The last time I analyzed Bit Digital was in August 2021 (article can be read here). At the time, I had called the low in Red II, and was looking for an impulsive leg up to take place. Bit Digital is one of the worlds largest bitcoin miners. Before moving their operations to North America, they were primarily based out of China. This had a negative impact on the stock price leading into the Red II low. However, most of their equipment is now setup, or is close to being setup in North America. So that risk factor is now in the past. Lets take a look at my view from August.

Bit Digital Early August 2021 Elliottwave View:

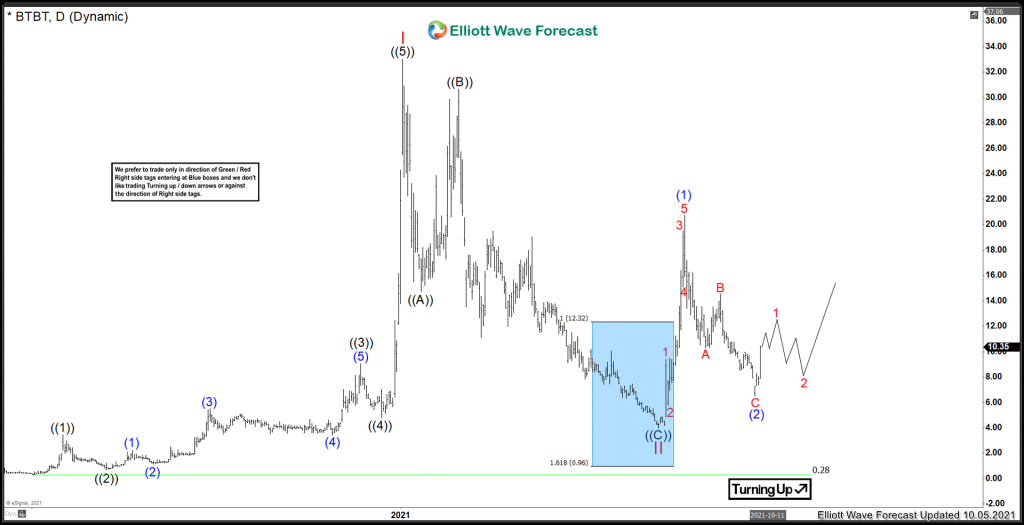

As you can see, in August 2021 the low was looking like it was set and I was favouring a 5 waves rally into (1), before pulling back into (2). Now lets take a look at todays price action.

Bit Digital October 2021 Elliottwave View:

The stock has performed exactly as anticipated. After rallying in 5 waves higher into (1), the stock pulled back to correct the cycle from the July 20/2021 low. This correction unfolded as an ABC correction. Typically, an event will cause the final turn to take place. In this case with Bit Digital, they announced a private stock offering which caused prices to decline into the (2) low. The dip didn’t last long and prices are well on their way higher.

In conclusion, as per chart above, the expectation is for another wave 2 to take place before moving strong higher. As long as the (2) lows hold, further upside in a wave 3 is favored to take place.

Risk Management

Using proper risk management is absolutely essential when trading or investing in a volatile stocks. Elliott Wave counts can evolve quickly, be sure to have your stops in and define your risk when trading.

Improve your trading success and master Elliott Wave like a pro with 14 day trial today. Get Elliott Wave Analysis on over 70 instruments including GOOGL, TSLA, AAPL, FB, MSFT, GDX and many many more.

Back