Since the crash of March 2020, all stocks have tried to recover what they lost and P&G was no exception. P&G did not only recover the lost, but It also reached historic highs Now, we are going to try to build an impulse from wave II when it is completed with a target around to $167.14 – $173.32.

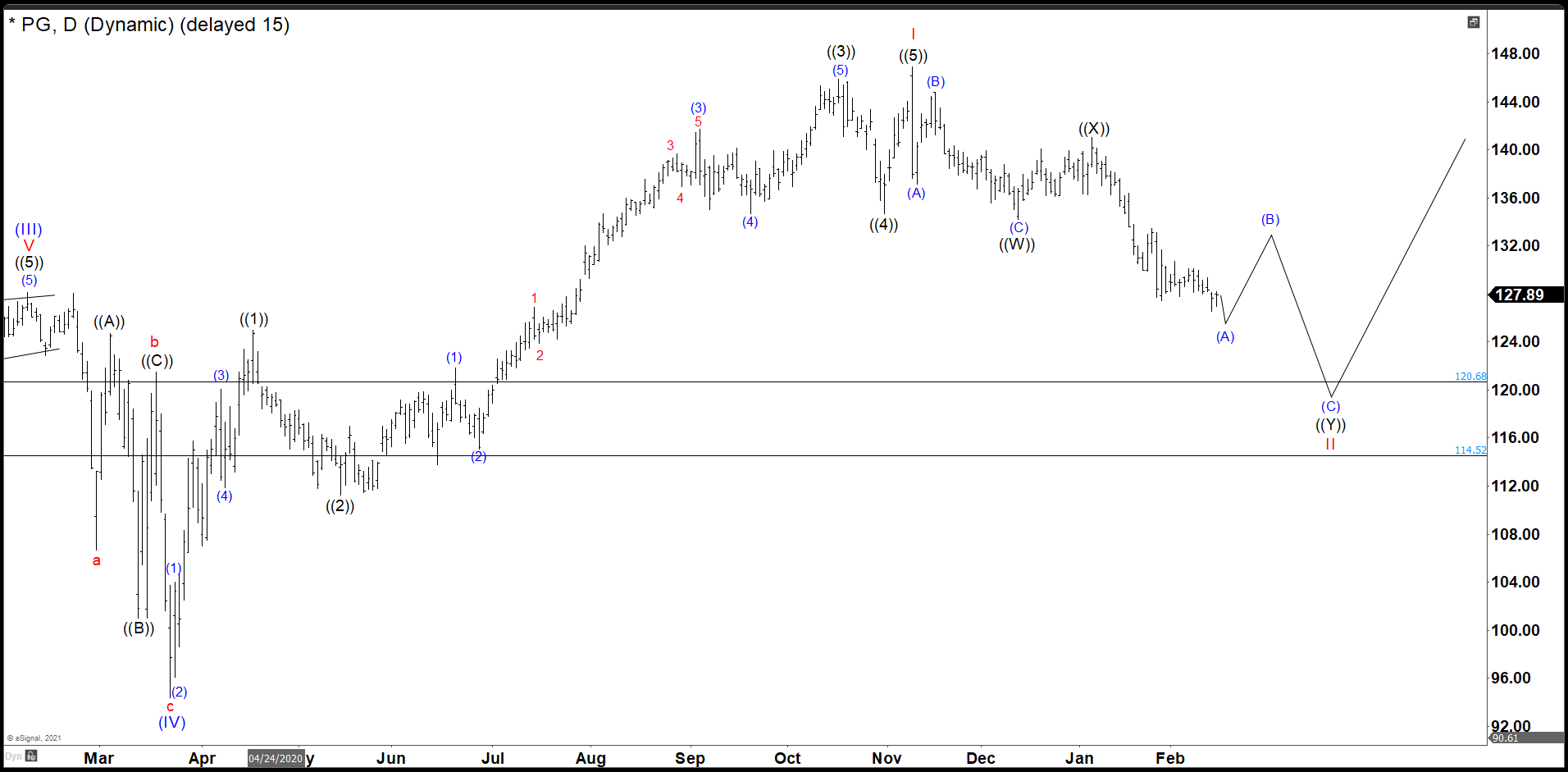

P&G Daily Chart

As we see in the daily chart, P&G built an impulse ((1)), ((2)), ((3)), ((4)), and ((5)) that we call I in red and it ended at 146.92. Since November, the stock has dropped only. We see 3 swings down (A), (B), and (C) as wave ((W)) and then a wave ((X)) as a corrective structure. We are looking for 3 more swings down to complete wave ((Y)) and II as a double correction in $114.52 – $120.68 area, it could be lower, but for now is the ideal one. From here, we expect to continue the rally to a new high in an impulse structure. (If you want to learn more about Elliott Wave Theory, please follow this link: Elliott Wave Theory).

As we see in the daily chart, P&G built an impulse ((1)), ((2)), ((3)), ((4)), and ((5)) that we call I in red and it ended at 146.92. Since November, the stock has dropped only. We see 3 swings down (A), (B), and (C) as wave ((W)) and then a wave ((X)) as a corrective structure. We are looking for 3 more swings down to complete wave ((Y)) and II as a double correction in $114.52 – $120.68 area, it could be lower, but for now is the ideal one. From here, we expect to continue the rally to a new high in an impulse structure. (If you want to learn more about Elliott Wave Theory, please follow this link: Elliott Wave Theory).

P&G 60 Minutes Chart

In the 60 minutes chart, we are ending a impulse as wave (A). As we can see wave 3 finished at 127.42 and we did a triangle as wave 4 at 129.96. Now, we are looking for 5 swings lower to complete the cycle between 124.17 – 125.88 dollars. After that we should build a corrective structure at least to 133.50 dollars as wave (B).

In Elliottwave Forecast we update one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market at the moment. Let’s trial for 14 days totally free here: I want 14 days of free trial.

Back