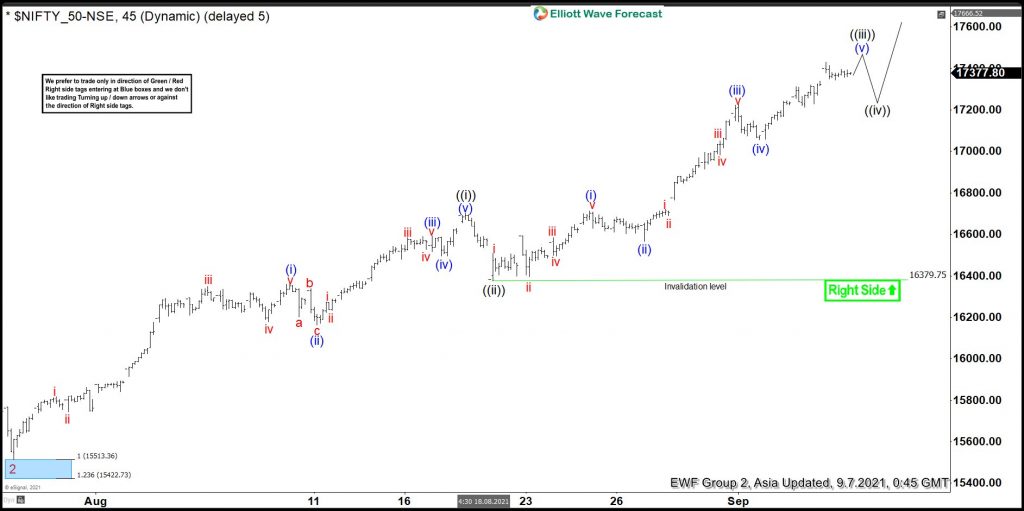

Short Term Elliott Wave view in Nifty suggests that decline to 15513.45 on July 28 ended wave 2. The Index has resumed higher in wave 3 with internal subdivision as 5 waves in a lesser degree. Up from wave 2, wave (i) ended at 16359.25, and a pullback in wave (ii) ended at 16162.55. Index resumes higher in wave (iii) towards 16701.85 and pullback in wave (iv) ended at 16495.5. The last push higher wave (v) of ((i)) ended at 16701.85.

The pullback in wave ((ii)) ended at 16379.75 and the Index has resumed higher in wave ((iii)). Internal of wave ((iii)) is unfolding as a 5 waves impulse structure in a lesser degree. Up from wave ((ii)), wave (i) ended at 16712.45, and a pullback in wave (ii) ended at 16565.60. Index resumes higher in wave (iii) towards 17225.75 and pullback in wave (iv) ended at 17055.05. Expect the Index to soon end wave (v) of ((iii)), then it should pull back in wave ((iv)) to correct cycle from August 20 low before turning higher again. Near term, as far as August 20 pivot low at 16379.75 remains intact, expect dips to find support in 3, 7, or 11 swing for more upside.