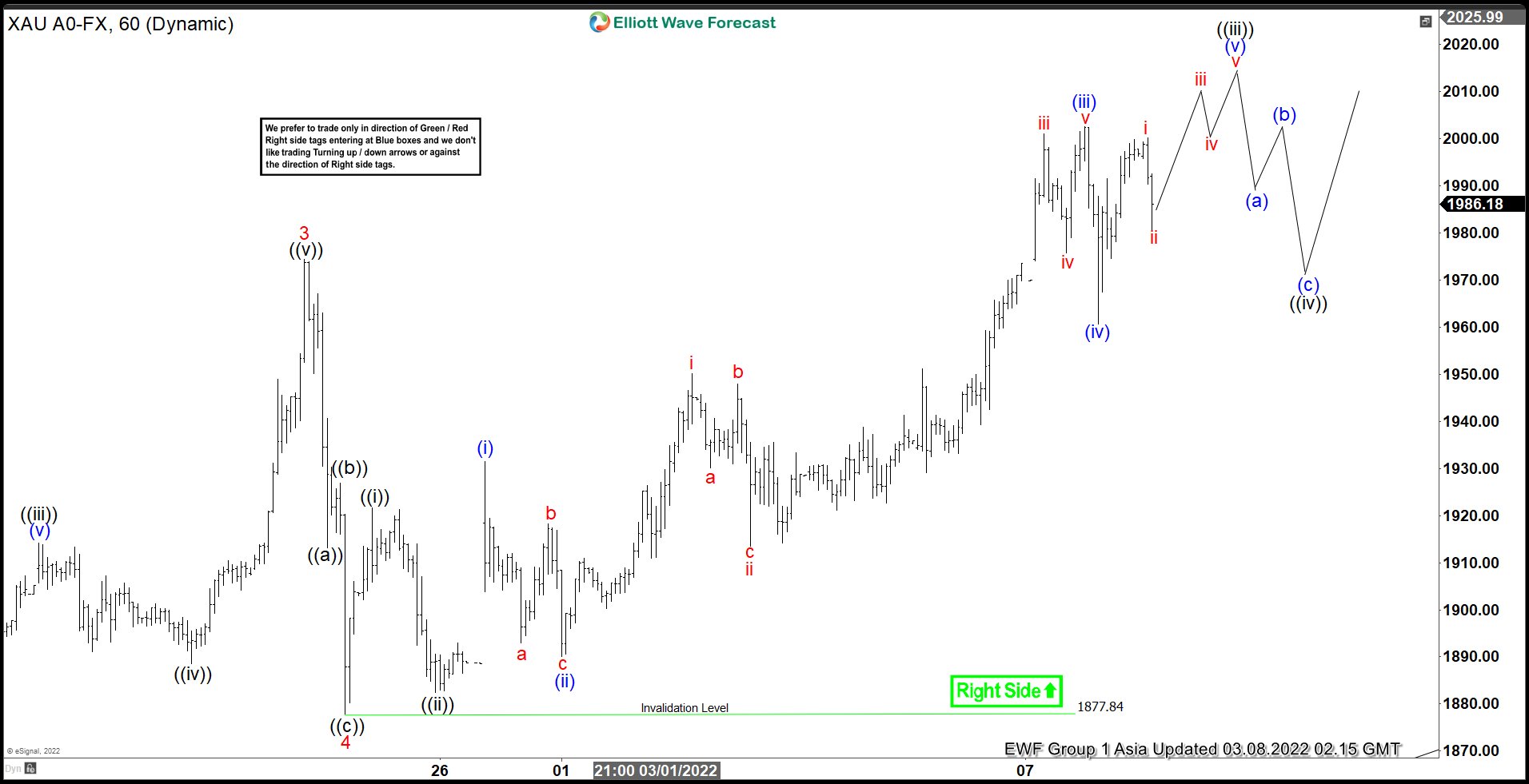

Short Term Elliott Wave View in Gold (XAUUSD) suggests that cycle from September 30, 2021 low is unfolding as a 5 waves impulse Elliott Wave structure. Up from September 30 low, wave 1 ended at 1877.15 and pullback in wave 2 ended at 1753.10. The metal then rallied higher in wave 3 towards 1974.40 and dips in wave 4 ended at 1877.84. Wave 5 higher is currently in progress with subdivision as another impulse in lesser degree.

Up from wave 4, wave ((i)) ended at 1921.59 and pullback in wave ((ii)) ended at 1882.50. Wave ((iii)) is nesting with wave (i) ended at 1931.47 and wave (ii) ended at 1890. The yellow metal then resumed higher in wave (iii) which ended at 2002.57, and wave (iv) pullback ended at 1960.70. Expect the yellow metal to extend higher to end wave (v) and this should complete wave ((iii)) in higher degree. Afterwards, it should pullback in wave ((iv)) before the next leg higher in wave ((v)) of 5. Near term, as far as pivot at 1877.84 low stays intact, expect pullback to find support in the sequence of 3, 7, or 11 swing for further upside.