Since the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured from 0 to 2019’s high projected from March’s low, equal legs. Since we begin with this analysis on February 13th, we bought the share in 160.97 – 165.89 area.

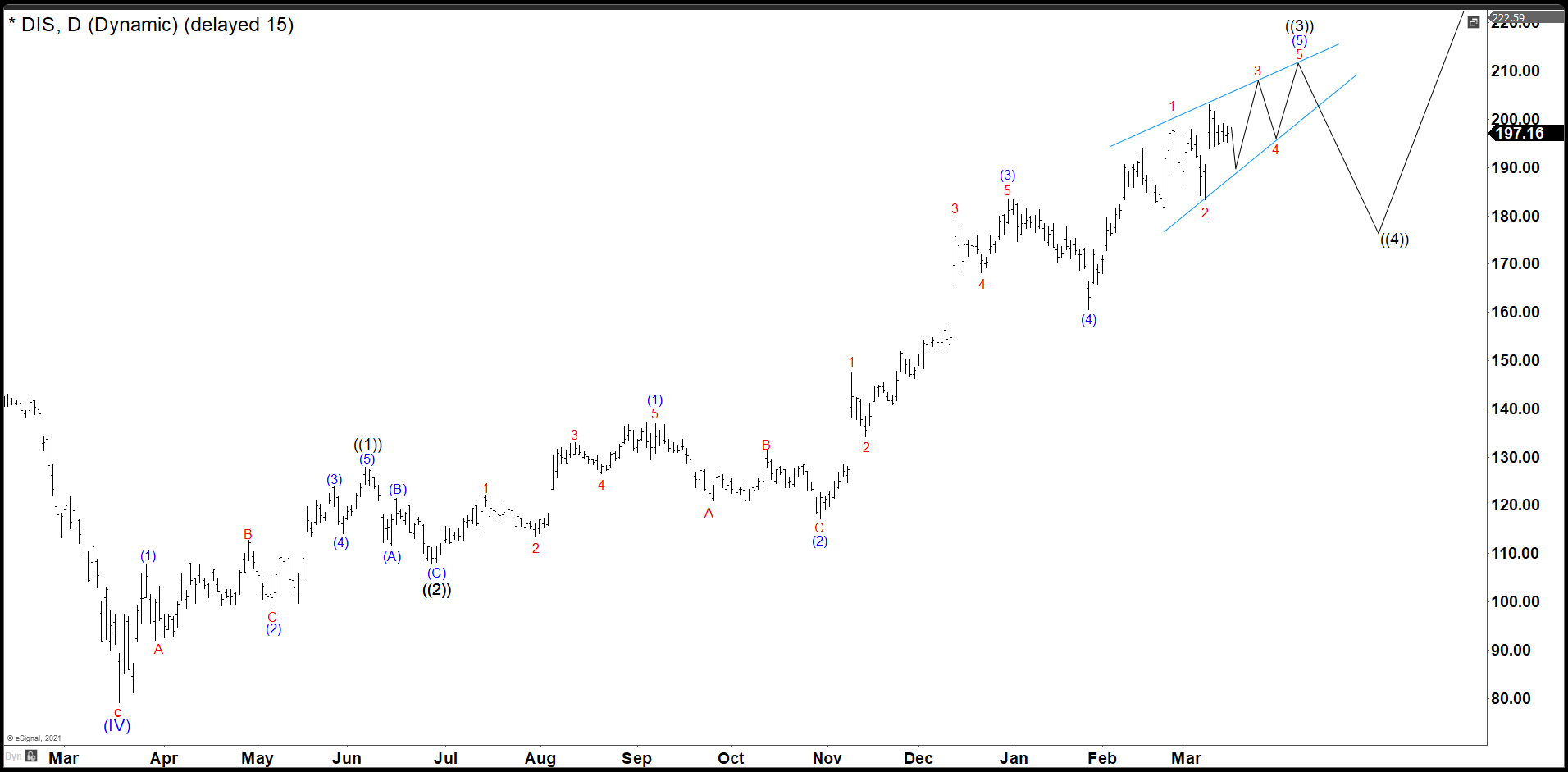

Disney Daily Chart

As we see in the daily chart, the waves ((1)) and ((2)) of the impulse have completed and currently we are building the wave ((3)). We hit our first target at 190.88. The target gave us a return of +18.58% from 160.97. Last week the share has continued ranging. Disney did not make too much progress and the current structure shows that it is better to thinkthe stock should build to the upside an ending diagonal. (If you want to learn more about Elliott Wave Theory, please follow this link: Elliott Wave Theory).

This ending diagonal makes me think about to adjust the impulse counting. Although it is the same result as the previous chart, that we are finishing wave ((3)), structurally speaking it looks much better labelled wave (3) at 183.55 and wave (4) at 160.56. Thus, the move from 160.56 is wave (5) as diagonal. In the chart we suggest a structure to form the ending diagonal, but it could change during the week. I do not think we will complete the diagonal this week because these are slow structure to develop. Then we will see in what area this wave ((3)) could be ending and the possible levels for wave ((4)).

Disney 30 minutes Chart

We change the near term structure as an ending diagonal, wave 1 and 2 in red has concluded and we are building wave 3 as an ((a)), ((b)) and ((c)) structure. The chart shows wave ((b)) still needs one more low to complete it and we should look for a bounce in 189.63 – 183.82 area. The market would continue the rally and break above wave ((a)) to find a top to end wave ((c)) and also wave 3 in red.

In Elliottwave Forecast we update one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. Let’s trial for 14 days totally free here: I want 14 days of free trial.

Back