CSX Corporation (CSX) provides rail-based fright transportation services. The Company offers rail services & transportation of intermodal containers & trailers as well as other services such as rail-to-truck transfers & bulk commodity operations. It transports chemicals, agricultural & food products, minerals, automotive, forest products, fertilizers, metals & equipment & coal, coke, iron ore to electricity-generating power plants & industrial plants. It is based in Jacksonville, US, comes under Industrial sector & trades as “CSX” ticker.

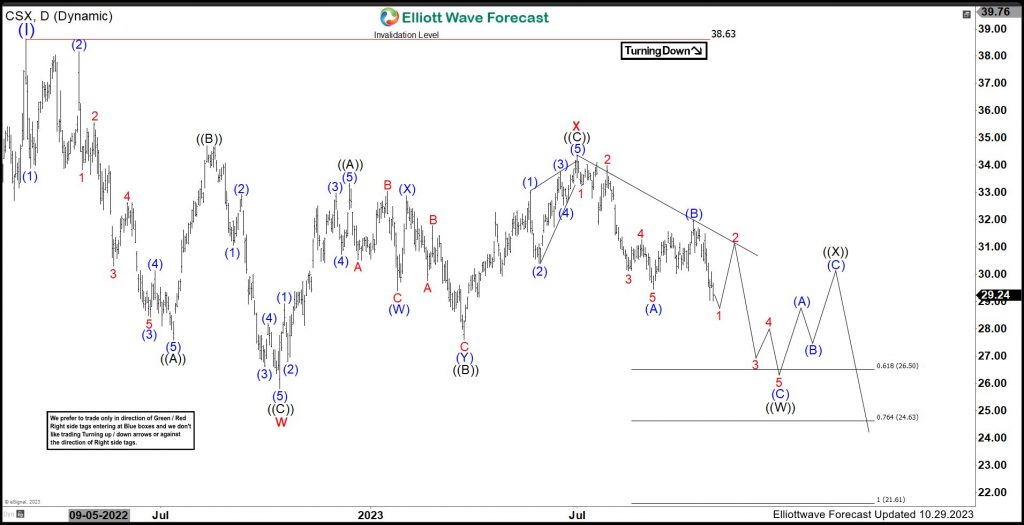

CSX placed (I) at $38.63 high in daily sequence & favors pullback in (II) in double correction. It expects to remain sideways to lower, while bounce fail below $34.38 high of x connector.

CSX – Elliott Wave Latest Daily View:

It placed (I) at $38.63 high in March-2022 as impulse sequence in weekly. Below there, it ended w at $25.80 low in zigzag correction on 10.13.2022. It ended ((A)) of w at $27.59 low as 5 swings sequence. It bounced off in ((B)) as sharp correction, ended at $34.71 high. Later, it resumed lower in ((C)) in 5 swings lower, ended at $25.80 low as w of (II) correction. Above w low, it reacted higher in x connector in zigzag, which ended at $34.38 high on 7.03.2023. It placed ((A)) at $33.33 high as 5 swings move, followed by ((B)) at $27.60 low in double correction. Finally, it ended ((C)) at $34.38 high as diagonal to finish x connector.

Below x high, it resumed lower in ((W)) of y of (II) & can extend towards $26.50 – $24.63 area. Within ((W)), it placed (A) at $29.45 low & (B) at $32.00 high on 10.11.2023. Currently, it favors lower in 1 of (C) & soon can bounce in 2, which expect to fail below (B) high to resume downside in 3 of (C). Alternatively, if it breaks above $32.00 high, it can do flat correction in (B), which yet expect to fail below x high to resume downside as the part of ((W)) of y of (II). It expects y to extend lower towards $21.61 – $13.69 area to finish (II) correction, where buyers expect to enter the market.

Elliottwave Forecast updates 1-hour charts four times a day & 4-hour charts once a day for all our 78 instruments. We do a daily live session, where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. You can try us for 14 days for only $9.99.

Back