enter for a bounce is the 1.80 to 1.26 area.

In order for this count to remain intact, the 1.26 low must not get violated. After that (2) is set, the next area above after (2) is complete for a target, is the 4.22 to 5.71 area.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our 14 day trial today. Get free Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back