-

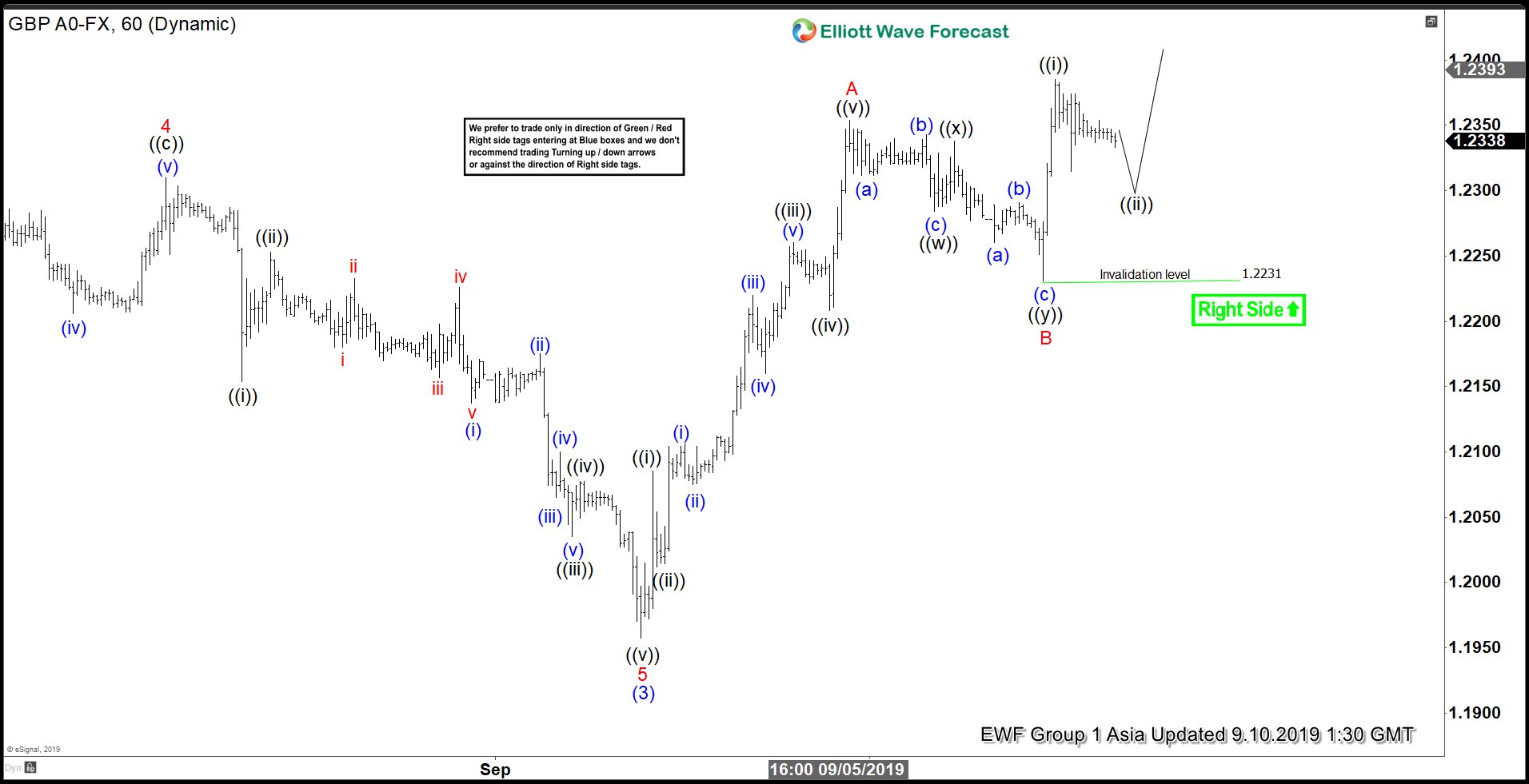

Elliott Wave View: Further Rally in GBPUSD in Zigzag Structure

Read MoreShort term Elliott Wave view in GBPUSD suggests that the decline to 1.1957 on September 3 ended wave (3). Wave (4) bounce is in progress as a zigzag Elliott Wave structure. Up from 1.1957, wave A ended at 1.235 and subdivides as a 5 waves impulse. Wave ((i)) of A ended at 1.2085, wave ((ii)) […]

