Lockheed Martin (NYSE: LMT) has a current market cap of $104.3B and $56.46B in revenue, outperforming the defense sector companies in the recent years. The second quarter earnings report provided a clear indication that the bull case for the stock is intact with revenue up across the board.

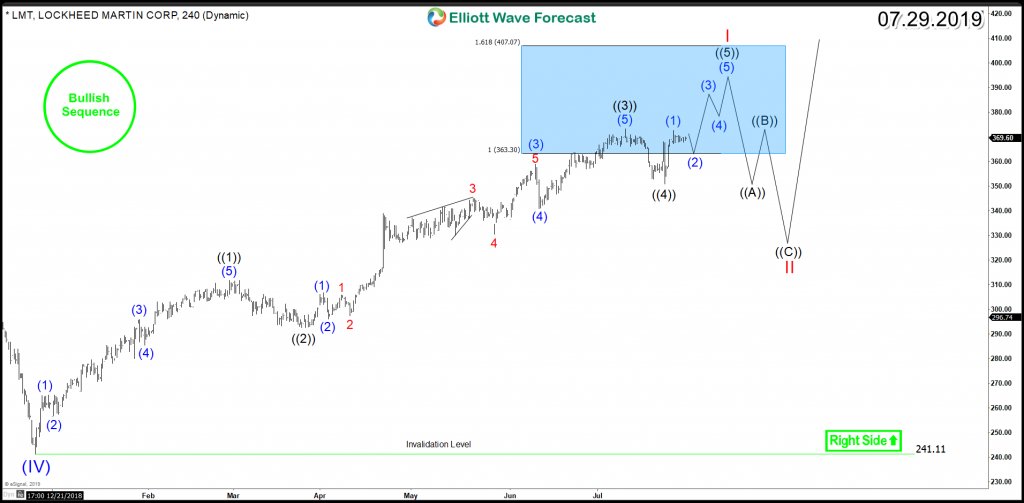

The technical picture for the stock is showing an Impulsive Elliott Wave structure from all time lows which remains in progress as LMT managed to break to new all time highs earlier this month opening further upside against December 2018 low.

LMT Daily cycle remains bullish with the current structure unfolding as impulsive waves but the stock still have the possibility of following two different path within that cycle:

The main scenario is based on a bullish nest taking place from $241 low and consequently the pullbacks are expected to be shallow and supported above July low in first degree and March low in second degree. Based on this path, the stock can extend higher toward a target area of $431 – $482 before another correction takes place.

LMT 4H Chart ( Bullish Nest )

In the second possible scenario, LMT can be ending an initial impulsive 5 waves advance from December 2018 after it reached the equal legs area $363 – $407 from where the stock can correct that cycle in 3 waves pullback before it can resume the rally toward new all time highs as long as $241 low is holding.

LMT 4H Chart ( 5 Waves )

Conclusion:

Lockheed Martin is looking to remain supported in a bullish cycle mainly against December 2018 low and the stock can either continue the rally higher using an aggressive path or can provide another buying opportunity with a larger 3 waves correction.

If you’re interested in further structures & sequences then take this opportunity and try our services 14 days to learn how to trade Stocks and ETFs in the right side of the market using the 3, 7 or 11 swings sequence and our blue boxes. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.

Back