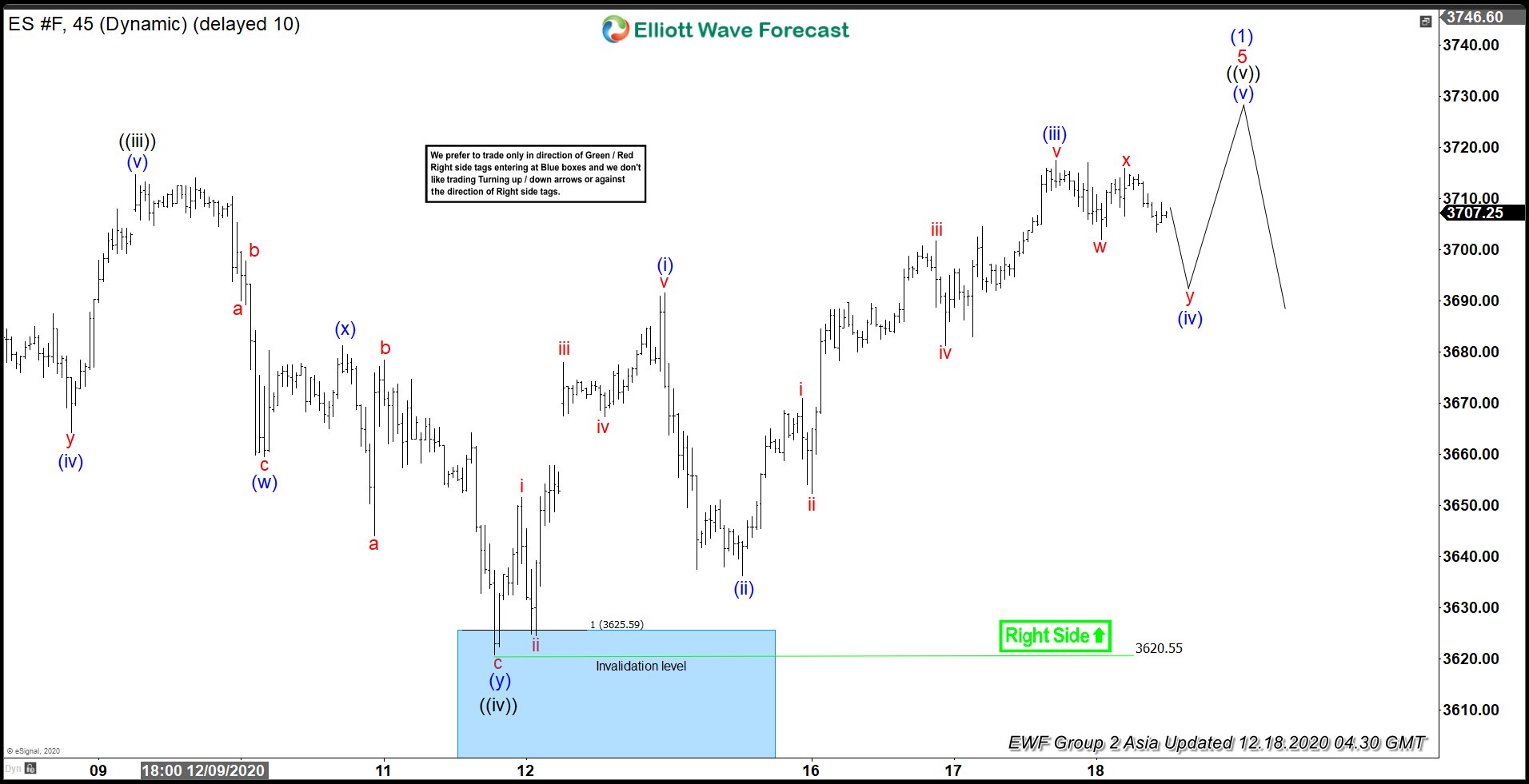

S&P 500 E-Mini Futures (ES) cycle from November 10 low is unfolding as a 5 waves diagonal Elliott Wave structure. In the 45 minutes below, we can see wave ((iii)) of this diagonal ended at 3714.75 and dips in wave ((iv)) ended at 3620.75. Internal subdivision of wave ((iv)) unfolded as a double three structure. Down from wave ((iii)) at 3714.75, wave (w) ended at 3659.5, bounce in wave (x) ended at 3681.25, and final leg wave (y) of ((iv)) ended at 3620.75.

Index turned higher from the 100% – 123.6% fibonacci extension area of the (w)-(x), as denoted by the blue box. Wave ((v)) is currently in progress and subdivides in another 5 waves in lesser degree. Up from wave ((iv)) at 3620.55, wave (i) ended at 3691.50 and pullback in wave (ii) ended at 3636.25. Pair then resumed higher in wave (iii) towards 3717.50. Dips in wave (iv) is in progress to correct cycle from December 15 low before it resumes higher again. As far as wave ((iv)) low pivot at 3620.55 stays intact, Index can see 1 more push higher to end wave ((v)). Afterwards, Index could end at least cycle from November 10 low as a diagonal then see larger degree pullback in 3 waves before the rally resumes.