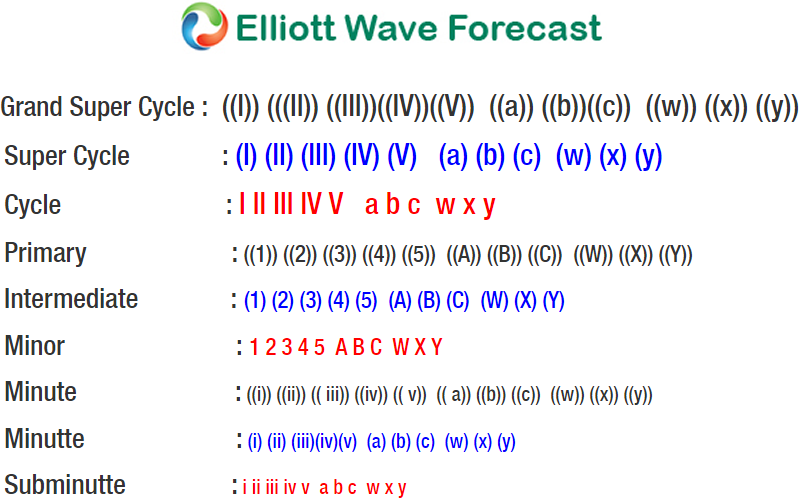

BAC short-term Elliott wave view suggests that the rally to $31.49 low ended Minor wave X bounce. Down from there, the decline to $30.08 low ended Minor wave Y & also completed intermediate wave (2) pullback. The internals of Minor wave Y unfolded as double three structure where Minute wave ((w)) ended at $30.62 low as zigzag structure.

Up from there, the bounce to $31.09 high ended Minute wave ((x)) bounce. Then finally, a decline to $30.08 low ended Minute wave ((y)) in 3 swings as Zigzag structure. Above from there, the stock is expected to resume the next leg higher in intermediate wave (3). However, a break above $31.91 August peak remains to be seen for final confirmation of next leg higher. Up from $30.08 low the initial rally higher to $31.37 high ended Minute wave ((i)) as impulse structure. Near-term focus remains towards $30.64-$30.30 100%-123.6% Fibonacci extension area of Minutte wave (a)-(b) to end the 3 wave correction in Minute wave ((ii)) against $30.08 low cycle. Afterwards, the stock is expected to resume the upside looking for more upside. We don’t like selling it.