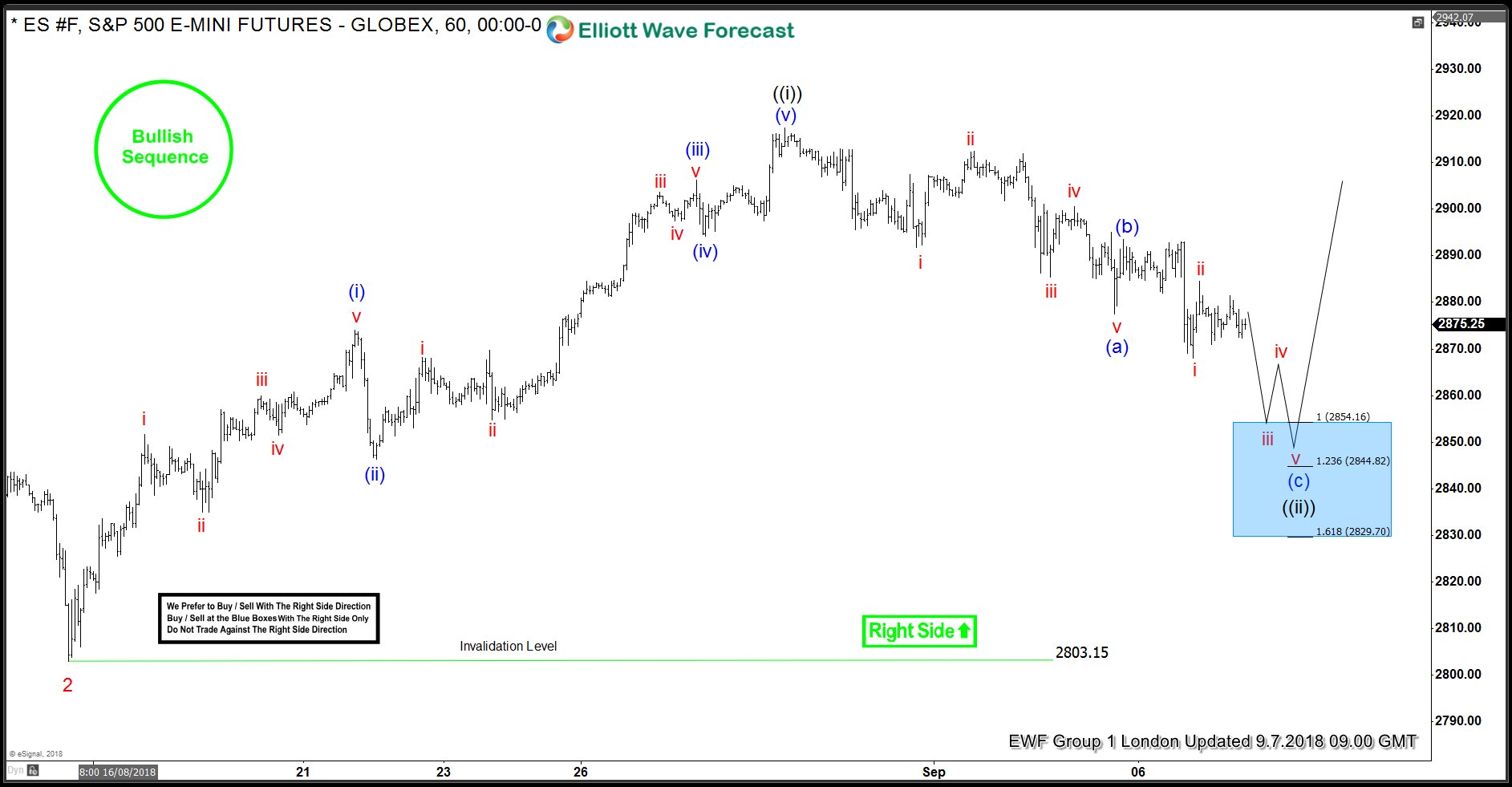

ES_F Short-term Elliott wave analysis suggests that the pullback to $2803.15 ended Minor wave 2 pullback. Up from there, the index has rallied higher into new highs confirming that Minor wave 3 has started. The internals of that rally higher is unfolding as impulse structure with the sub-division of 5 waves structure in the lesser degree, i.e. Minutte wave (i), (iii) & (v).

Above from $2803.15, the initial rally in 5 waves to $2874 high ended Minutte degree wave (i). Down from there, the pullback to $2846.25 low ended Minutte wave (ii). A rally higher to $2903.25 high unfolded in another 5 wave structure & completed Minutte wave (iii). A pullback to $2894.25 low ended Minutte wave (iv). Then finally a rally higher to $2917.50 ended Minutte wave (v) & also completed the Minute wave ((i)). Below from there, the index is doing a Minute wave ((ii)) pullback as a Zigzag structure looking to extend 1 more time towards blue box area at $2854.16-$2829.70, which is 100%-161.8% Fibonacci extension area of Minutte wave (w)-(x). Afterwards, the index is expected to resume the upside or to do a 3 wave bounce at least. We don’t like selling it and expect buyers to appear in 3, 7 or 11 swings against $2803.15.

ES_F 1 Hour Elliott Wave Chart

Back