Since March 2020 crash, Alcoa (AA) has risen in share value around 800% and with the high prices of the Aluminum it must continue rising its value. Besides, AA has built an incomplete impulse and it needs to keep the rally to develop the whole structure. We are considering a target above $47.00 dollars in first instance and in the future, we are going to recalculate that because the price should be more higher.

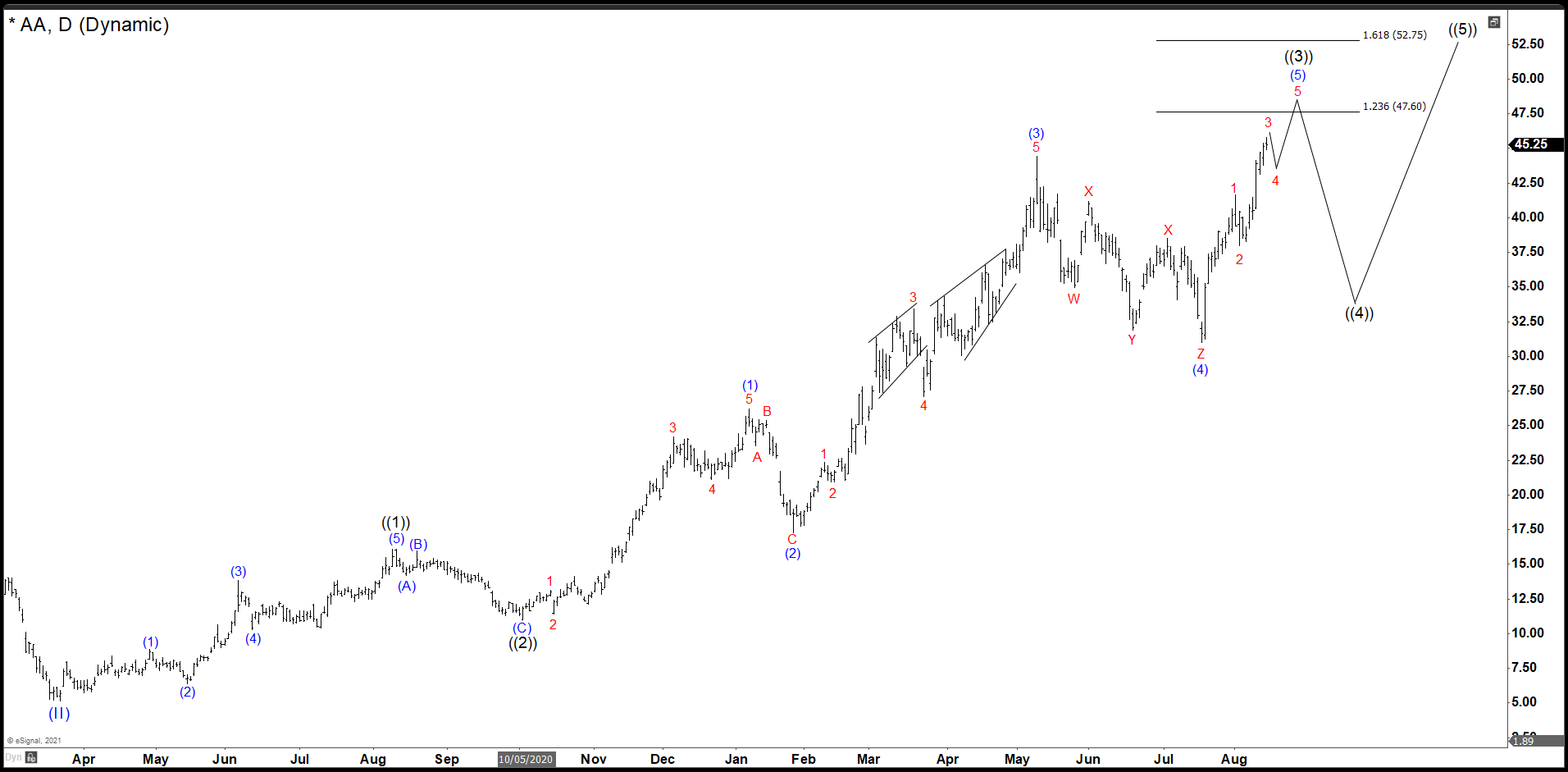

Alcoa (AA) Daily Chart

As we see in the daily chart, the wave ((1)) ended in 5 swings and the pullback as wave ((2)) bounced from $10.95. With the break of the price of wave ((1)) we confirmed that wave ((2)) has done. Currently, we are developing the wave ((3)) that needs one high to complete 5 swings up. The wave (3) of ((3)) reached $44.49 and wave (4) of ((3)) ends as a triple correction. With that data, it give us an area of $47.60 – 52.75 as possible target to end the wave ((3)). If you want to learn more about Impulse and Elliott Wave Theory, please follow this link: Elliott Wave Theory).

Short Term the bounce from wave (4) of ((3)) looks impulsive and we already see 3 swings up near to the possible target. Therefore, we should do a pullback as wave 4 and continue higher to complete (5) and wave ((3)). Only an extension of wave (5) will invalidate this count and we could see this how would work in the video above.

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments. Besides, we do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions and you have about what is happening in the market at the moment. Let’s trial for 14 days totally free here: I want 14 days of free trial.

Back