American Express Company (Amex), symbol AXP, is an American multinational financial services corporation that specializes in payment cards. Headquartered in New York City, it is one of the most valuable companies in the world and one of the 30 components of the Dow Jones Industrial Average.

AXP Weekly Chart December 2023

We believed that AXP had ended a Great Super Cycle at the peak of 199.55 which we call wave ((I)). The stock started a bearish structure (a), (b), and (c). Wave (a) built a leading diagonal ended at 130.65 in October 2022 low. The market bounced beginning a wave (b) as a double correction. We expected to reach around 192.29 where market should turn lower to end a wave ((II)) before resuming to the upside. However, market broke higher invalidated the view. (If you want to learn more about Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory)

We believed that AXP had ended a Great Super Cycle at the peak of 199.55 which we call wave ((I)). The stock started a bearish structure (a), (b), and (c). Wave (a) built a leading diagonal ended at 130.65 in October 2022 low. The market bounced beginning a wave (b) as a double correction. We expected to reach around 192.29 where market should turn lower to end a wave ((II)) before resuming to the upside. However, market broke higher invalidated the view. (If you want to learn more about Elliott Wave Theory, follow these links: Elliott Wave Education and Elliott Wave Theory)

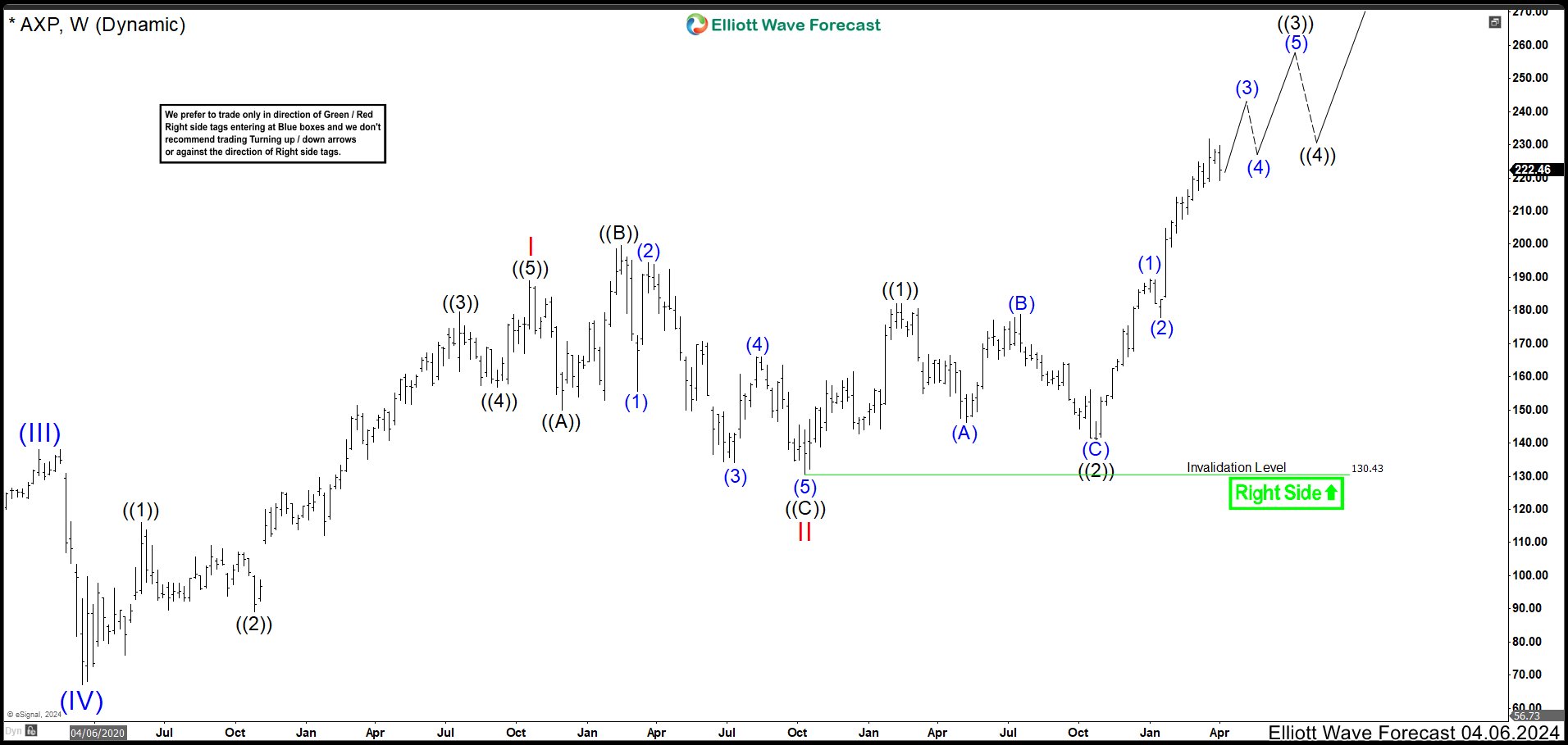

AXP Weekly Chart April 2024

The stock broke higher in Jan 2024 suggesting an extension in wave (V) of ((I)). That is why we adjusted the count. Wave I ended at 189.03 high. Then wave II built an expanding flat correction ending at 130.65 low. The wave ((1)) of III completed at 182.15 and pullback as a flat correction ended wave ((2)) at 140.91. From here, AXP is developing a strong rally that is wave ((3)) of III and currently market is trading in wave (3) of ((3)). We are calling one more leg higher to end wave (3) and any pullback after wave (3) is ended, we should look for buying opportunities to trade in favor of the trend.

Elliott Wave Forecast

www.elliottwave-forecast.com updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions you have about what is happening in the market.

14 day Trial costs $9.99 only. Cancel anytime at support@elliottwave-forecast.com

Back