Rally from 8/29 low in DAX is unfolding as a double three Elliott Wave structure where Intermediate wave (W) ended at 13089 and Intermediate wave (X) ended at 12903. Up from there, the rally from 12903 low appears to be unfolding as an impulse. Minute wave ((i)) ended at 13066, Minute wave ((ii)) ended at 12906.5, and Minute wave ((iii)) ended at 13249.5. Near term, while pullbacks stay above 12903 low, expect Index to extend higher.

Alternatively, the rally from 10/19 low (12903) can also be unfolding as a flat Elliott Wave structure. In this alternate scenario, DAX can start to correct cycle from 10/19 low now in 3, 7, or 11 swing without making another push higher in Minute wave ((v)). However, regardless whether DAX makes another leg higher or not, we expect Index to remain supported and dips remain to be bought in 3, 7, or 11 swing as far as pivot at 12903 stays intact.

DAX 1 Hour Elliott Wave Analysis

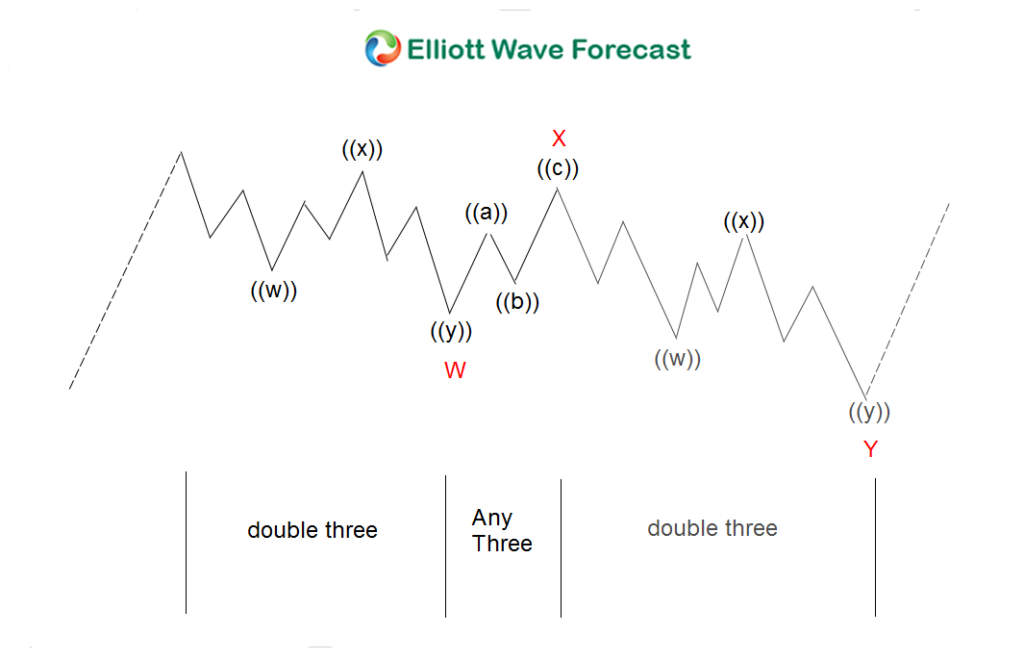

Double three ( 7 swings) is one of the most important patterns in Elliott wave’s new theory. It is also one of the most common patterns in the market these days. Double three is also called a 7-swing structure. It is a very reliable pattern and it gives traders a good opportunity to trade with a well-defined level of risk and target areas. The image below shows what Elliott Wave Double Three looks like. It has labels (W), (X), (Y) and an internal structure of 3-3-3. This means that all 3 legs has corrective sequences. Each (W) and (Y) is formed by 3 wave oscillations and has a structure of A, B, C or W, X, Y of smaller degrees.

Back