Freeport McMoran based in Arizona, USA is the largest copper and molybdenum producer in the world. In 2015 , 67% of revenues were from the sale of copper, 11% were from the sale of petroleum, 10% from the sale of gold, and 5% from the sale of molybdenum. Without doubt the company balance sheets have suffered in the commodity price declines since 2008 however assuming this trend lower is over as well as the financials get ironed out the company stock should eventually respond with higher prices as well.

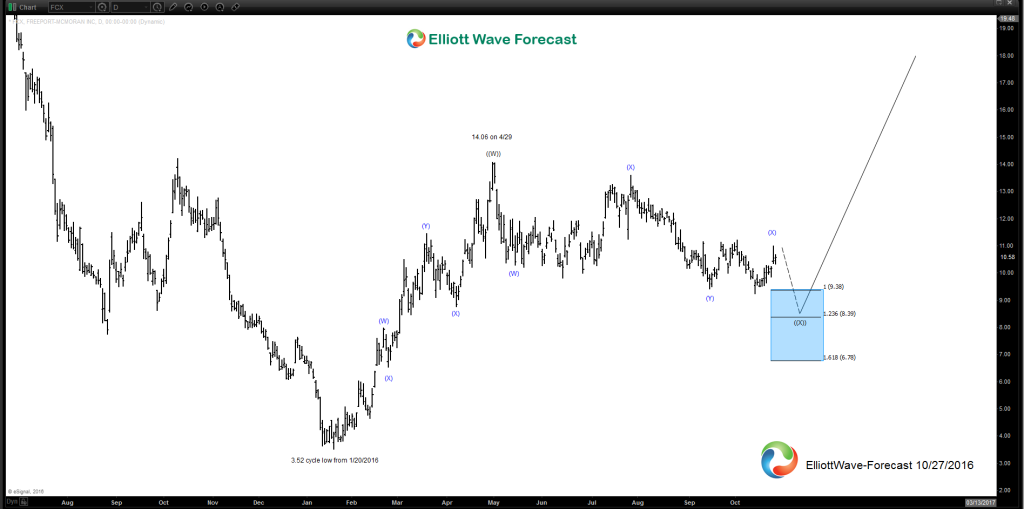

From an Elliott Wave standpoint the stock price made a large 3 swing move from the 2008 all time highs to just past an equal legs target area down to the 3.52 lows from January 20th earlier this year. From there price rebounded to 14.06 near the end of April. That did not appear to be an impulse wave however that is not important for a cycle or trend. What is significant is it appears to have ended the cycle down with the nice bounce. That said, from the April highs it currently appears the stock is in a triple three corrective dip with this current 2nd (X) wave bounce possibly already over at 11.00 however it could still see 11.45-12.14 area without that idea being invalidated. The 9.24 low from the 13th of October was just past the equal legs of the (W)-(X) target at 9.38 and already has qualified the double three (W)-(X)-(Y) as possibly being complete however what I’m expecting is the equity to turn back lower for one more swing lower toward the 8.39-6.78 area first before developing a trending move higher toward the 18.00-19.00 area next year in 2017.

Thanks for looking and coming to the website and if you like take a trial subscription of our service and see if we can be of help in your trading. Kind regards & good luck trading. Lewis Jones of the elliottwave-forecast.com Team