Expedia is showing a well-defined Elliott Wave pattern across the market place. The Elliott Wave Principle is a form of technical analysis which we use to analyze price action and forecast the future path. Ralph Nelson Elliott proposed that market prices unfold in specific patterns which alternate between impulsive and corrective phase. The most popular structure is the impulsive advance which subdivides into a set of 5 lower-degree waves.

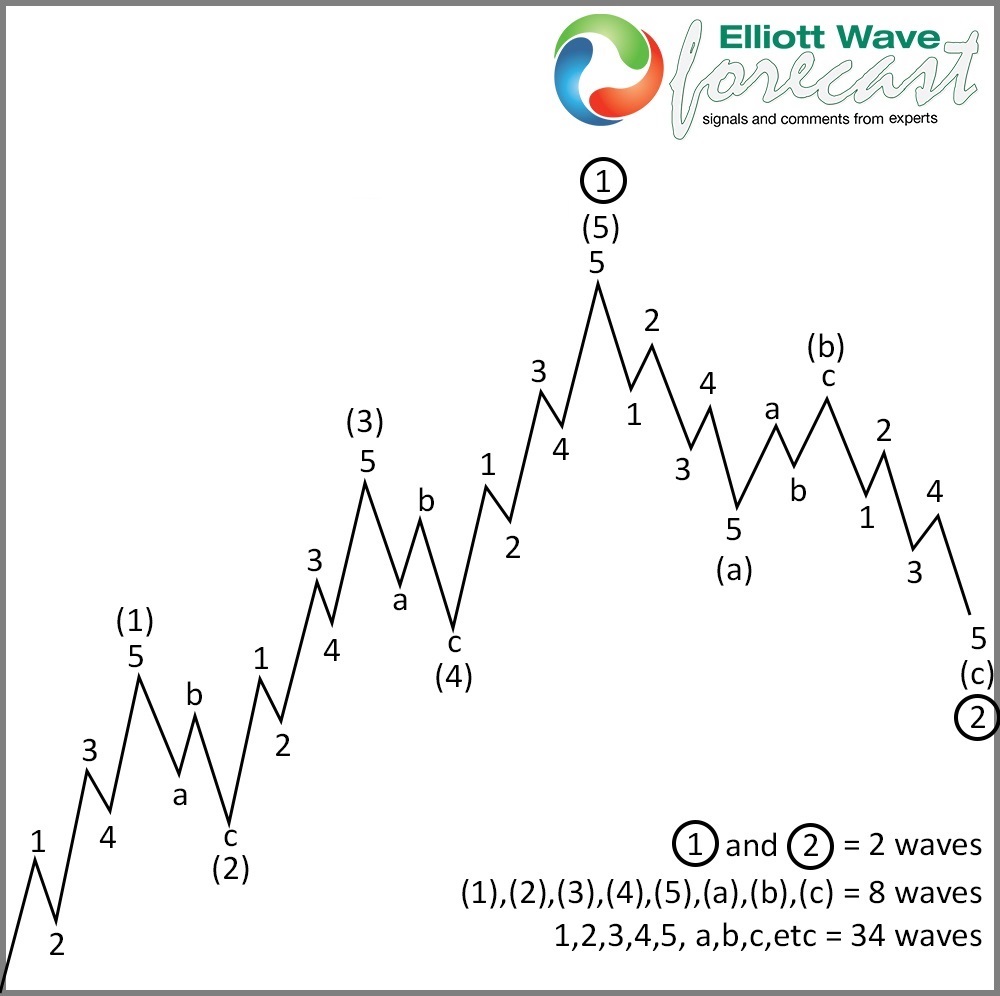

The subdivision alternates between motive and corrective phase. Waves 1, 3, and 5 are impulses, whereas waves 2 and 4 are smaller retraces of waves 1 and 3 and therefore corrective. The idea is that when the price action shows a five waves advance, there will be a follow up advance in the same direction after a 3 waves correction. The following chart shows the pattern with each lower degree subdivision.

As we can see, the three impulses within the primary impulse follow a sequence of 5-9-13-17-21 until it ends at the top. This price action repeats in each time frame or degree. After the cycle ends, then market will start a new cycle, which, most of the time, develops in an ABC. Ideally, after the ABC lower ends, then a new cycle higher will start providing traders with a trading opportunity.

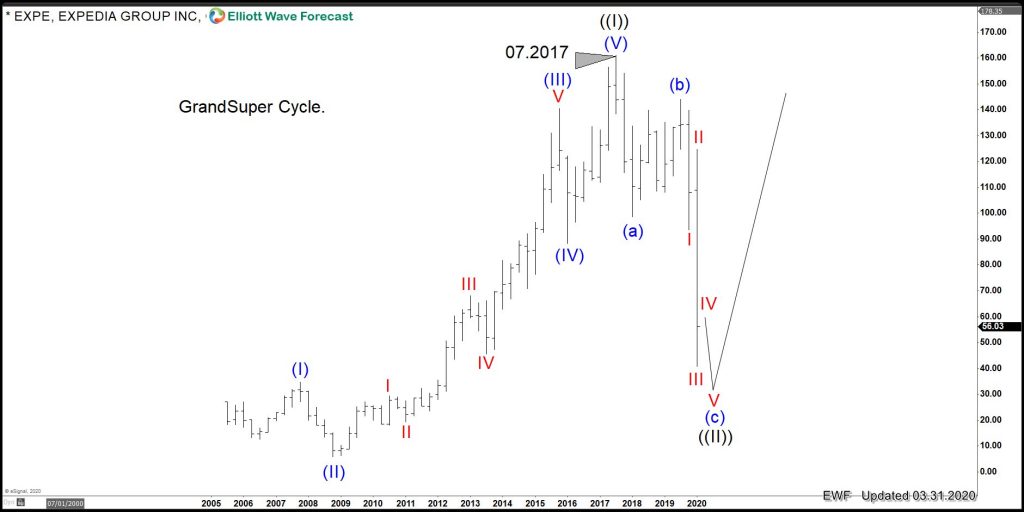

EXPE (EXPEDIA) shows a textbook five waves advance within the Grand Super Cycle. The price action shows three impulses higher in the Blue Degree, i.e. wave (I), wave (III), and wave (V). The entire 5 waves advance ended at 07.2017. Since then, the price is showing an ABC lower, which is in the finals step. Once the pullback is complete, the trend should renew to the upside. The following chart shows the idea:

Expedia Monthly Elliott Wave

Right now, we should be in the wave IV red, within the (c) blue, which is part of the ((II)) Black. As we always do at EWF, we will show the most aggressive view. In this case, it means the entire decline is wave ((II)) and the stock can soon resume to new high. The alternate view is that price will turn higher soon into the $110.00-$120.00 area. Afterwards, it resumes lower again to complete a seven swings correction lower.

We want to make the point that in correctives patterns, market moves in a series of 3-7-11-15-19. As of right now, nothing indicates there will be a seven swing, so this dip is a great chance to buy as soon as there is a confirmation that wave ((II)) has ended. The Elliott Wave Theory is calling Expedia higher, and we believe the world will soon be traveling again after the shutdown due to corona virus.

Back