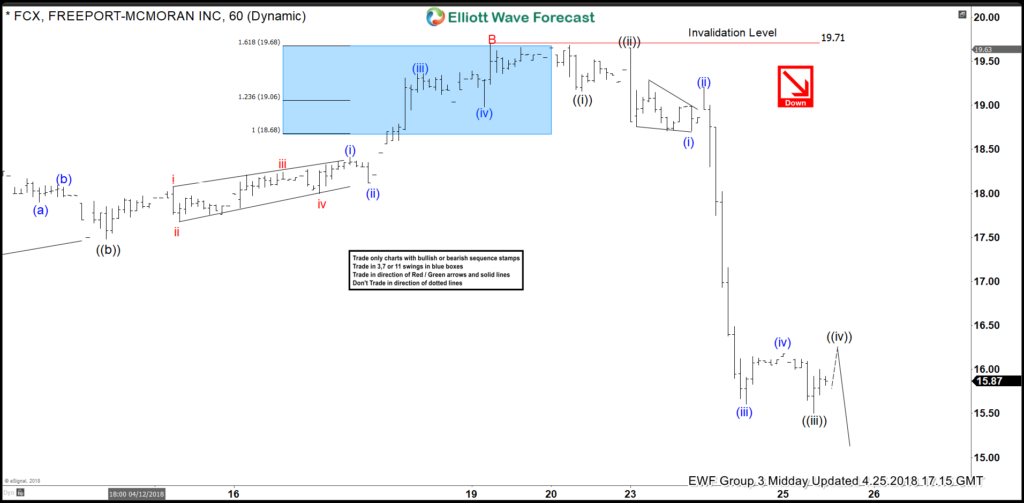

FCX Elliott Wave view in short-term cycles suggest that the cycle from January 25th, 2018 peak is unfolding as Elliott wave flat correction. When Minor wave A ended in 3 swings at 16.51 and bounce to 19.71 April 19 high ended Minor wave B. Below from there, the stock reacted lower strongly and made new lows below March 28 lows confirming the next extension lower in Minor wave C. Whereas, the decline from 19.71 high came with internal distribution of 5 waves structure with extension in the 3rd wave thus suggested the Impulse sequence.

Down from 19.71 high, Minute wave ((i)) of C ended 19.16, Minute wave ((ii)) of C ended at 19.65. Below from there, Minute wave ((iii)) of C ended in 5 waves structure at 15.50. Above from there, Minute wave ((iv)) of C is expected to fail in 3, 7 or 11 swings before the final push lower in wave ((v)) of C is seen. However, it’s important to note here that the stock has already reached the 100%-123.6% Fibonacci extension area of A-B within the cycle coming from January 25th, 2018 peak at 15.61-14.65 area. And after ending the 5 waves decline from 19.71, we should ideally see the stock doing a bounce in minimum 3 swings at least as the Elliott wave theory suggests. We don’t like selling it.

FCX Elliott Wave 1 Hour Chart

Keep in mind that the market is dynamic and the view could change in the meantime. Success in trading requires proper risk and money management as well as an understanding of Elliott Wave theory, cycle analysis, and correlation. We have developed a very good trading strategy that defines the entry. Stop loss and take profit levels with high accuracy and allows you to take a risk-free position, shortly after taking it by protecting your wallet. If you want to learn all about it and become a professional trader, then join our service with any of our monthly plan here.

Back