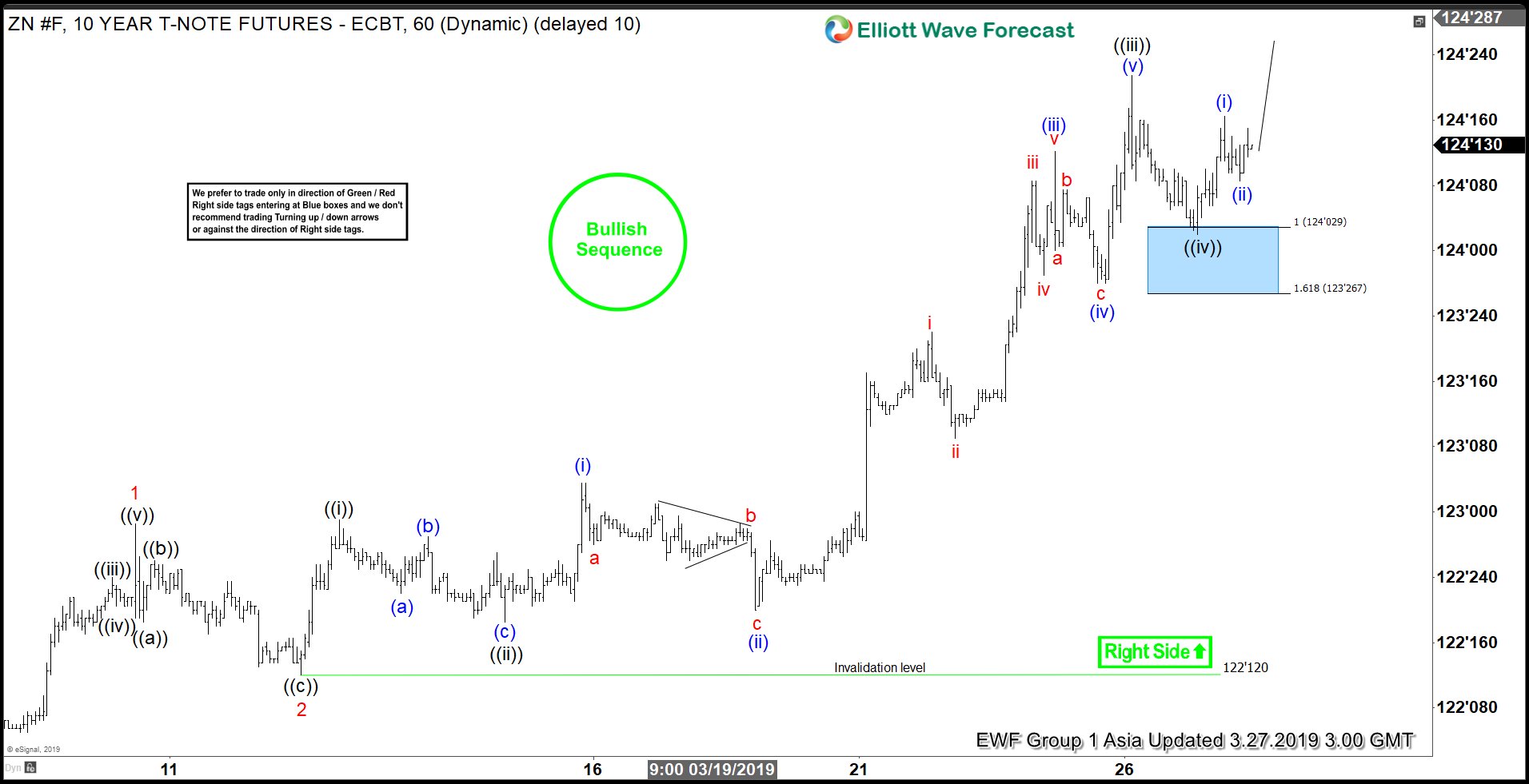

Short term Elliott Wave view on Ten Year Treasury Notes (ZN_F) suggests that the rally from January 18, 2019 low (121.02) is unfolding as an Impulse Elliott Wave structure. The Notes is currently within wave (3) of this impulsive move. The internal of wave (3) subdivides in 5 waves of lesser degree. Wave 1 of (3) ended at 122.3 and wave 2 of (3) ended at 122.12. Wave 3 of (3) is currently in progress and also subdivides in 5 waves of lesser degree. This illustrates the fractal nature of the market. Fractals suggest that each wave consists of smaller wave patterns and the pattern repeats itself in different degrees.

Up from wave 2 at 122.12, wave ((i)) ended at 122.31 and wave ((ii)) pullback ended at 122.18. The Notes rallied again in wave ((iii)) which ended at 124.21, and wave ((iv)) pullback appears completed at 124.02. Near term, expect the Notes to continue in wave ((v)) and extend higher to above 124.21. If the Notes breaks below the proposed wave ((iv)) low at 124.02, this suggests a double correction. However, even in the case of a double correction, as far as the Notes stay above 122.12, expect more upside. We don’t like selling the Notes.