Intel is a very important component for the Semiconductor industry. It is the #2 holding in in both the SOXX ETF, and the SMH ETF. With such a strong weighting in the overall sector, it has much influence over the direction of the industry as a whole. Most recently, Intel has declined with the broad indices, in one of the fastest declines ever witnessed. So what is in store for Intel after this decline? Today I’ll go over some long term and short term counts to help clarify what the future may hold.

Intel Elliott Wave Weekly

Generally speaking, INTC is closely aligned with the major American Indices at the present time. For the most part, the current climate in the indices will control the price movement with Intel in the Medium term. On a weekly time frame, our view is that Intel is correcting the cycle from the 2009 lows set on Feb 23/2009 at 12.05. From those lows, Intel has formed a 5 waves sequence and topped in Blue (I) on Jan 24/2020 at 69.29. Our current expectation is for a 3 waves correction in Blue (II) to present itself before a long term bottom can materialize.

Wave red a has been set on Mar 16/2020 at a low of 43.63. From there a bounce in 3 waves at least is expected to take place in red b. From there it should head lower in wave red c of Blue (II). It is also possible that the whole decline in Blue (II) is complete at the recent lows. At this time, we do not favour that with the current data we have.

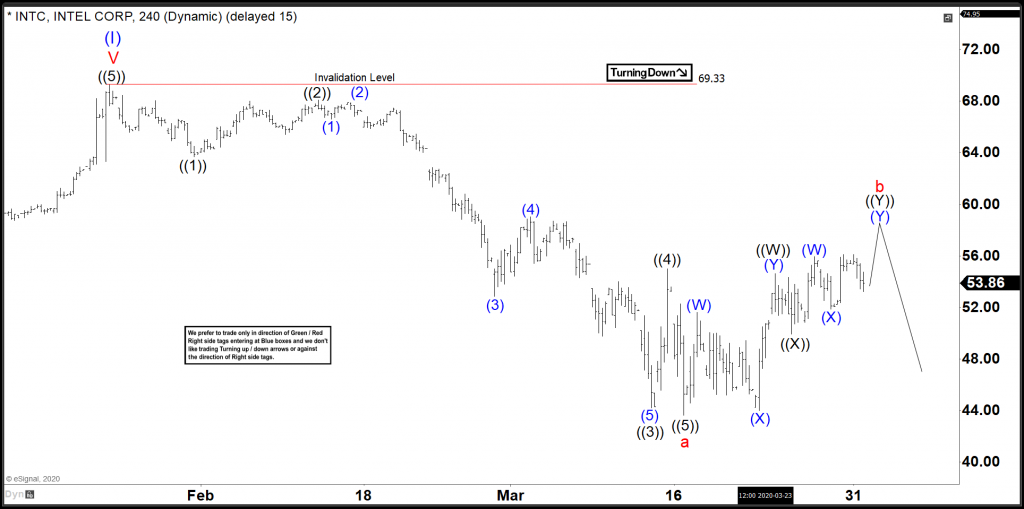

Intel Elliot Wave 4H View

Our view is that Intel has declined from the All Time Highs in an impulsive 5 waves move. It is important to realize that Elliot Wave is suggestive. As much as we are expecting another low in the Indices, we will follow the data and price action as it reveals itself. With this said, Intel can be done the decline in Blue (II). However the current data we have suggests to us that another lower low is favoured at the present time. Red b is taking shape as a double correction from the recent lows. Once Red b is complete, it is favoured that Intel head down for red c of Blue (II) to complete the correction from the All Time Highs.

As always, proper risk management is essential to long term trading success. We have a free Seminar regarding risk management techniques that you can view here if you haven’t seen it.

Try out our services for free for 14 days to see how Elliott Wave can help you be more successful with trading. We cover 78 different instruments with time frames from weekly all the way down to 1hr intraday.

Back