-

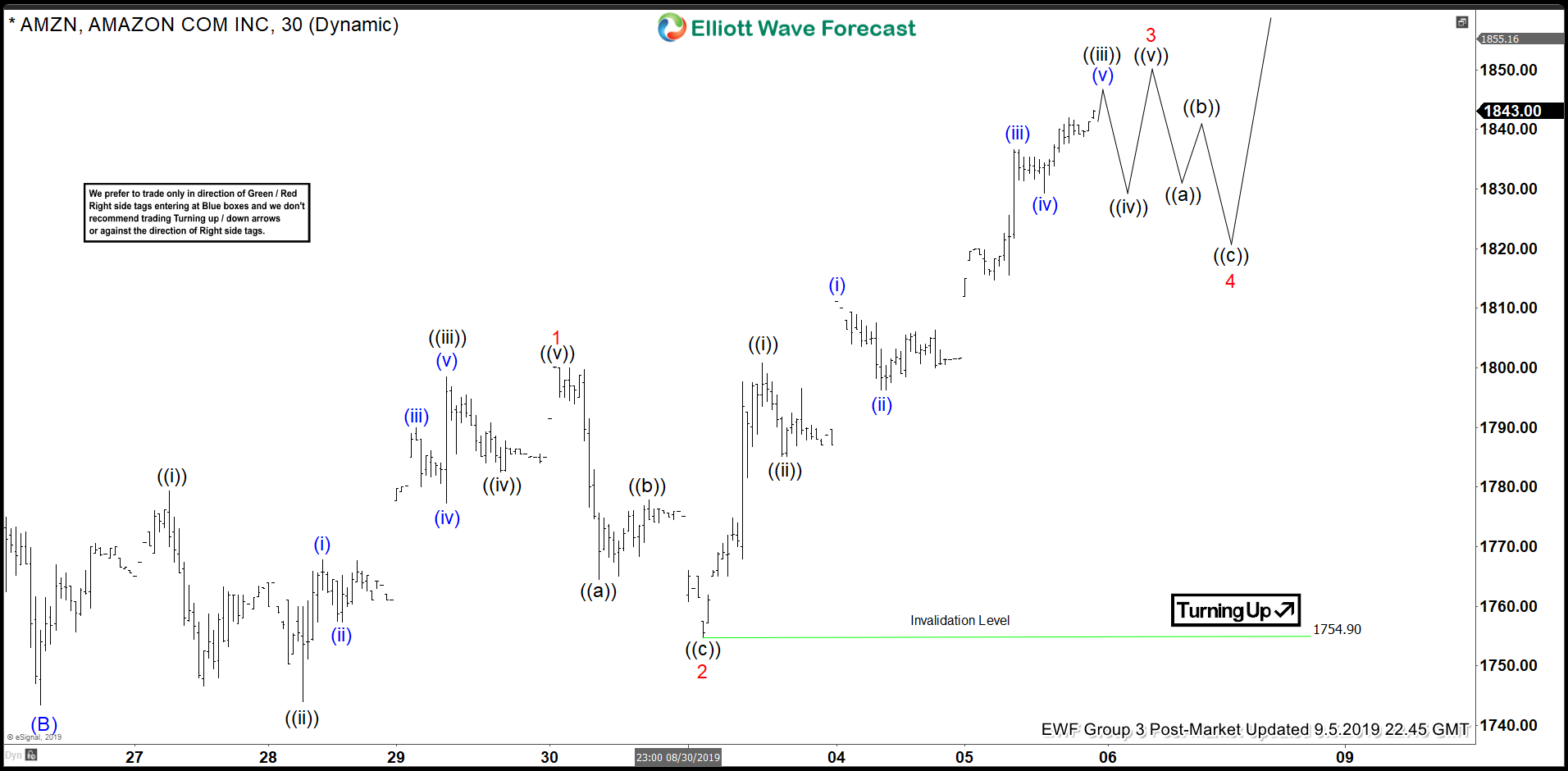

Elliott Wave View: Impulsive Rally in Amazon (AMZN)

Read MoreRally in Amazon (AMZN) from Aug 26 low appears impulsive and incomplete. This article & video talks about the short and medium term Elliottwave path.

