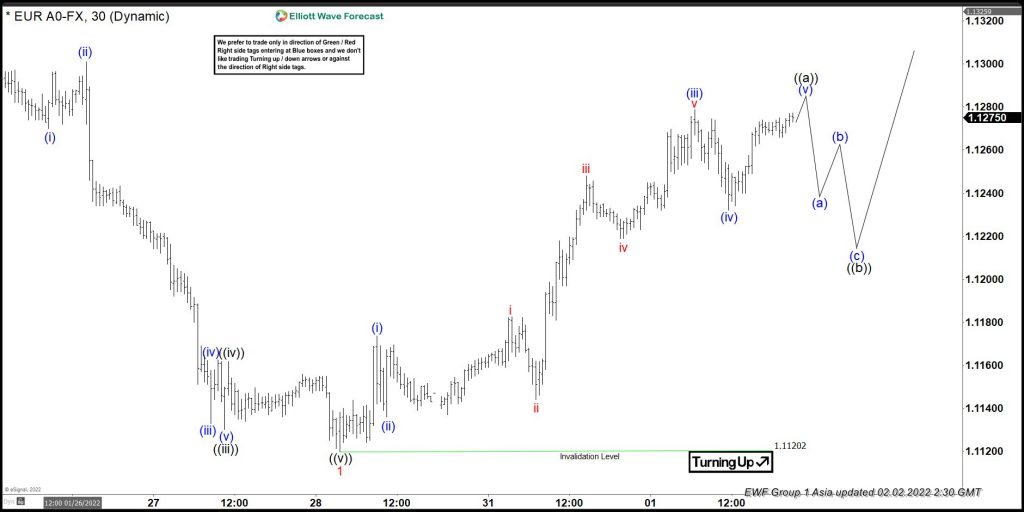

The short-term Elliott wave view in EURUSD suggests that the pair is doing a corrective bounce to correct the cycle from January 14, 2022 high. While the decline to $1.1120 low has ended wave 1 in an impulse sequence. Up from there, the pair is proposed to be in a wave 2 bounce. However, the bounce so far bounce looks impulsive. Therefore it’s proposed to be in a zigzag correction when we must be in the first leg of the bounce.

Above from $1.1120 low, the initial bounce to $1.1173 high ended small wave (i). A pullback to $$1.11326 low ended wave (ii). Then pair rallies in another 5 waves in a lesser degree cycle to complete the wave (iii) at $1.1278 high. Down from there, wave (iv) pullback ended at $$1.1232 low. Near-term, as far as dips remain above that level the pair should be targeting a minimum $1.1289- $1.1307 area to the upside within wave (v) to end wave ((a)). Which is the inverse 1.236%- 1.618% Fibonacci extension area of wave (iv). Afterward, the pair should see the pullback in wave ((b)) in 3 or 7 swings before the next leg higher in wave ((c)) starts.