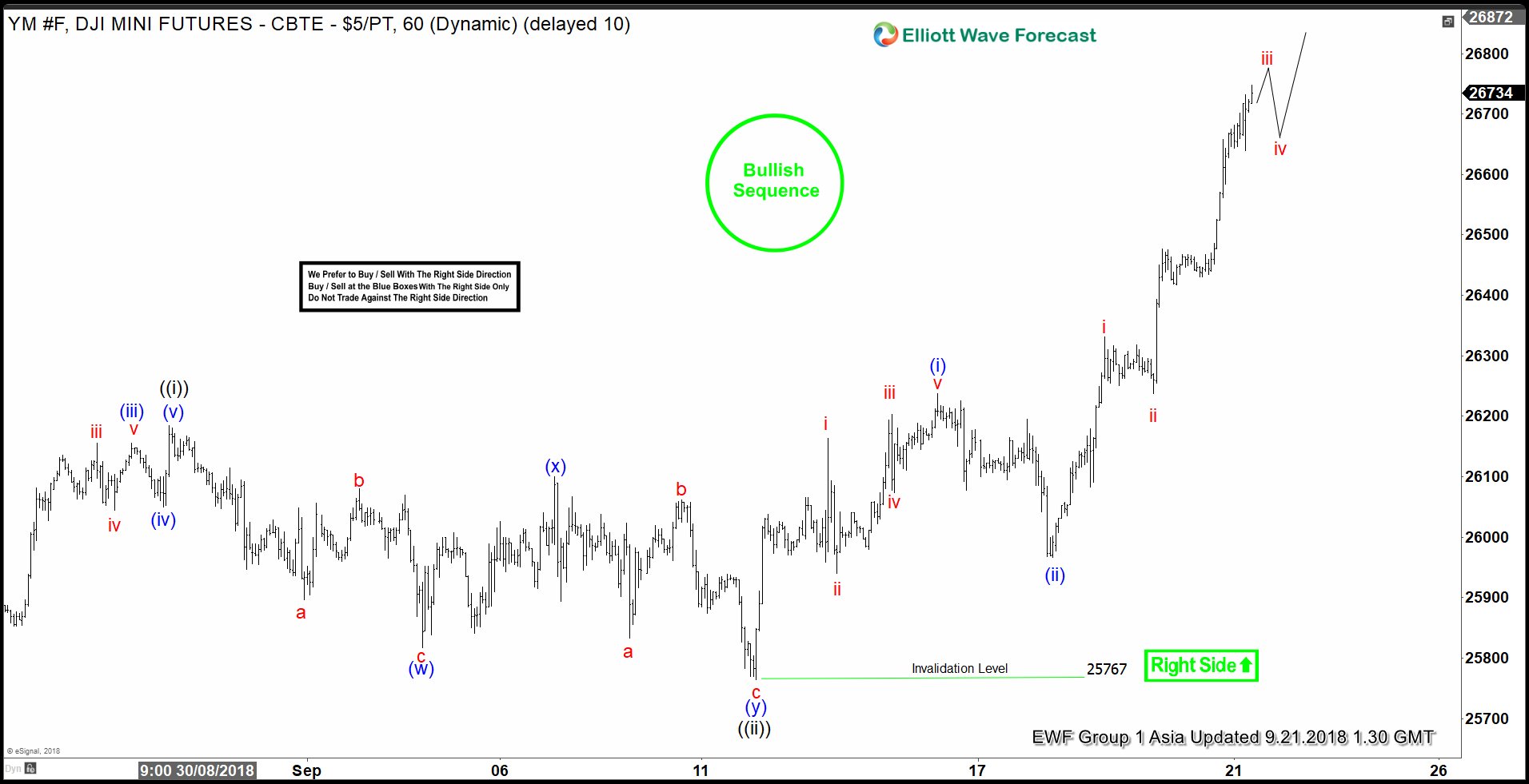

DJIA Mini Futures mid-term Elliott wave view suggests that the cycle from 2/05/2018 low is nesting higher as impulse structure & already managed to make new all-time highs. While shorter-cycles suggests that index should be extending higher in lesser degree wave ((iii)) of 3 still looking for more upside extension. The initial rally in index to $26185 high ended Minute degree wave ((i)) in 5 waves structure. Down from there, the pullback to 25767 low ended intermediate wave ((ii)) pullback.

The internals of Minute wave ((ii)) pullback unfolded as double three structure where Minutte wave (w) ended in 3 swings at 25819 low. Minutte wave (x) ended at 26092 and Minutte wave (y) of ((ii)) ended in 3 swings at 25767. Up from there, Minute wave ((iii)) remain in progress as an impulse with lesser degree cycles showing 5 waves structure in each leg higher i.e Minutte wave (i) showed 5 waves rally up to 26237 high. Minutte wave (ii) ended at 25991 low & Minutte wave (iii) is extending higher in another 5 waves. Near-term, while dips remain above 25767 low the index is expected to see more upside. We don’t like selling it as the right side tag is up and having a bullish sequence. Therefore, expect buyers to appear on any dip in 3, 7 or 11 swings against 25767 low.