Hello fellow traders, in this blog post, we will discuss the related indices to the DAX from Germany in a more bigger picture. Those mid/small caps could give us a floor for the DAX Index. We will discuss the MDAX, SDAX, and the TECHDAX

Let’s start with the MDAX.

The MDAX is a German stock index which lists 50 Prime Standard shares from sectors excluding technology that rank immediately below the companies included in the DAX index.

From the post-financial crises low (2009), we can clearly see that the MDAX has an incomplete 5 swing bullish sequence. Please note a 5 swing sequence is different than 5 waves impulse. Where it is still in the possible 5th swing. We should see a bigger dip in the near future as swing 6 and then followed by the last big push higher into 2020-2022. Before the biggest pullback in history could be seen. Please read our article about indices here: https://elliottwave-forecast.com/stock-market/world-stock-index-has-much-more-upside/. Overall, we can conclude that the MDAX needs way more upside in the very long term.

MDAX Monthly Chart

Let’s have a look now at the SDAX.

The SDAX is a German stock index of 50 small and medium-sized companies in Germany. These are small caps ranked directly below the MDAX shares in terms of order book volume and market capitalization.

From the post-financial crises low (2009), we can clearly see that the SDAX also has an incomplete 5 swing bullish sequence. Where it is still in the possible 5th swing. We should see a bigger dip in the near future as swing 6 and then followed by the last big push higher into 2020-2022. Before the biggest pullback could be seen. Overall, we can conclude that the SDAX also needs way more upside in the very long term.

SDAX Monthly Chart

Now let’s have a look at the last one. It is called the TECHDAX.

The TECHDAX is a German stock index of the 30 largest German companies from the technology sector. The companies rank below those included in the DAX.

From the post-financial crises low (2009), we can see that the TECHDAX also has an incomplete 5 swing bullish sequence. Where it is still in the possible 5th swing. We should see a bigger dip in the near future as swing 6 and then followed by the last big push higher into 2020-2022, like all the other indexes above. We can also with this index that the TECHDAX also needs way more upside in the very long term.

TECHDAX Monthly Chart

But what to do with that information above, you might think. Well, for our members it is very clear what to do –> Buying the world indices further to the upside. Let me give you a conclusion.

Point 1.) The German economy is doing very well and should also continue in the future. Why? Because the stock market is just a reflection of the health of a country.

Point 2.) With the gathered information, we can say also that the American indices will take the similar path to the upside. Why? Because all stock indexes are big-time correlated to each other.

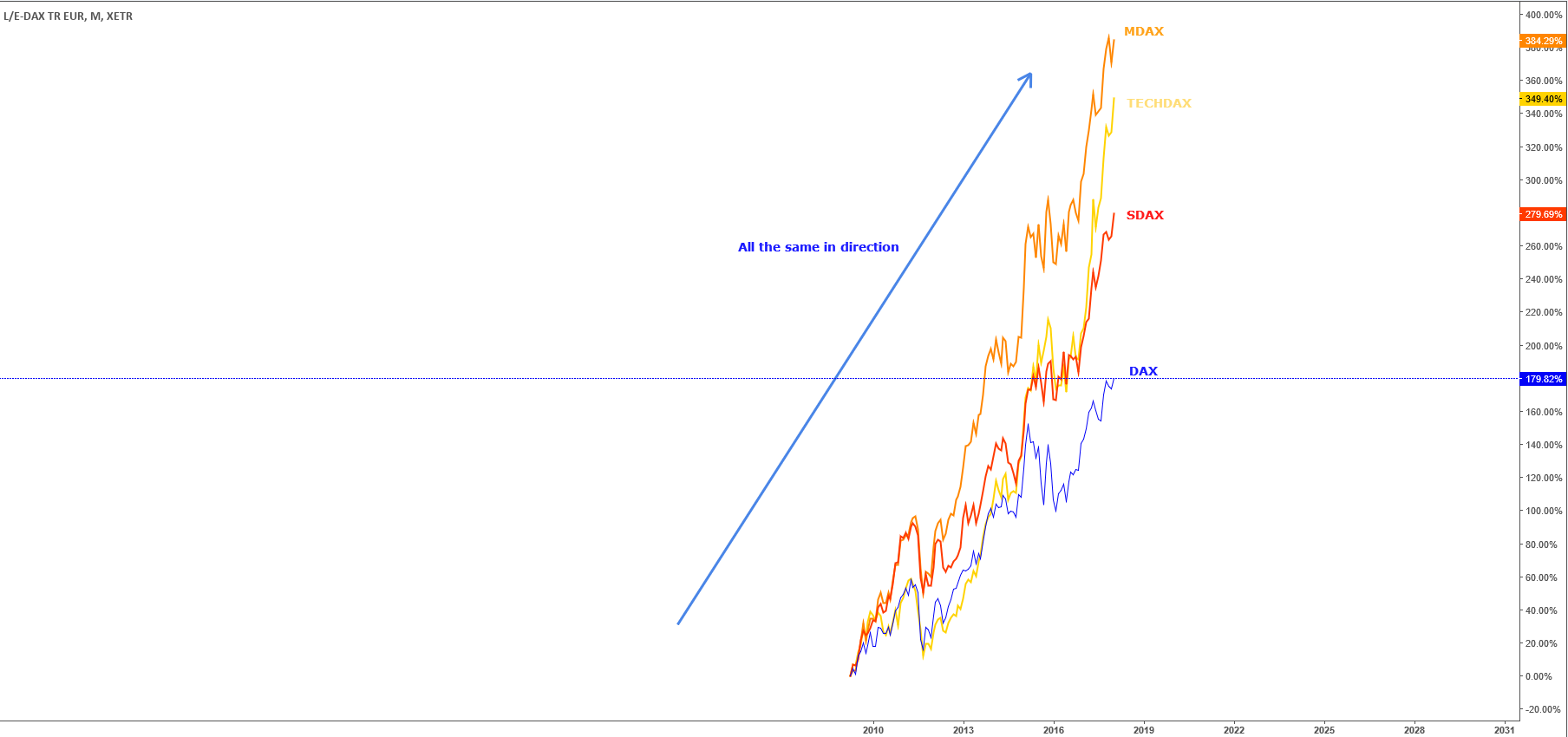

Point 3.) The German DAX should also be supported, due to the high correlation. In the chart below you can see the SDAX, MDAX, TECHDAX and the DAX overlayed. You can clearly see, that they move very similar.

I hope you liked this blog and i wish you all the best. Dont forget to sign up for a 14 days FREE trial below.

We believe in cycles, distribution, and many other tools in addition to the classic or new Elliott wave Principle. To get a regular update on the market and Elliott wave charts in 4-time frames, try our service for 14 days for FREE. Click Here.

If you enjoy this article, check our work and join HERE to see Elliott Wave Forecast in 4-time frames for 78 instruments as well as getting access to Live Trading Room, Live Session, and more.

Back