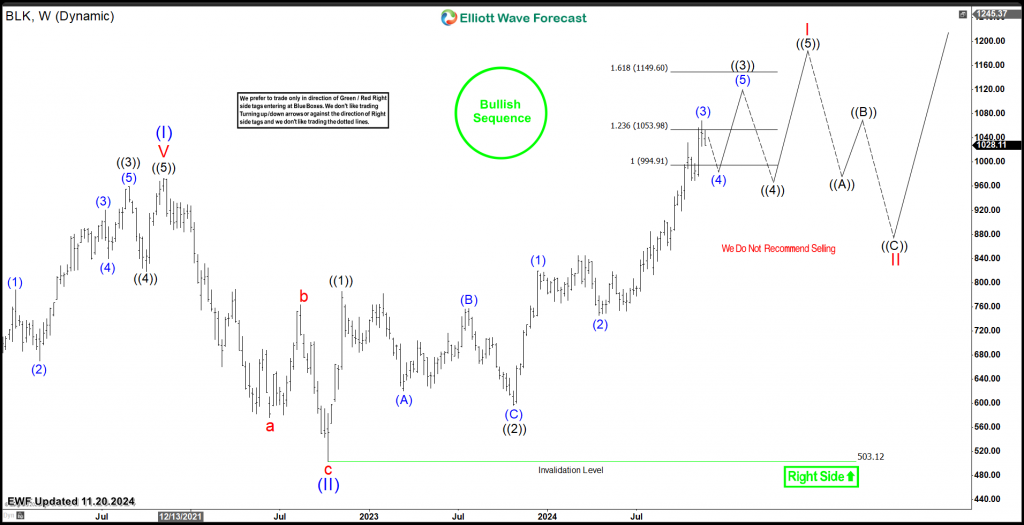

In our previous article, BlackRock (NYSE: BLK) was expected to continue the rally to the upside based on the bullish sequence created from 2022 low. In today’s video blog, we’ll go over the new development in the technical structure of the stock and we’ll explain the potential path based on the Elliott Wave Theory .

BLK cycle from 2022 low remains in progress showing 5 swings to the upside with the 3rd one being the shortest. Therefore, we can expect the stock to remain supported to the upside within a 9 swings structure to establish the main 5 waves advance in wave I.

The break above 2021 peak was a key moment for BLK weekly structure because it’s now showing an incomplete bullish sequence from all time lows. Consequently, investors are advised to keep buying the daily pullbacks in 3 , 7 or 11 swings.

The larger correction will only take place after the stock ends wave I and then it will be looking to find buyers again in wave II above $503.

BLK Weekly Chart 11.20.2024

The following video offers a technical outlook based on Elliott Wave Cycles :

Explore a variety of Stocks and ETFs investing ideas by trying out our services 14 days and learning how to trade our blue boxes using the 3, 7 or 11 swings sequence. You will get access to our 78 instruments updated in 4 different time frames, Live Trading & Analysis Session done by our Expert Analysts every day, 24-hour chat room support and much more.