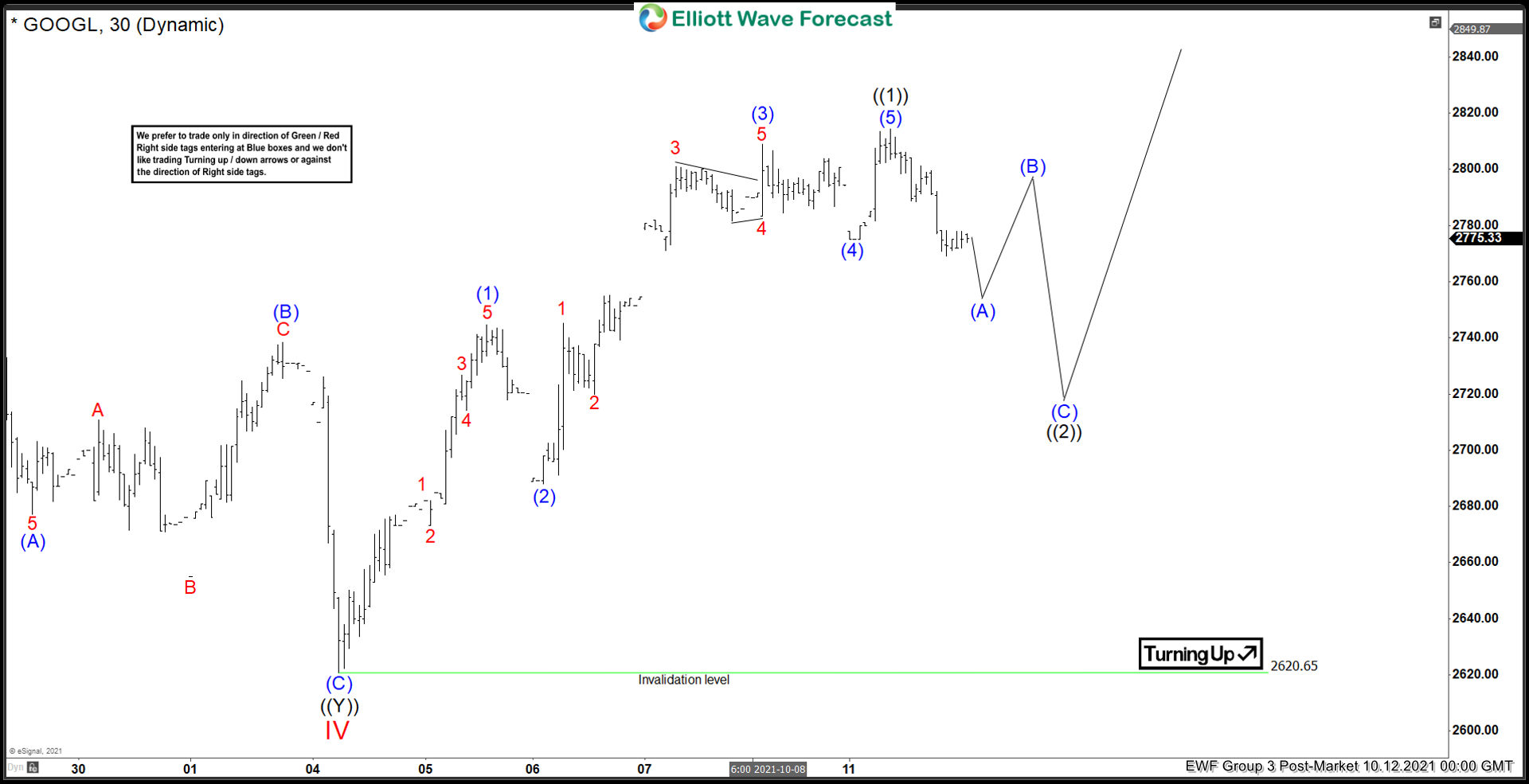

Short-term Elliott wave view in Alphabet (GOOGL) suggests the rally from October 04, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from wave IV low, with internal subdivision as 5 waves in lesser degree wave (1) ended at 2744.49 and pullback in wave (2) ended at 2688.00. Wave (3) continues higher building 5 swings more which ended at 2808.85 and pullback in wave (4) ended at 2775.00. The last push to complete wave (5) and the first swing up as wave ((1)) finished at 2814.24,

From here, GOOGL has started a pullback that should be the beginning of wave ((2)). Expect wave ((2)) dips to find support in 3, 7, or 11 swing before the rally resumes to continue developing the 5 waves impulse. In lesser degree wave (A) of ((2)) is building one more leg lower to complete it. Then we are calling a corrective structure as wave (B) that should fail for one more drop to complete an (A), (B) and (C) waves correction of wave ((2). Near term, as far as pivot at 2620.65 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.