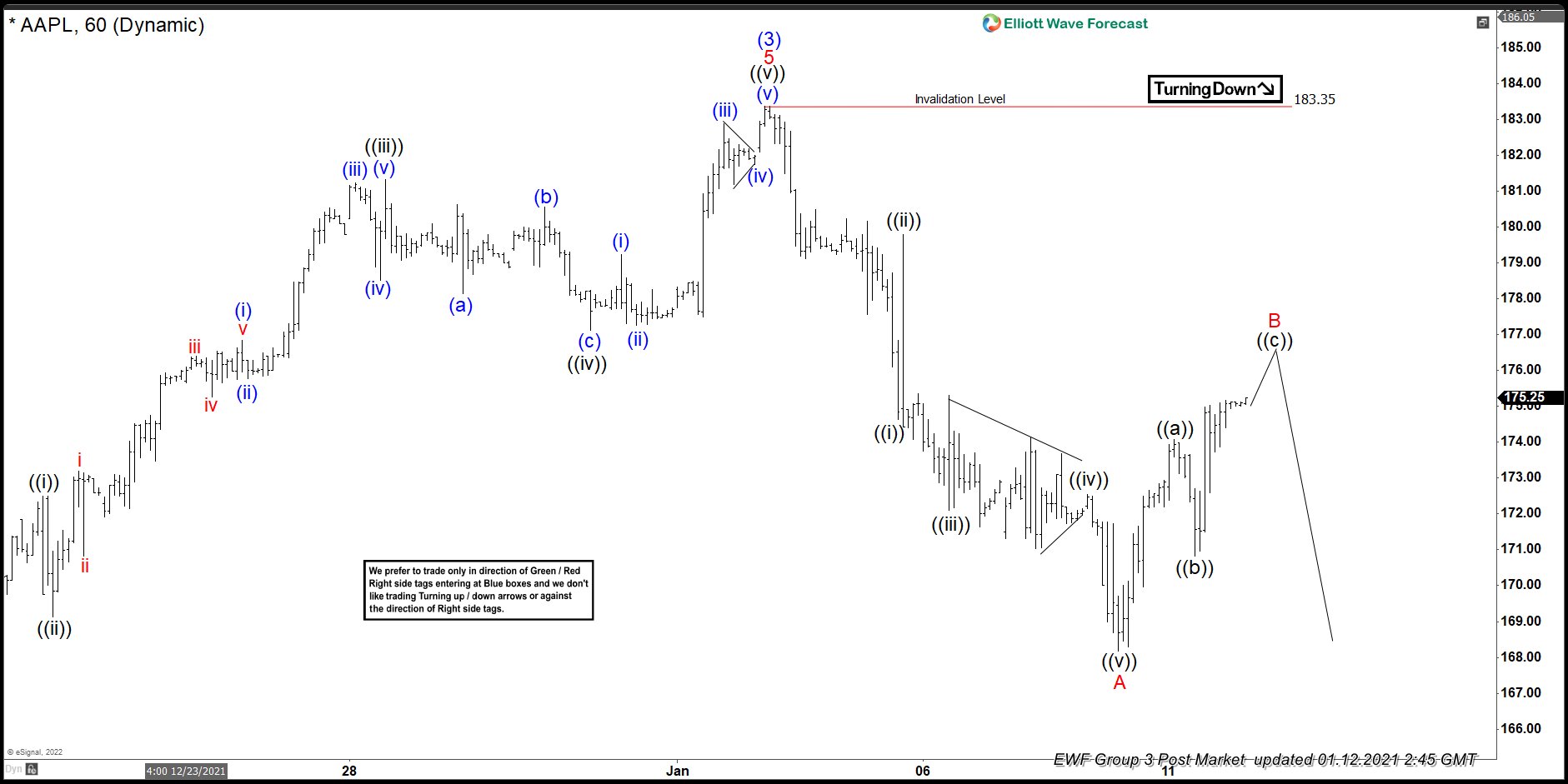

Short Term Elliott Wave View in AAPL suggests the decline from January 04th peak is unfolding as a zig zag Elliott Wave structure. Down from January 04th high, wave ((i)) ended at 174.46. Wave ((ii)) bounce was a strong movement pullback completed at 179.80. Then the stock continued dropping to complete wave ((iii)) at 172.10. In lesser degree, we could see a triangle structure as wave ((iv)) ending the sideways movement at 172.55. The last push lower ended wave ((v)). It also completed the first leg of the zig zag structure wave A ended at 168.17.

Near term, we are looking to complete wave B bounce. We are suggesting a zig zag structure for this purpose, where wave ((a)) already ended at 174.08 and pullback as wave ((b)) is also done at 170.82. We are expecting more upside to complete wave ((c)) and wave B before turning lower again. The view is valid as far as we stay below 183.35 and it should continue dropping below 168.17 to confirm the fractal and complete wave (4) in upper degree. Potential target for wave ((c)) is 100% – 161.8% Fibonacci extension of wave ((a)) which comes at 176.7 – 180.4.