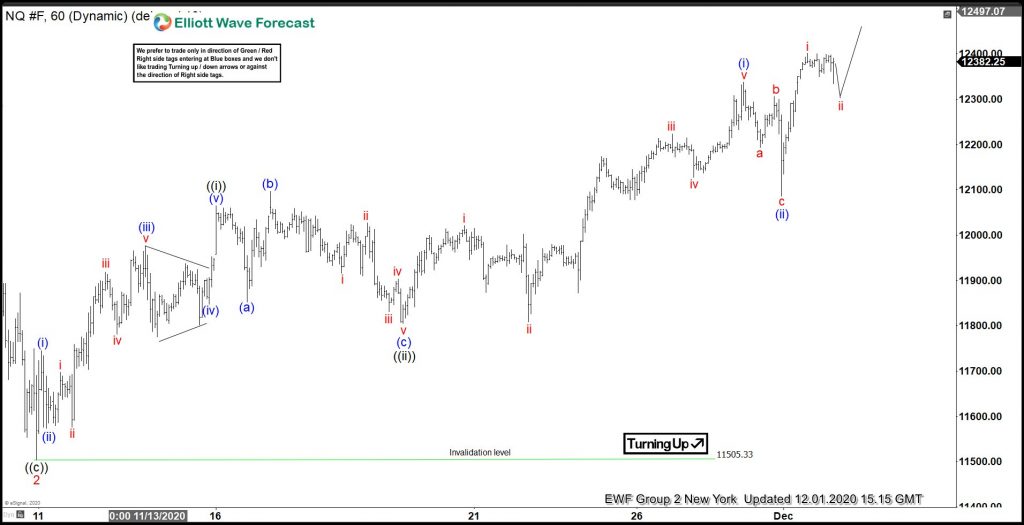

Short term Elliott Wave View in Nasdaq (NQ) suggests the Index ended wave 2 on November 10 at 11505.33. The Index has since turned higher in wave 3. The internal of wave 3 is nesting higher as a 5 waves impulse. Up from wave 2 low at 11505.33, wave ((i)) ended at $12065, and wave ((ii)) pullback ended at $11804.5. Above from there, the index is nesting higher in wave ((iii)) whereas lesser degree wave (i) ended at $12337.25 high. And wave (ii) pullback ended at $12286.25 low. And now the index is looking for more strength towards $12617- $12742 area next within wave (iii) of ((iii)) before a pullback can take place.

As far as pivot at 11505.33 stays intact, expect dips to find support in the sequence of 3, 7, or 11 swings for further upside. If pivot at 11505.33 gives up, then there’s a possibility that the Index ends cycle from September 21 low as a diagonal. In this case, Index can do a larger pullback in 3, 7, or 11 swings to correct the rally from September 21 low before the rally resumes.