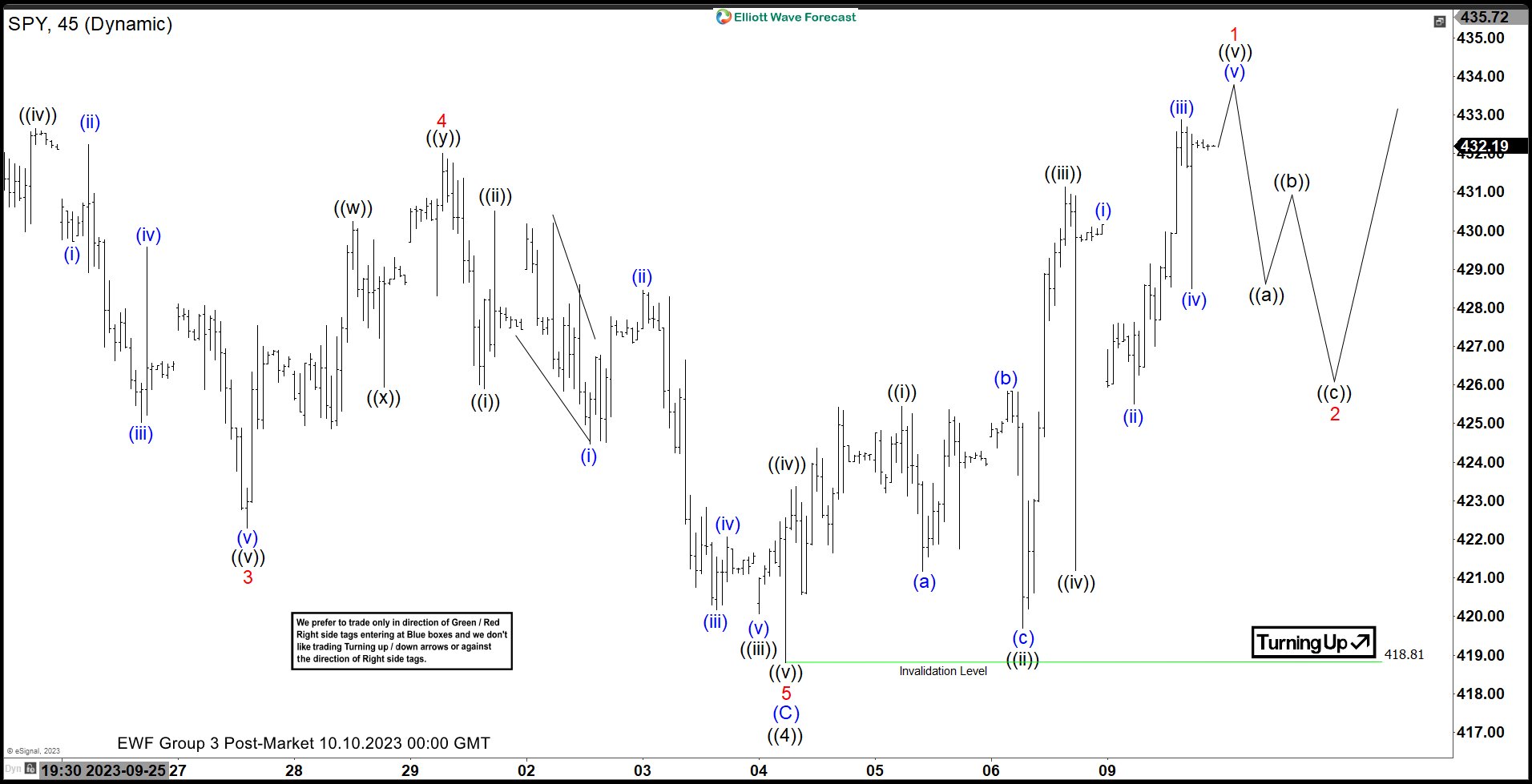

Short Term Elliott Wave in S&P 500 ETF (SPY) suggests that the ETF has ended correction in wave ((4)) at 418.81. The decline from 7.27.2023 high unfolded as a zigzag Elliott Wave structure. Down from 7.27.2023 high, wave (A) ended at 433.01 and wave (B) ended at 453.67. Wave (C) lower subdivided into 5 waves impulse. Down from wave (B), wave 1 ended at 442.75 and wave 2 ended at 451.08. Wave 3 lower ended at 422.29 as the 45 minutes chart below shows. The ETF then rallied in wave 4 which ended at 432. Final leg lower ended wave 5 at 418.81 which also completed wave (C) of ((4)) in higher degree.

SPY has turned higher in wave ((5)). Up from wave ((4)), wave ((i)) ended at 425.45 and pullback in wave ((ii)) ended at 419.70. The ETF extended higher in wave ((iii)) towards 431.13 and pullback in wave ((iv)) ended at 421.18. Expect wave ((v)) to end soon which should also complete wave 1 in higher degree. Then it should pullback in wave 2 to correct cycle from 10.4.2023 low in 3, 7, or 11 swing before the rally resumes. Near term, as far as pivot at 418.81 low stays intact, expect dips to find support in 3, 7, or 11 swing for further upside.