Bitcoin miners have had a great 2021 but can it continue? Bitfarms is one of the worlds largest public bitcoin miners and has an incomplete bullish sequence, lets take a look at the company profile:

“Founded in 2017 Bitfarms is one of the one of the largest public bitcoin mining operations in the world. Bitfarms run verticall mining operations with onsite technical repair, data analytics and engineers to deliver high performance and uptime of operations. $BITF is currently listed as a Rising Star by the TSX-V.

Bitfarms has a diversified production platform with five industrial scale facilities located in Quebec. Each facility is 100% powered with environmentally friendly hydro power and secured with long-term power contracts. Bitfarms is currently the only publicly traded pure-play mining company audited by a Big Four audit firm.”

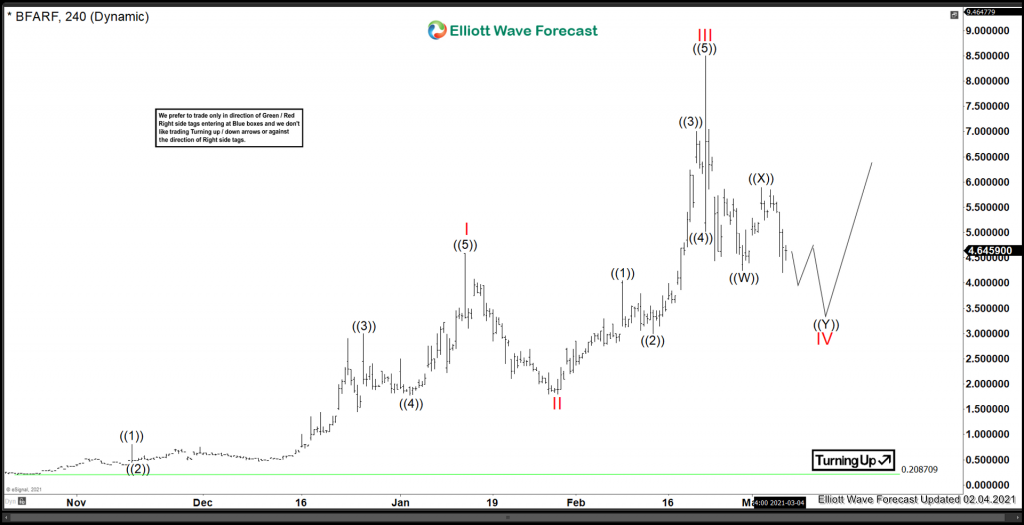

Lets take a look at the Elliottwave View:

Bitfarms Elliottwave View:

Medium term term view from the all time low in October 2020. Bitfarms appears to have 5 swings into the peak into Red I. From there, a wave 3 advance (Red III) has taken shape. This wave has recently peaked at $8.50 and has since pulled back. Is that all this stock has for this cycle? According to the data we have, the stock appears to have an incomplete bullish sequence. What does this mean? At least one more high is needed to satisfy an impulsive swing higher before a larger pullack. We do not favour to sell this instrument, but like to look for opportunity where buyers may enter at the extreme areas.

In Conclusion, with the data that is present, this stock is favouring further extension higher in at least one more high before correcting in a larger degree. But at this point, it is important to observe good risk management as the 5th wave can take on many shapes and forms.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with our free 14 day trial today. Get free Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back