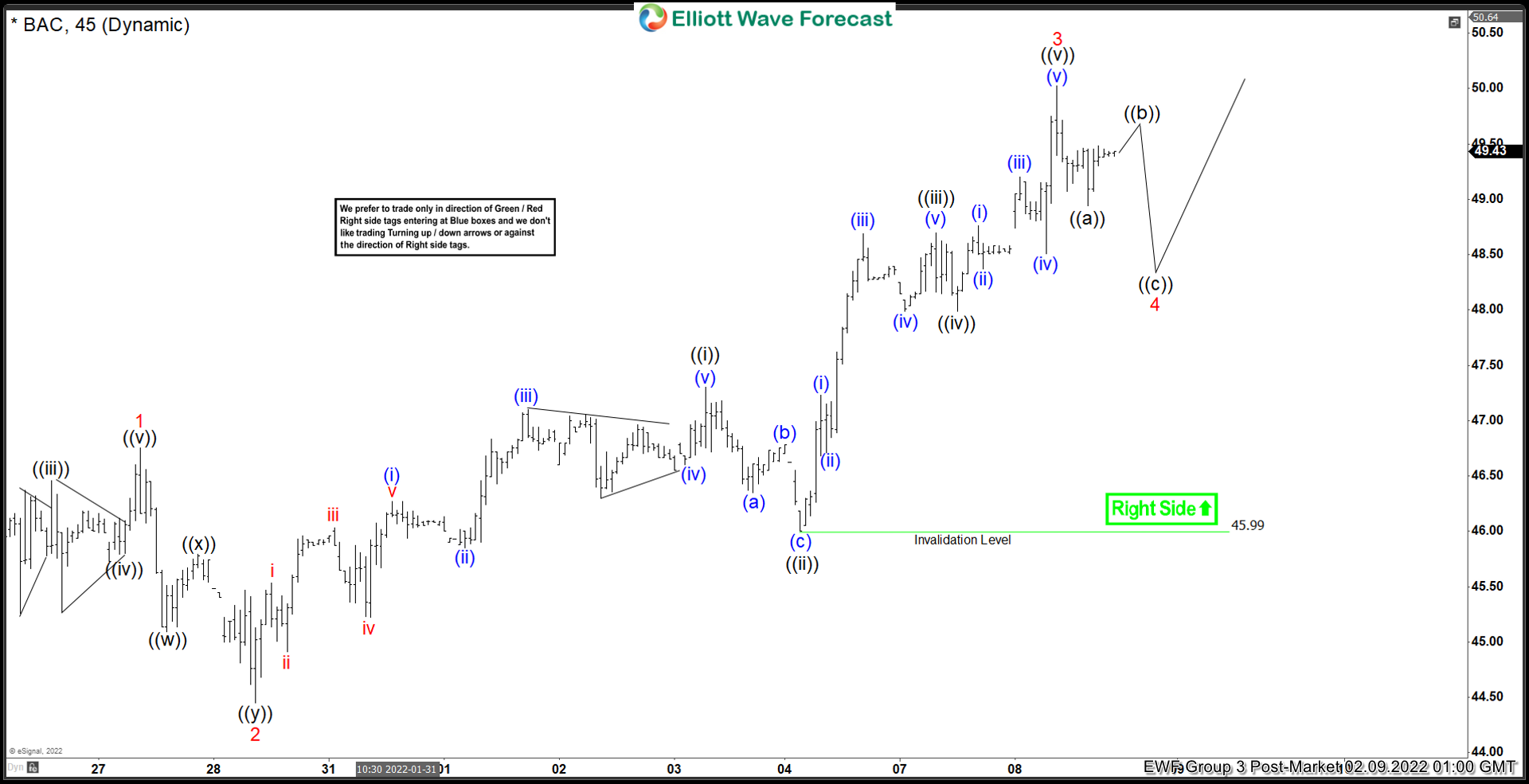

The short-term Elliott wave view in Bank of America (BAC) shows that we are looking for more upside to complete a 5 waves impulse structure, before a 3 swings pullback at least. The impulse move started from 42.59 low to end wave 1 at 46.75. A pullback in wave 2 ended at 44.45 low. BAC then resumes higher in wave 3 with internal subdivision as another impulse in a lesser degree. Up from wave 2, wave ((i)) ended at 47.30, dips in wave ((ii)) ended at 46.00, wave ((iii)) rallied to 48.70 and a pullback appeared as wave ((iv)) ended at 47.98. The last push higher to finish wave ((v)) ended at 50.02. This completed wave 3 in a higher degree.

Wave 4 pullback is building already and we are expecting an ((a)), ((b)), and ((c)) zigzag correction to complete it. Wave ((a)) is ended at 48.94 and we can see a little more higher to finish wave ((b)) to turn lower again. BAC should bounce again after end wave 4 to continue the rally and it needs to break 48.70 peak to confirm that wave 5 has started. Once a wave 5 is done, BAC could find seller to begin a correction in 3, 7, or 11 swings. The view of the wave 4 is valid as we stay above 45.99.