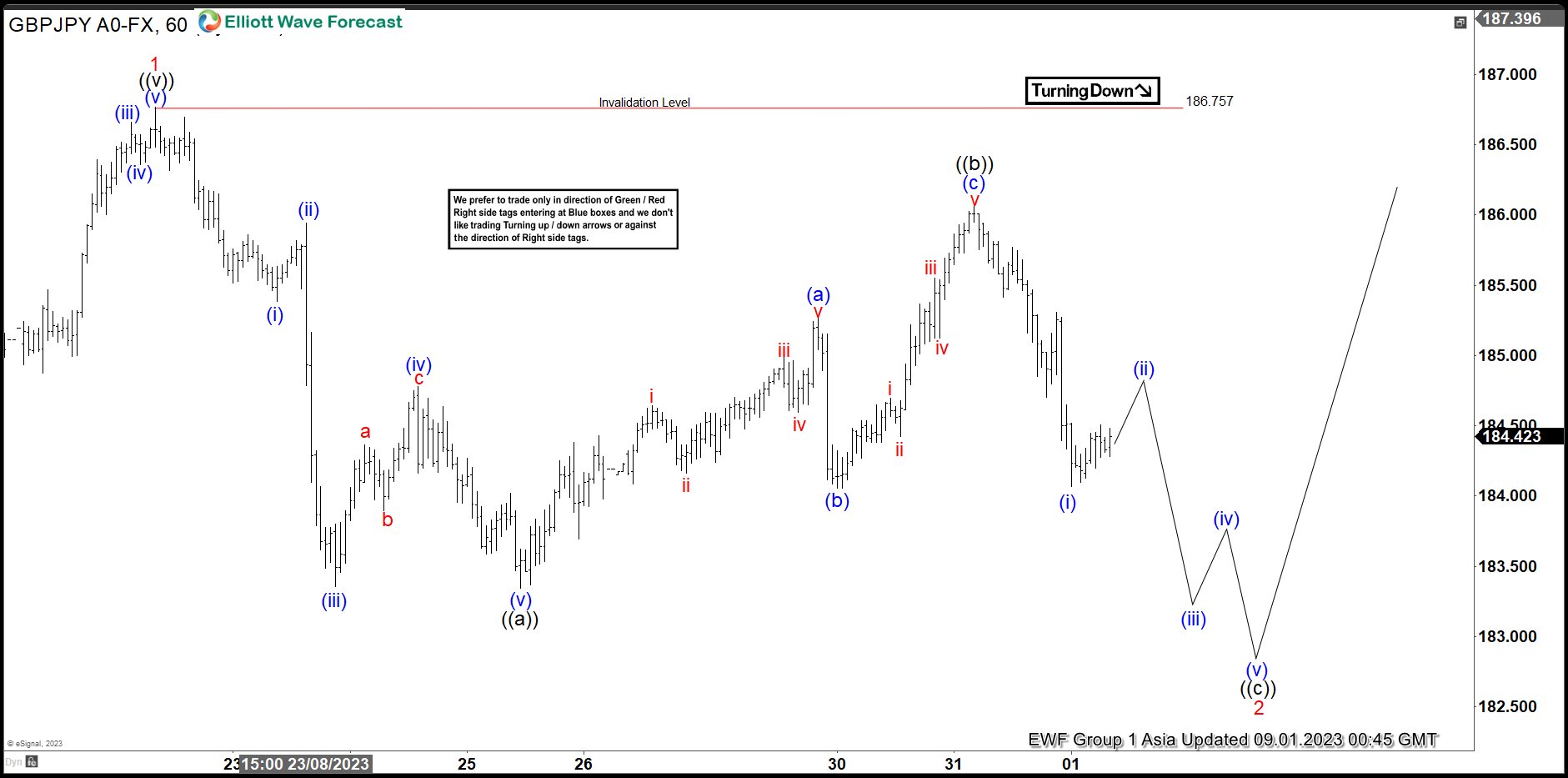

Short Term Elliott Wave view in GBPJPY suggests the rally to 186.75 ended wave 1. Pullback in wave 2 is currently in progress as a zigzag Elliott Wave structure. Down from wave 1, wave (i) ended at 185.38 and wave (ii) rally ended at 185.94. The pair extended lower in wave (iii) towards 183.35 and wave (iv) ended at 184.78. Final leg wave (v) ended at 183.34 which completed wave ((a)). Pair then corrected in wave ((b)) as another zigzag in lesser degree. Up from wave ((a)), wave (a) ended at 185.26 and pullback in wave (b) ended at 184.056. Wave (c) higher ended at 186.06 which completed wave ((b)).

Pair then resumed lower in wave ((c)) with subdivision as an impulse. Down from wave ((b)), wave (i) is expected to complete soon. Pair should then rally in wave (ii) to correct the decline from wave ((b)) high at 186.06 before turning lower again in wave (iii). Potential target lower is 100% – 161.8% Fibonacci extension of wave ((a)). The area comes at 180.5 – 182.6 where buyers can appear for at least a 3 waves rally. Near term, as far as pivot at 186.75 high stays intact, expect rally to fail and pair to extend lower.