When it comes to create a financial portfolio, investors may have varying views and strategies based on their unique perspectives and goals. To choose financial instruments for a portfolio involves a combination of careful planning, diversification, and risk management. Therefore, here are some steps to help you create a solid financial portfolio:

6 Steps To Create A Solid Investment Portfolio

1. Define your financial goals: Start by clearly defining your short-term and long-term financial goals. This could include saving for retirement, purchasing a home, funding your children’s education, or achieving financial independence. Also your goals will shape your investment strategy.

2. Assess your risk tolerance: Understand your risk tolerance by considering factors such as your age, income, time horizon, and personal comfort with market volatility. In other words, risk tolerance will guide your asset allocation decisions.

3. Diversify your investments: Diversification is crucial for managing risk. Spread your investments across different asset classes such as stocks, bonds, real estate, commodities, etc. Additionally, diversify within each asset class by investing in various industries, sectors, and geographic regions.

4. Choose suitable investments: Select individual investments that align with your asset allocation strategy. This could involve investing in mutual funds, exchange-traded funds (ETFs), individual stocks, bonds, or other investment vehicles. Consider factors such as historical performance, fees, fund managers’ expertise, and the investment’s fit within your portfolio.

5. Monitor and rebalance regularly: Regularly review your portfolio’s performance and make adjustments as needed. Besides, some investments may outperform others, causing your asset allocation to drift from your desired targets. Rebalancing involves selling overperforming assets and reinvesting in underperforming ones to maintain your desired allocation.

6. Consider a long-term perspective: Investing should be viewed as a long-term endeavor. Avoid making impulsive decisions based on short-term market fluctuations. Stay informed about market trends and economic factors, but make investment decisions based on your long-term financial goals.

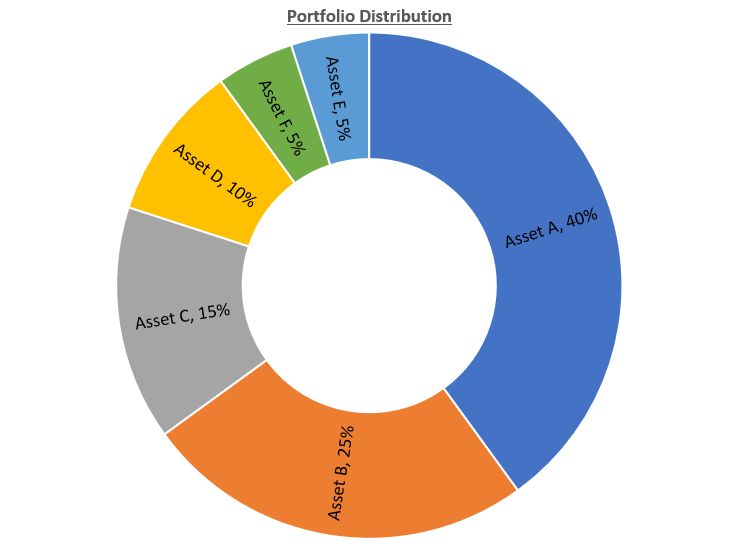

Example of an Invesment Portfolio

Asset A:

Asset class: U.S. Large-Cap Stocks (e.g., S&P 500 Index Fund) provides exposure to the U.S. stock market.

Allocation: 40%

Asset B:

Asset class: International Stocks (e.g., MSCI EAFE Index Fund) offers exposure to global equity markets outside the U.S.

Allocation: 25%

Asset C:

Asset class: Bonds (e.g., U.S. Aggregate Bond Index Fund) provides stability and income generation.

Allocation: 15%

Asset D:

Asset class: Real Estate Investment Trusts (REITs) offers exposure to the real estate sector.

Allocation: 10%

Asset E:

Asset class: Commodities (Broad Commodity Index Fund) provides diversification and also potential hedge against inflation.

Allocation: 5%

Asset F:

Asset class: Cash provides liquidity allowing you to cover unexpected expenses or take advantage of investment opportunities that may arise. Also, It provides flexibility to navigate market fluctuations without being forced to sell investments at unfavorable prices.

Allocation: 5%

The specific asset allocations can be adjusted based on an individual’s risk tolerance, investment objectives, and time horizon. Therefore, this allocation example aims to strike a balance between growth potential (stocks, real estate, commodities) and stability (bonds).

Taking 14 Days Trial

Elliottwave Forecast updates one-hour charts 4 times a day and 4-hour charts once a day for all our 78 instruments (Stocks, ETFs, Indices, Commodities, Forex, Cryptos). We do a daily live session where we guide our clients on the right side of the market. In addition, we have a chat room where our moderators will help you with any questions about the market.

Let’s trial 14 days for only $9.99 here: I want 14 days trial. Cancel Any time at support@elliottwave-forecast.com

Back