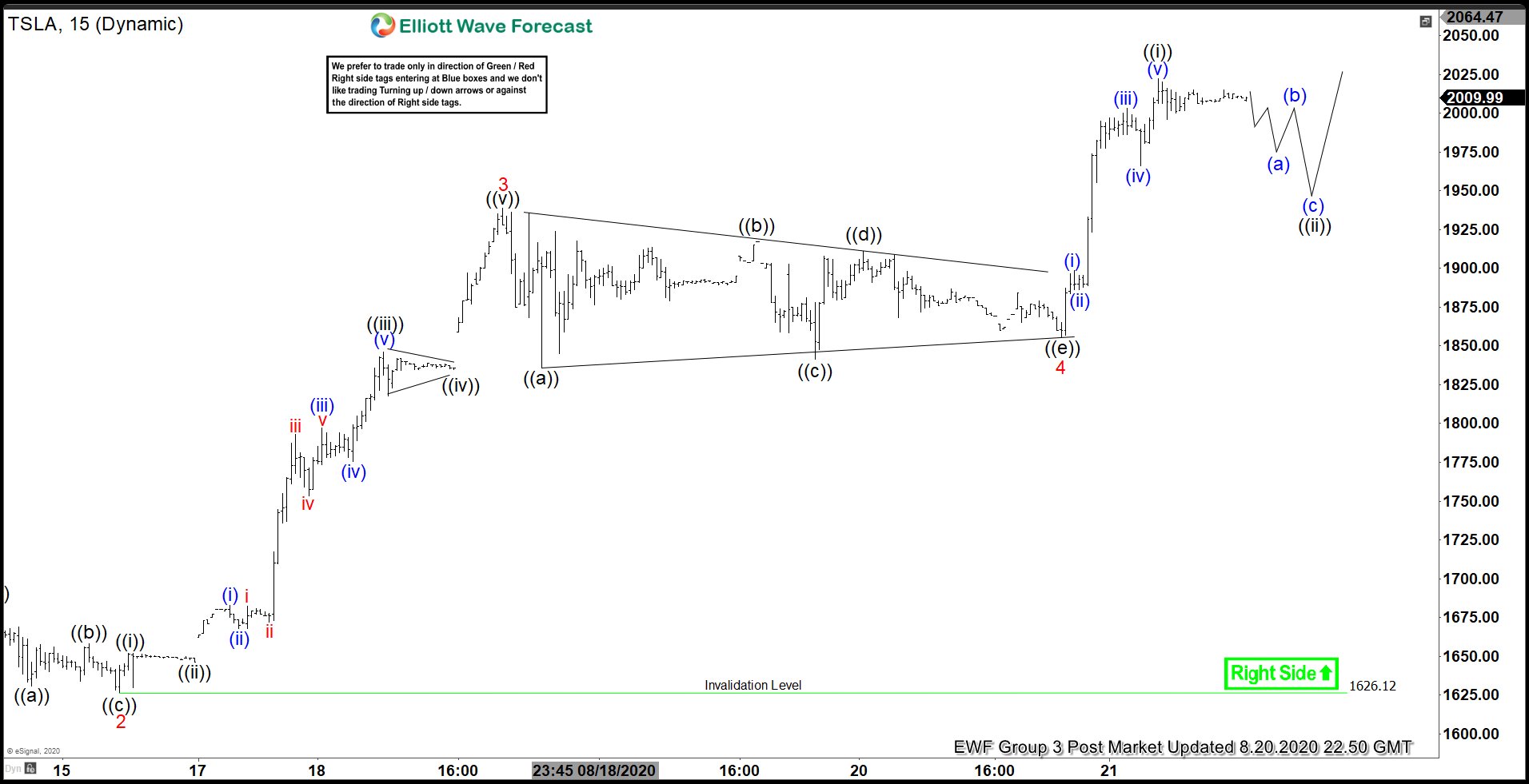

Tesla (TSLA) 15 minutes chart below shows that the stock has continued to extend higher from August 15 low. Up from that low, the stock extended higher in wave 3, which ended at 1939 high. The rally unfolded as a 5 waves impulsive Elliott Wave Structure. From wave 2 low, wave ((i)) ended at 1652 high. The dip in wave ((ii)) ended at 1646 low. The stock then extended higher in wave ((iii)), which ended at 1845.86 high. Wave ((iv)) pullback then ended at 1834.60 low. The push higher in wave ((v)) ended at 1939 high. This completed wave 3 in larger degree.

Afterwards, the stock did a pullback in wave 4, which unfolded as a triangle. Wave ((a)) ended at 1835.64 low and wave ((b)) ended at 1917 high. Wave ((c)) then ended at 1841.21 low and wave ((d)) ended at 1911 high. Finally, wave ((e)) ended at 1856 low to end wave 4 in higher degree. Since then, the stock has resumed higher and has broken above previous wave 3 high. This confirms that wave 5 is already in progress. Up from wave 4 low, wave ((i)) ended at 2021.99 high. Wave ((ii)) remains in progress. As long as 1626.12 low stays intact, the dips in 3,7 or 11 swings is expected to find support for more upside in wave 5. The alternate count is that TSLA has ended wave 5 at 2021.99 high and also the cycle from August 12 low. Then, the stock could do a bigger pullback to correct that cycle before resuming higher again.