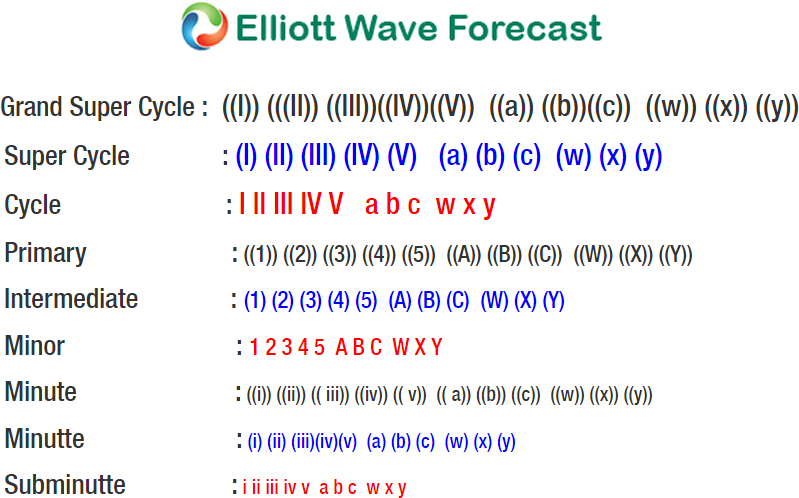

SPX short-term Elliott Wave analysis suggests that the decline to 2553.8 low ended intermediate wave (W). Above from there, the rally ended in intermediate wave (X) at 2717.49 high and the same time also completed the correction against 3/13/2018 peak (2801.9). The Index however still needs to break below wave (W) at 2553.8 low, and more importantly below 2/10 low (2532.69) to confirm that the next leg lower has started.

The internal of Intermediate wave (X) unfolded as a double three Elliott Wave structure, where Minor wave W ended at 2672.08. Minor wave X ended at 2586.27 and Minor wave Y of (X) ended at 2717.49. Down from there, the index made a 3 waves reaction lower as a zigzag Elliott Wave structure where Minute wave (a) ended at 2657.99 and Minute wave (b) bounce ended at 2683.55 high. Minute wave (c) of ((w)) appears complete at 2617.32 low. This level is within the 100%-123.6% Fibonacci extension area of Minute (a)-(b) at 2609.9 – 2624.01. Near-term, expect the index to rally in Minute wave ((x)) to correct cycle from 4/18 high (2717.52) before further downside is seen, provided that pivot at 2717.52 high stays intact.