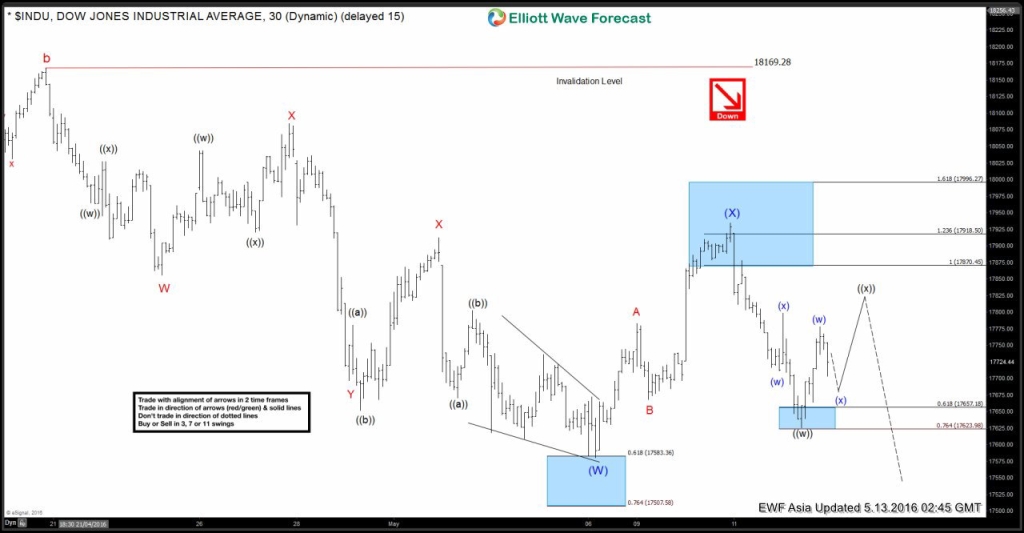

Short term Elliottwave structure suggests wave “b” is proposed over at 18173.54. Decline from there is unfolding as a double three structure where wave (W) ended at 17580.38 and wave (X) bounce ended at 17934.61. Near term, while wave ((x)) bounce stays below 17934.61, and more importantly as far as pivot at 18173.54 stays intact, expect the Index to resume the decline lower. We don’t like buying the proposed bounce and expect wave ((x)) correction to fail below 17934.61 in the first degree for another extension lower.

If pivot at 17934.61 high gives up during the bounce, then Index would do a double correction in wave (X) and could retest 18173.54 high before making a turn lower.

At EWF we offer 24 hour coverage of 50 instruments from Monday – Friday using Elliott Wave Theory as primary tools of analysis. We provide Elliott Wave chart in 4 different time frames, up to 4 times a day update in 1 hour chart, two live sessions by our expert analysts, 24 hour chat room moderated by our expert analysts, market overview, and much more! With our expert team at your side to provide you with all the timely and accurate analysis, you will never be left in the dark and you can concentrate more on the actual trading and making profits. Check out our 14 day Free Trial to sample everything EWF has to offer

Back