With Bitcoin recently breaking out to new all time highs the Crypto and Blockchain market has reached fever pitch. Mara is a stock that has been consolidating since it peaked from January 8th. One more swing lower may be coming before further upside takes place. lets take a look at what they do:

“Marathon is a digital asset technology company that mines cryptocurrencies, with a focus on the blockchain ecosystem and the generation of digital assets. We currently operate our proprietary Data Center in Hardin MT with a maximum power capacity of 105 Megawatts. Once fully deployed, the Company will have 21,500 Antminer Bitmain S-19 Pro Bitcoin Miners in operation at this facility. The Company also owns 2,060 advanced ASIC Bitcoin Miners at a co-hosted facility in North Dakota.”

Lets dig into the charts!

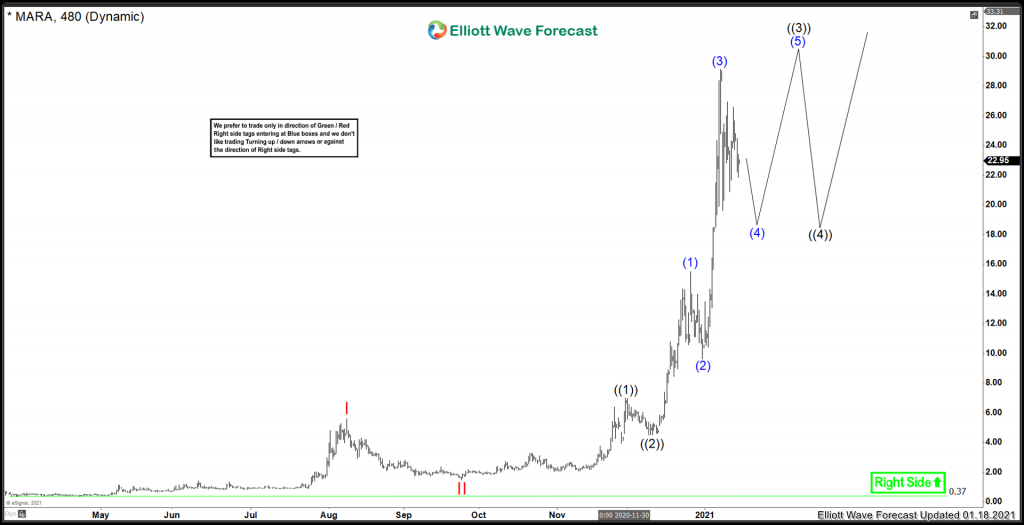

Elliottwave view 480 minute:

Medium term term view from the all time low in March 2020. There is enough evidence to support an extended wave III in progress. Blue (3) is favoured to have peaked on January 8th at 29.23 with blue (4) now in progress. BTC seems to be forming a wave 4 triangle, so it is possible that MARA does not move lower for blue (4). Regardless, it is important to know, the right side is higher, we do not like to short this instrument but like to buy pullbacks in 3, 7 or 11 swing to extremes.

In Conclusion, blue (4) may still be in progress, but depending on Bitcoin, a triangle may be in progress. Regardless we do not like to trade the sideways zones but like to trade extreme areas.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our free 14 day trial today. Get free Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back