-

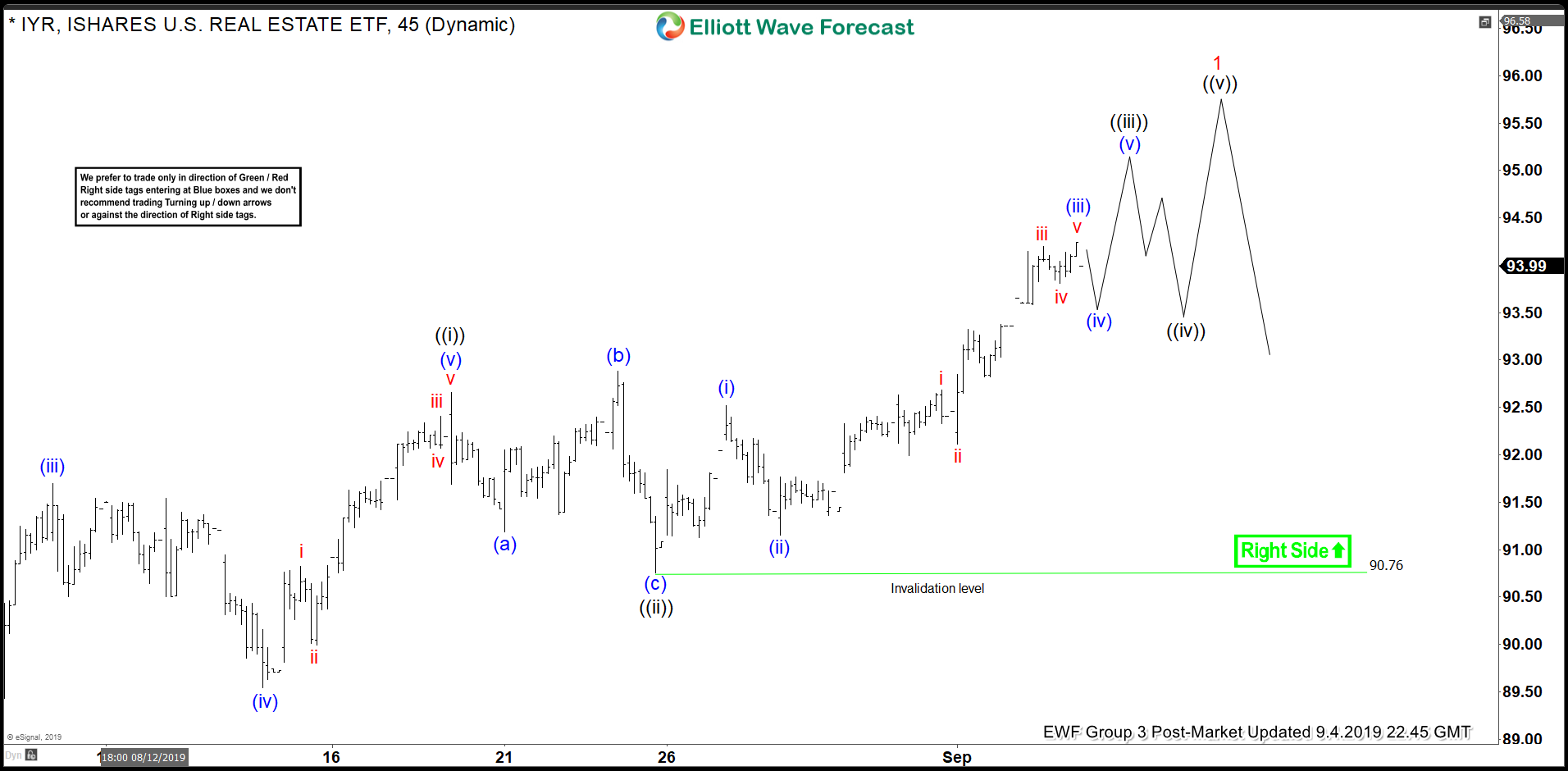

Elliott Wave View: IYR New All-Time-High in Sight

Read MoreIYR is near the 2007 all-time high and looking to break above it. This article & video explains the short term Elliott Wave path.

-

Elliott Wave View: How High Can Silver Go?

Read MoreSince forming the low on November 2018 at $13.9, Silver has rallied 40% to current price of $19.4. The move higher from $13.9 low took the form of a 5 waves impulsive Elliott Wave structure. On the 1 hour chart below, we can see wave (4) pullback ended at $16.92. The metal has since resumed […]

-

Elliott Wave View: EURJPY Remains Under Pressure

Read MoreEURJPY continues to extend lower and showing an impulsive structure. This article and video explains the short term Elliott Wave path of the pair.

-

Elliott Wave View: Ten Year Notes (ZN_F) Resumes Higher

Read More10 Year Note (ZN_F) has continued to extend higher. This article and video shows the short term Elliott Wave path of the instrument.