Hello traders, welcome to another blog post discussing trading opportunities from the blue box. In this one, the spotlight will be on the Analog Devices, Inc. ADI. The post aims to reveal where to buy the ADI stock.

Analog Devices, Inc. ADI is a global leader in designing and manufacturing integrated circuits and analog, mixed-signal, and digital signal processing (DSP). Founded in 1965, the company specializes in converting real-world phenomena like sound, light, and temperature into digital data, which is crucial for various applications in industries such as automotive, healthcare, industrial automation, and communications. Analog Devices went public in 1969 and trades on the NASDAQ under the ticker symbol $ADI.

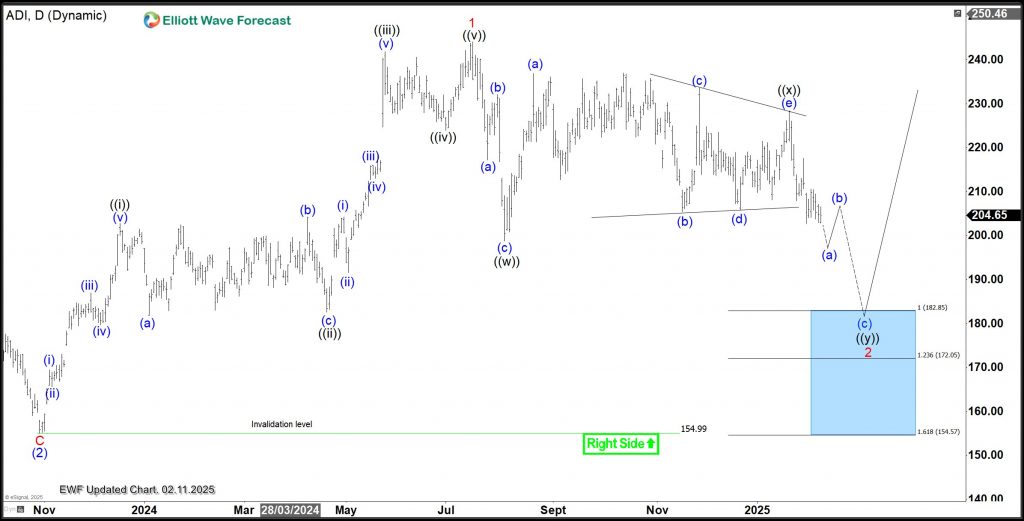

ADI is in an all-time bullish cycle breaking previous highs even within the shorter cycles. It can’t be more bullish that this stock. Within a bullish sequence, the best and safest strategy is to buy pullbacks in 3, 7 or 11 swings at the extreme area. Meanwhile, it appears the ADI all-time bullish cycle is not yet finished. Thus, traders can continue to buy pullbacks. A pullback started from July 2024 and completed a 3-swing structure on 5th August 2024. We discussed the aftermath of the setup in a previous post and used the chart below.

ADI H4 Chart, 9th April, 2024

The chart above shows response from the blue box as price quickly followed with a sharp bounce. Before the end of ((1)) of 3, buyers had closed half of their position in profit and adjusted rest to the low of wave 2 i.e. the 5th August 2024 low. In this update, we anticipated wave ((2)) pullback to find support above 198.73. Afterwards, the price should advance in wave ((3)) of 3 for more profits.

What has happened since April 2024?

Since April 2024, ADI didn’t add to profit for buyers. Rather, the stock went sideways and then turned lower to the breakeven price. Despite hitting back, buyers already booked good profit from the blue box. What next? Price is close to breaching the 198.73 invalidation level. As a result, the wave count has changed to prepare for a deeper pullback from the high of 17th July 2024.

ADI H4 Chart, 11th February, 2025. Where next to buy?

The chart above shows the adjusted wave count. A 7-swing pullback for new wave 2 of (3) now emerges. Price completed wave ((w)) of 2 with a zigzag structure and ((x)) with a sideways triangle structure. Thus, a 3-swing (zigzag) sequence should emerge lower for wave ((y)) of 2 at the 182.85-154.57 blue box. From the blue box, we will expect at least a 3-swing bounce if not an impulse recovery for wave 3 toward 282. Thus, the trade recommendation goes thus:

Long at 182.85

Stop at 154.57

Targets at 258.57 and 281.97

Close partial profit at 50% of wave ((y)) and adjust the rest to breakeven to protect profit.

About Elliott Wave Forecast

At www.elliottwave-forecast.com, we update one-hour charts four times daily and four-hour charts once daily for all 78 instruments. We also conduct daily live sessions to guide clients on the right side of the market. Additionally, we have a chat room where moderators answer market-related questions. Experience our service with a 14-day trial for only $0.99. Cancel anytime by contacting us at support@elliottwave-forecast.com.

Back